List of Abbreviations

AFBI Agri-Food and Biosciences Institute

AOP Armagh Observatory and Planetarium

C&AG Comptroller and Auditor General

DAERA Department of Agriculture, Environment and Rural Affairs

DE Department of Education

DETI Department of Enterprise, Trade and Investment

DfC Department for Communities

DfE Department for the Economy

DfI Department for Infrastructure

DFP Department of Finance and Personnel

DoF Department of Finance

DoH Department of Health

DoJ Department of Justice

EA Education Authority

FSA Food Standards Agency in Northern Ireland

HR Human Resources

INI Invest Northern Ireland

LPS Land and Property Services

LSANI Legal Services Agency Northern Ireland

NI Northern Ireland

NIAC Northern Ireland Assembly Commission

NIAO Northern Ireland Audit Office

NIAUR Northern Ireland Authority for Utility Regulation

NICF Northern Ireland Consolidated Fund

NIHE Northern Ireland Housing Executive

NILSC Northern Ireland Legal Services Commission

NIPSO Northern Ireland Public Services Ombudsman

PPSNI Public Prosecution Service for Northern Ireland

PSNI Police Service of Northern Ireland

RHI Renewable Heat Incentive

Sport NI Sports Council for Northern Ireland

TEO The Executive Office

TIU Technical Inspection Unit

Executive Summary

Each year I prepare a report which summarises the results of my financial audit work across central government departments and their arm’s length bodies. This report primarily deals with the results of my audit of 2017-18 accounts, but also reports the outcome of audits for previous accounting periods which I have certified since my last report. It does not encompass my work on bodies within the health and social care sector, which will be addressed in a separate report.

Section One summarises the receipts and expenditure of the Northern Ireland Consolidated Fund, a central fund which accounts for items including the receipt of the Northern Ireland block grant and rates income and the distribution of these monies to Northern Ireland departments and other public bodies.

Section Two summarises the audit qualifications which I have made on the accounts of central government departments and their arm’s length bodies during 2018. My audit qualifications should be viewed in the context that the vast majority of public bodies continue to provide accounts on time which result in unqualified audit opinions. During the year there was a substantial fall in the number of qualifications, largely as a result of mechanisms now being in place to enact Spring Supplementary Estimates in the absence of an Assembly. A number of excess votes had occurred in the previous year in the absence of these mechanisms.

Section Three summarises short reports which I produced during 2018 which did not relate to the qualification of accounts, but addressed issues of public interest.

It is clear throughout this General Report that central government departments and their arm’s length bodies continue to make efforts to improve their control systems, but that further work is needed to resolve weaknesses. It also remains critical that bodies ensure basic controls are in place and operating effectively to prevent the misuse of public funds.

KJ DONNELLY

Comptroller and Auditor General

Northern Ireland Audit Office

106 University Street

BELFAST BT7 1EU

26 July 2019

Section One: Central Funding

Northern Ireland Consolidated Fund 2017-18 – Introduction

1.1 The Northern Ireland Consolidated Fund (NICF) is the Executive’s current account (operating on a receipts and payments basis). All payments out of the NICF must have legislative authority and may either be charged to it directly by statute (known as Standing Services) or voted by the Assembly each year in the Budget Acts (known as Supply Services). Government Accounts Branch within the Department of Finance (DoF) controls the NICF, subject to the Comptroller and Auditor General (C&AG) authorising payments, and determines arrangements for payments into the NICF.

1.2 Payments into and out of the NICF are reported annually in the Public Income and Expenditure Account which the DoF prepares and submits for audit by the C&AG, in accordance with the Exchequer and Financial Provisions Act (Northern Ireland) 1950. I am content that the 2017-18 financial statements of the Public Income and Expenditure Account properly present the receipts and payments, and that they are regular.

