List of Abbreviations

AME Annually Managed Expenditure

C&AG Comptroller and Auditor General

CED Central Expenditure Division

DAERA Department for Agriculture, the Environment and Rural Affairs

DE Department of Education

DEL Departmental Expenditure Limit

DfC Department for Communities

DfE Department for the Economy

DfI Department for Infrastructure

DoF Department of Finance

DoH Department of Health

DoJ Department of Justice

EA Education Authority

EU European Union

FSA Food Standards Agency

FTC Financial Transactions Capital

HOCS Head of the Civil Service

HM His Majesty’s

LSA Legal Services Agency

MLAs Members of the Legislative Assembly

MoU Memorandum of Understanding

NDNA New Decade, New Approach

NI Northern Ireland

NIA Northern Ireland Assembly

NIAC Northern Ireland Affairs Committee

NIAO Northern Ireland Audit Office

NIAUR Northern Ireland Authority for Utility Regulation

NICS Northern Ireland Civil Service

NIFC Northern Ireland Fiscal Council

NIPSO Northern Ireland Public Services Ombudsman

OECD Organisation for Economic Co-operation and Development

PAC Public Accounts Committee

PfG Programme for Government

PFSU Public Finance Scrutiny Unit

PPS Public Prosecution Service

PSD Public Spending Directorate

SSE Spring Supplementary Estimate

TEO The Executive Office

UK United Kingdom

Executive Summary

1. Our report The Northern Ireland budget process published in 2021 highlighted several issues of concern relating to the Northern Ireland (NI) budget process. Among the issues raised were the use of single-year budgets and the need for a clearer link between budgets and outcomes identified in the Programme for Government (PfG). Our report was considered by the Public Accounts Committee (PAC), which in March 2022 published its own report, Review of the Northern Ireland Budget Process(external link opens in a new window / tab), making ten recommendations. Although the Department of Finance (DoF) accepted the majority of recommendations and has been taking action to address the issues identified in the report, implementation of some of the recommendations had been impacted by the absence of the NI Executive.

2. The Secretary of State set single-year budgets for 2022-23 and 2023-24. The absence of multi-year budgets, during a time of unprecedented pay and price pressures, inhibits the departments’ ability to plan, finance and invest in the long-term delivery of public services in NI.

3. In light of the current budget constraints facing the NI public sector, we reviewed outturn against budget allocations for the five-year period 2018-19 to 2022-23 to identify underspends, the reasons for these and the amounts subsequently returned to His Majesty’s (HM) Treasury during the period.

4. We identified that overall £2.1 billion had been returned to HM Treasury during the five-year period. However, of this total, £1.5 billion (72 per cent) related to non-cash funding for depreciation and impairments (including Student Loans impairments) which could not be used for any other purpose, with the amount allocated to NI reflecting a Barnett consequential of higher spend in England. A further £0.5 billion (23 per cent) returned to HM Treasury related to Financial