Payments into the Northern Ireland Consolidated Fund

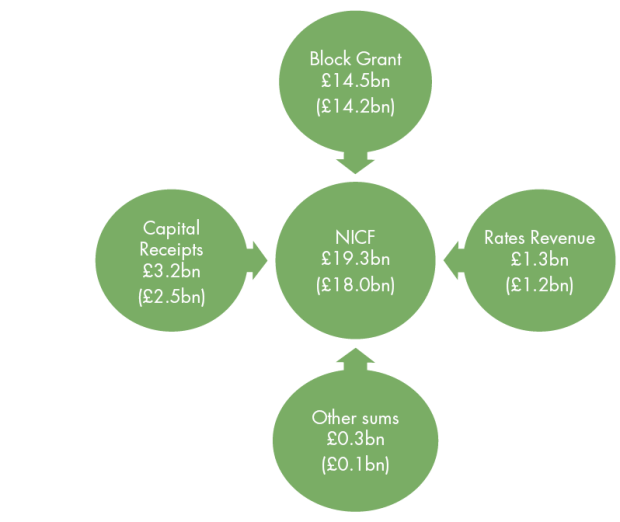

1.3 An analysis of the amounts paid into the NICF in 2017-18, compared to the previous year’s sums in brackets, is shown in Figure 1.

1.4 Payments into the NICF are categorised as follows:

- Block Grant: this is paid by the Secretary of State for Northern Ireland out of monies provided by the UK Parliament and is, subject to the limit set by HM Treasury, the balance required to bring the level of public income in Northern Ireland up to the amount needed to cover public expenditure;

- Capital Receipts: the Exchequer and Financial Provisions Act (Northern Ireland) 1950 provides that all money raised by the creation of debt is payable into the NICF, together with receipts representing repayment of loans made from the fund and interest on those loans;

- Rates Revenue: rates receipts (regional and district) are due for each property in Northern Ireland and are billed and collected by Land and Property Services (LPS); and

- Consolidated Fund Extra Receipts and other sums due to the NICF: receipts which are not the product of taxation, for example, interest received on Government loans and loans from the Consolidated Fund.

Figure 1. Analysis of Payments into the NICF – 2017-18

Source: Public Income & Expenditure Account for Year Ended 31 March 2018

1.5 Rates Revenue (regional and district) which is billed and collected by LPS, is accounted for in the LPS Trust Statement – Rate Levy Accruals Account and is subject to separate audit.

Payments out of the Northern Ireland Consolidated Fund

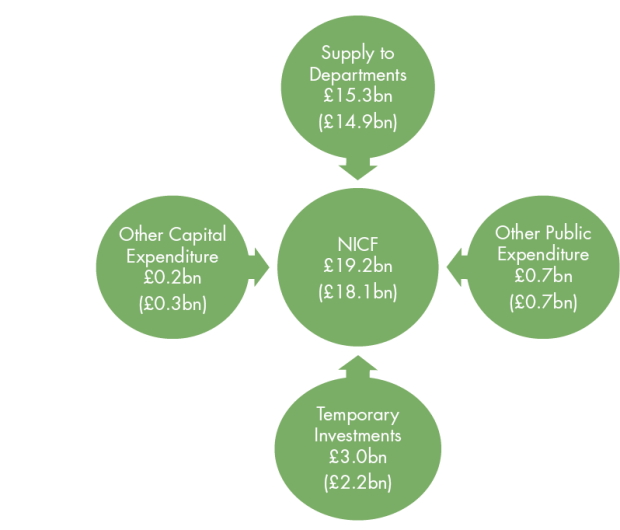

1.6 An analysis of the amounts paid out of the NICF in 2017-18, compared to the previous year’s sums in brackets, is shown in Figure 2.

Figure 2. Analysis of Payments out of the NICF – 2017-18

Source: Public Income & Expenditure Account for Year Ended 31 March 2018

1.7 Payments out of the NICF are categorised as follows:

- Supply to Departments: payments required to meet central government expenditure i.e. from departmental Supply Estimates. Normally money is voted by the Assembly for a particular financial year. Statutory authority for the necessary payments from the NICF is given by the Budget Act for the year in question, which also grants authority for the money to be used for what the Assembly intends. Given the ongoing absence of the Northern Ireland Assembly, different forms of statutory authority were activated during the 2017-18 year to allow these payments to be made;

- Temporary Investments and Other Capital Expenditure: these payments include loans to district councils; other public bodies under statute; and schools. They also include redemption of debt and other payments such as the investment of temporary cash surpluses on the short-term money market; and

- Other Public Expenditure: payments for services which the Assembly has decided by statute should be met directly from the NICF, for example, interest on loans from the National Loans Fund; judicial salaries; and the salary and pensions of the Northern Ireland Public Services Ombudsman (NIPSO).

1.8 Appendix 1 sets out the amount of supply received by Northern Ireland (NI) departments in 2017-18. The two largest spending departments were the Department of Health (DoH) and the Department for Communities (DfC), receiving supply of £4.8 billion and £4.1 billion respectively.

Section Two: Qualified Options

Remit

2.1 I am responsible for forming an audit opinion on 127 central government accounts (i.e. from central government departments and their arm’s length bodies). In order to reach this opinion on a set of financial statements, I must assess whether expenditure is regular and in accordance with the intentions of the Assembly when it granted the money.

Qualified audit opinions – Resource Accounts

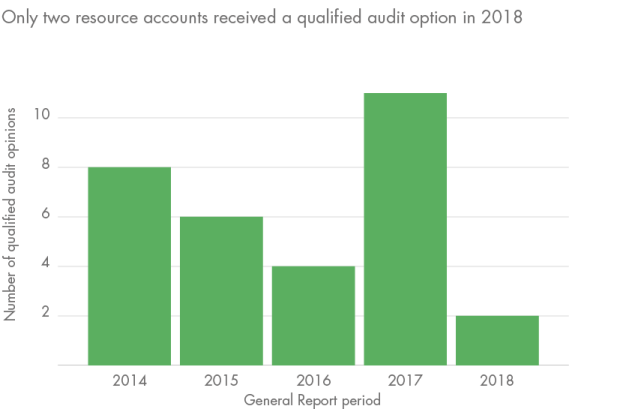

2.2 Departments plan their resource and cash requirements so that they do not exceed the limits approved by the Assembly. If one or both of these limits are exceeded, an excess vote occurs and I qualify my opinion on the accounts and report on the circumstances giving rise to the excess. I will also bring the matter to the attention of the Public Accounts Committee, which must decide whether to recommend that further grant is approved to the department involved to regularise the overspend. In respect of the 2017-18 accounting period, there were no excess votes, and therefore no remedial action was required.

2.3 In the 2017-18 accounting period, 2 out of 17 resource accounts received qualified audit opinions, compared to 11 in the previous year (Figure 3). The main reason for this decrease was that a significant number of excess votes had occurred in the previous accounting period following the Assembly’s dissolution in January 2017, before it had the opportunity to approve revised limits which would have regularised the situation. With respect to the two qualified accounts in 2017-18, the main reasons for qualification included:

- the material level of estimated fraud and error in benefit expenditure, excluding state pension, in 2017-18;

- a failure to obtain the necessary DoF approvals for £7.9 million of Renewable Heat Incentive (RHI) expenditure; and

- £2.1 million of grant expenditure by Invest NI under the Skills Growth Programme.

Figure 3. Number of Resource Accounts receiving a qualified audit opinion

Source: NIAO

2.4 Figure 4 contains brief details of all the resource accounts which received qualified audit opinions for the 2017-18 financial year. My full reports are published separately and laid in the Assembly.

Figure 4. Resource Accounts 2017-18 receiving a qualified audit opinion

|

Public Body |

Nature of the qualified audit opinion and C&AG’s Report |

|---|---|

|

Department for Communities (DfC) |

My regularity opinion provides assurance that payments have been made in accordance with the authorities which govern them. I have qualified my regularity opinion on the 2017-18 Departmental Resource Account in respect of the material level of estimated fraud and error in benefits expenditure, excluding State Pension. In 2017-18, expenditure on benefits was £5,897 million. This comprised:

The Department’s estimate of the overall level of overpayments in 2017-18, due to fraud and error, was in line with its 2016-17 estimate of 1.5 per cent of total annual benefit expenditure. This equates to total overpayments of £91.4 million (2016-17: £87.7 million). The Department’s estimate of the overall level of underpayments in 2017-18 due to official error was also in line with its 2016-17 estimate of 0.3 per cent. This equates to underpayments of benefits due to official error of £16.9 million (2016-17: £19.7 million). Benefits paid out due to customer fraud were estimated to have increased by £3.4 million, to £55.1 million, and are now at their highest reported level. The Department told me that the level of customer fraud within benefit expenditure remained consistent in 2017-18 at 0.9 per cent. |

|

Department for the Economy (DfE) |

I qualified my opinion on the 2017-18 accounts on the same grounds as I had qualified the 2016-17 accounts of DfE and the 2015-16 accounts of the former Department of Enterprise, Trade and Investment (DETI), namely:

I was unable to obtain sufficient evidence that the Department’s controls over spending on the non-domestic RHI scheme were adequate to prevent or detect abuse of the scheme. Due to this lack of evidence, I was unable to form an opinion on whether the expenditure on the scheme of £21.7 million in 2017-18 had been applied for the purposes intended by the Assembly. Included within this expenditure is an amount of £7.9 million (36 per cent of total RHI expenditure) on which approval had not been granted by DoF. This arose because re-approval of the scheme from the then Department of Finance and Personnel (DFP) was required from 1 April 2015, but not granted until the end of October 2015. During this seven-month period in 2015-16, 788 applications were accepted onto the scheme by DETI and since there was no approval in place from the DoF, the resulting £7.9 million expenditure incurred in 2017-18 is irregular. Consequently, my regularity opinion has been qualified, since this expenditure does not conform to the authorities which govern it. It is likely that a similar proportion of the non-domestic RHI expenditure will continue to be irregular each year until 2037-38 when the scheme closes, unless the DfE is able to obtain retrospective approval from the DoF. I have reported previously on the RHI scheme, firstly in July 2016 on the establishment and operation of the scheme, in June 2017, and again in June 2018, providing an update on what had changed in each year. I have also qualified my regularity audit opinion in relation to £2.1 million expenditure incurred by Invest Northern Ireland (INI) in 2017-18 under the Skills Growth Programme, due to DoF refusing to provide retrospective approval for grant expenditure which had been committed to during the period 1 January 2016 to 5 April 2018. As DfE has overall responsibility for ensuring that approvals are obtained and provides funding to INI through grant-in-aid, my regularity opinion has also been qualified in respect of this expenditure, as it does not conform to the authorities which govern it. I have also included an emphasis of matter paragraph in relation to uncertainties inherent in the valuation of student loans. This is not a qualification, but it reflects the fact that changes to the assumptions that have been made by the Department could have a very significant impact on the student loans figure in the accounts. https://www.economy-ni.gov.uk/publications/dfe-annual-report-and-accounts-2017-18 |

Qualified Audit Opinions – other accounts

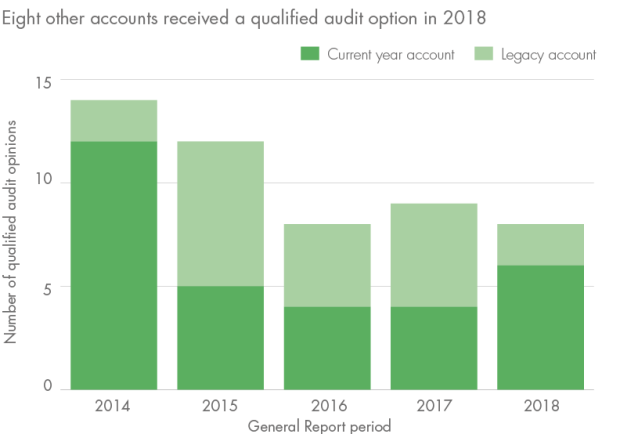

2.5 Since my last General Report I have qualified eight other accounts. Six were in respect of the 2017-18 accounting period, with the remainder relating to the 2016-17 accounting period (for the purpose of this report, accounts which are not certified within 12 months of the end of the accounting period are termed ‘legacy’ accounts). Figure 5 illustrates the numbers of other qualified accounts which were certified in the General Report periods 2014 to 2018.

Figure 5. Number of Other Accounts receiving a qualified audit opinion

Source: NIAO

2.6 Figure 6 contains brief details of the six other accounts which received qualified audit opinions for the 2017-18 financial year.

Figure 6. Other 2017-18 Accounts receiving a qualified audit opinion

|

Public Body |

Nature of the qualified audit opinion and C&AG’s Report |

|---|---|

|

Child Maintenance Service Client Funds Account |

The audit opinion on the Child Maintenance Service Client Funds Account has been qualified for a number of years and continues to be qualified in respect of two issues:

|

|

LPS’ Trust Statement – Rate Levy Accruals Account |

The audit opinion on the LPS Trust Statement Rate Levy Accruals Account has been qualified for a number of years and is qualified again in 2017-18 on regularity grounds, because of what I consider to be exceptionally high levels of fraud and error in Housing Benefit expenditure. Total Housing Benefit expenditure administered by LPS in 2017-18 was £38.2 million. Within this, the levels of fraud and error estimated by the DfC’s Standards Assurance Unit amounted to £4.5 million. My qualification notwithstanding, I am pleased to note the improvements in the level of fraud and error. I also reported on the level of outstanding ratepayer debt at year-end, and the amount written off in-year. The ratepayer debt outstanding at 31 March 2018 was £125.8 million, compared to £131.7 million at 31 March 2017. Also, the amount written off in 2017-18 (£19.3 million) was less than the sum written off in 2016-17 (£20.7 million). These are encouraging developments. In late 2015, LPS discovered and reported an incidence of suspected fraud carried out by one member of staff. Further investigations found that this employee misappropriated almost £130,000, of which £98,000 has since been recovered. I note that the collection of the debt remains the responsibility of the Public Prosecution Service for Northern Ireland (PPSNI), however, as the perpetrator’s circumstances change and additional assets become available, the outstanding amount should be pursued and recouped. As part of the fraud investigation, a number of recommendations were made. LPS has advised that of the 12 recommendations made, five have been implemented and the remaining seven are ongoing. |

|

Invest Northern Ireland (INI) |

I have qualified my audit opinion on the 2017-18 INI financial statements on the regularity of £2.1 million of expenditure committed under the Skills Growth Programme, during the period in which INI did not have approval from DoF. As the Department decided not to provide retrospective approval for grants of £2.1 million committed to during the period 1 January 2016 to 5 April 2018, this expenditure is irregular and has been incurred without conforming to the authorities which govern it. https://secure.investni.com/static/library/invest-ni/documents/annual-report-investni-2017-2018.pdf |

|

Legal Services Agency Northern Ireland (LSANI) |

I have qualified my audit opinion on the 2017-18 financial statements of LSANI, an Agency of the Department of Justice (DoJ). The audit opinions on the annual accounts of the LSANI and its predecessor body, the Northern Ireland Legal Services Commission (NILSC), have been qualified since 2003 due to the lack of effective counter fraud arrangements and weaknesses in the financial estimates for provisions in the annual accounts for legal aid liabilities. Nevertheless, there has been substantial progress by the LSANI in addressing the underlying issues giving rise to the qualifications this year. This includes significant work to improve the provisions model and the investment of significant resources to develop a robust strategy to counter fraud and error. I have continued to qualify the LSANI’s accounts on the basis of two limitations in scope on my work:

Reforms to Improve the Governance of the Legal Aid System I also published a report on 21 June 2016, highlighting a range of concerns in relation to the management of legal aid. The Public Accounts Committee published a report in January 2017, which was critical of how the legal aid budget had been managed by the NILSC and LSANI over a number of years. I am concerned that, over two years later, the DoJ and the Agency had not taken action on all of the Committee’s recommendations. This lack of progress was most notable in two key areas:

|

|

Armagh Observatory and Planetarium (AOP) |

AOP has recognised heritage assets with a value of £1.2 million in its financial statements as at 31 March 2018. This is based on a 2010 valuation provided for insurance purposes. Since that time, AOP has not sought to update the valuation. As a result, I was unable to obtain sufficient, appropriate audit evidence to support the amount of £1.2 million included on the Balance Sheet in respect of these assets and to confirm the existence and completeness of the heritage assets as at 31 March 2018. |

|

Northern Ireland Housing Executive (NIHE) |

Estimated Levels of Fraud and Error in Housing Benefit Expenditure The audit opinion on the regularity of financial transactions in NIHE’s accounts has been qualified due to significant levels of estimated fraud and error in housing benefit expenditure. Total housing benefit expenditure in 2017-18 was £647.8 million (£674.5 million in 2016-17). The Standards Assurance Unit in DfC has estimated that:

I note that the Accounting Officer has provided comprehensive detail on the wide range of measures being undertaken to prevent and detect fraud and error in housing benefit in his Annual Governance Statement. Planned Maintenance Expenditure During 2017-18, NIHE spent a total of £103 million on planned maintenance work. In previous years’ audits, I had qualified my regularity audit opinion in this area. This was because NIHE was unable to provide me with sufficient evidence relating to the proper operation of controls relating to work carried out by contractors on planned maintenance programmes. NIHE’s Technical Inspection Unit (TIU) carries out a programme of inspections over the planned maintenance work. This inspection work provides assurance to the Audit Committee and Board. Due to the technical nature of the maintenance work, I too rely on this inspection work. Having considered the testing carried out by my own staff, the inspection reports prepared by TIU and the assurances provided by both Internal Audit and the DfC’s Housing Regulation Branch, I concluded that I was in a position to remove the qualification which previously applied to planned maintenance expenditure. Whistleblowing Matters

In my 2016-17 Report, I highlighted that the DfC’s Internal Audit Unit had investigated anonymous whistleblowing allegations. Some of these related to Human Resources (HR). In November 2017, NIHE told me that its own Internal Audit Unit would review HR and `… provide an overall assessment and make recommendations for further improvement to ensure compliance, at all levels within the Housing Executive.’ In 2017-18, NIHE Internal Audit carried out two reviews. The first was an overall review of the HR function and the second on the use of agency workers by NIHE. With regard to the review of the HR function, Internal Audit gave a Limited Opinion and provided a number of important findings and recommendations. NIHE advised me that the HR team had established an action plan to address the issues identified within the Internal Audit Review.

Agency workers are used to provide cover for a temporary staff need within NIHE. NIHE has two contracts in place with a total value of £62.4 million. Agency workers’ costs are 11 per cent of the total direct staff costs incurred. In my report last year, I commented on the number of agency staff employed for periods which would seem to be longer that the word `temporary’ would suggest. I noted that NIHE needed to demonstrate it was achieving value for money by employing this number of agency workers over this extended timeframe. Whilst Internal Audit was able to provide a satisfactory opinion in respect of agency workers, it did raise concerns over certain aspects of the management of the two contracts, with recommendations on how this could be improved. NIHE has advised me that Internal Audit confirmed actions required to close off these recommendations are now complete.

In my 2016-17 report, I noted NIHE was investigating two separate whistleblowing allegations in respect of grounds maintenance. These were received in May 2015 and April 2016. As there was some overlap in the issues raised, NIHE delayed finalising the earlier allegation pending its review of the later one. NIHE told me that its review of these allegations became `enormously resource-hungry’ due to having to visit and re-measure thousands of plots of land. It also told me it had established there was no fraud involved. The work then focussed on identifying and rectifying a long-standing data issue and providing clarity on contract management procedures and associated compliance. I am concerned that the review of grounds maintenance whistleblowing allegations remained to be completed two to three years after the allegations were made. If public confidence in NIHE to deal with whistleblowing matters is to be maintained, it is essential that reviews into allegations are completed in a timely manner. The full text of my report on the 2017-18 financial statements can be found at: https://www.nihe.gov.uk/About-Us/Our-Mission-Vision/Our-annual-reports |

2.7 Figure 7 provides some background on the two legacy accounts which received qualified audit opinions.

Figure 7. Legacy accounts receiving a qualified audit opinion

|

Public Body |

Nature of the qualified audit opinion and C&AG’s Report |

|---|---|

|

LPS’ Trust Statement – Rate Levy Accruals Account 2016-17 |

The audit opinion on the LPS Trust Statement – Rate Levy Accruals Account has been qualified for a number of years and is qualified again in 2016-17 on regularity grounds, because the levels of fraud and error in Housing Benefit expenditure continue to be material. Total Housing Benefit expenditure administered by LPS in 2016-17 was £39.2 million. Within this, the levels of fraud and error estimated by the DfC’s Standards Assurance Unit amounted to £5.8 million. I also reported on the level of outstanding ratepayer debt at year-end and the amount written off in-year. The level of ratepayer debt has fallen for the fourth consecutive year from £142.7 million at 31 March 2016 to £131.7 million at 31 March 2017. The debt written off in-year has also fallen from £٢٨.٦ million in 2015-16 to £20.7 million in 2016-17, however the impairment of debt rose by £1.4 million in-year from £35.2 million at 31 March 2016 to £36.6 million at 31 March 2017. It is encouraging that both the overall level of ratepayer debt and the levels of write-offs have fallen significantly in-year. |

|

Armagh Observatory and Planetarium (AOP) 2016-17 |

AOP has recognised heritage assets with a value of £1.2 million in its financial statements as at 31 March 2017. This is based on a 2010 valuation provided for insurance purposes. Since that time, AOP has not sought to update the valuation. As a result, I was unable to obtain sufficient, appropriate audit evidence to support the amount of £1.2 million included on the Balance Sheet in respect of these assets and to confirm the existence and completeness of the heritage assets as at 31 March 2017. |

Outstanding Accounts

2.8 In previous General Reports, I have referred to accounts which should have been covered by my Report’s scope, but where certification of the financial statements has not occurred. In my current Report, four accounts remained outstanding (i.e. uncertified) at 31 March 2019, as the financial year-end in each case has been more than 12 months ago.

2.9 In my 2017 Report, I noted that the 2014-15 and 2015-16 financial statements of the Sports Council for Northern Ireland (Sport NI) were outstanding, as a result of accounts of insufficient quality being prepared and submitted for audit. Certification has still not taken place in either case and, with the passage of time, the backlog of Sport NI’s financial statements has extended to include later years. In order to draw this matter to a close, I have asked the organisation to submit its financial statements in their current form for 2014-15 and 2015-16, in order to allow me to form my opinion on them. Once complete, I will be turning my attention to any subsequent financial statements submitted. With regard to the governance issues present in Sport NI since 2015, I intend to publish a full (and separate) report on these matters later in 2019.

Conclusion

2.10 Most central government departments and their arm’s length bodies have continued to produce good quality accounts for audit scrutiny, resulting in unqualified audit opinions. This Report records the qualification of 10 accounts. As in previous years, the type and nature of qualifications are usually indicative of weaknesses in internal control and compromised entities’ ability to provide sound accountability to the Assembly.

Section Three: Public Interest reporting on unqualified accounts

3.1 Section Two covered my reporting on resource and other accounts which received qualified audit opinions. In Section Three I summarise the public interest reports which I prepared on accounts which received unqualified audit opinions at certification during the 2017-18 accounting period – see Figure 8.

Figure 8. Accounts receiving an unqualified audit opinion and with an associated public interest report

|

Public Body |

Nature of the C&AG’s public interest report |

|---|---|

|

Education Authority (EA) |

The Education Authority is responsible for the provision of education and youth services in Northern Ireland. Its two sponsoring departments (DE and DfE) set annual budgetary limits for the EA which should not be exceeded without prior approval. However, in 2016-17, the Education Authority overspent by £19.1 million compared with its total budget allocation for the year. This overspend related to schools’ delegated budgets; Special Educational Needs and schools maintenance. I am both disappointed and concerned about this overspend and I intend to keep this area under review, looking to see what lessons have been learnt and how the EA strengthens its ongoing financial management arrangements. |

|

Northern Ireland Fire and Rescue Service (NIFRS) |

In relation to reports produced by the Internal Audit function of the NIFRS, I continue to have concerns over both the number of recommendations made which have not been fully implemented, and the extended period of time over which the majority of these have remained outstanding. While I welcome NIFRS’ progress with implementation in recent years, certain outstanding recommendations, including procurement and integrated risk management, could leave the organisation vulnerable to risks from internal control failures – these now require resolution in the short-term. https://www.nifrs.org/wp-content/uploads/2018/07/NIFRS-Annual-Report-2017-18.pdf |

|

Police Service of Northern Ireland (PSNI) |

The PSNI is responsible for managing the firearms licensing regime in Northern Ireland. A paper-based system for firearms licensing applications operated until January 2017, when a new online system was introduced, with the intention of contributing to more effective and efficient service delivery. The two systems operated in parallel until July 2018. I identified four main issues:

I recommended PSNI develop plans to address each of the issues identified, and action them. https://www.niauditoffice.gov.uk/publications/firearms-licensing-northern-ireland |

|

Agri-Food and Biosciences Institute (AFBI) |

My audit of AFBI’s 2016-17 accounts highlighted failures in governance within the organisation which involved funding from the Centre for Innovation and Excellence in Livestock (CIEL). Despite no eligible expenditure having been incurred, AFBI issued three sales invoices totalling £0.5m to CIEL during 2015-16, with a further pro-forma invoice for £1.267 million issued in 2016-17. AFBI provided these invoices in order for CIEL to secure funding in advance of year end deadlines for eligible spending. The invoices were intended to ensure that AFBI would be able to maximise funding in future years. My report raised a number of significant matters, and in my view these represent evidence of behaviour and standards that fall far short of those a public body should display. AFBI identified a number of actions to ensure that there is no recurrence of the matters raised in this report, and I will be keeping this under review. https://www.niauditoffice.gov.uk/publications/agri-food-and-biosciences-institute-2016-17 |

|

Northern Ireland Social Fund (NISF) |

I did not qualify my audit opinion on the reported level of estimated errors in Social Fund benefit expenditure in 2016-17 as I had in previous years. I qualified my audit opinion on the NISF 2015-16 accounts because of significant levels of error in Social Fund benefit expenditure (except for Winter Fuel and Cold Weather payments, which are considered less susceptible to error). However, as there have been consistent reductions in the levels of error in benefit expenditure reported by DfC since 2013-14, this did not lead to a qualification of the 2016-17 account. |

|

Northern Ireland Social Fund (NISF) |

Nonetheless, I will continue to keep the estimated level of error in Social Fund payments under review and consider the implications for my audit opinion should this increase in the future. |

Appendix One: Northern Ireland Supply Figures by Department

|

Department |

2017-18 Supply £m |

2016-17 Supply £m |

|---|---|---|

|

DoH |

4,848.1 |

4,635.0 |

|

DfC |

4,149.8 |

4,093.4 |

|

DE |

2,342.7 |

2,344.8 |

|

DoJ |

1,191.0 |

1,269.3 |

|

DfE |

1,112.0 |

1,168.8 |

|

DfI |

807.1 |

772.9 |

|

DoF |

302.0 |

244.3 |

|

DAERA |

239.7 |

239.0 |

|

TEO |

142.3 |

64.0 |

|

NIAC |

33.1 |

38.0 |

|

PPSNI |

31.3 |

33.9 |

|

FSA |

8.3 |

7.9 |

|

NIAO |

7.6 |

7.7 |

|

NIAUR |

2.9 |

1.4 |

|

NIPSO |

2.3 |

2.2 |

|

TOTAL |

15,220.2 |

14,922.6 |

Note: Compared to the overall 2016-17 Supply figure of £14,922.6 million, an additional 2 per cent of Supply was issued in 2017-18.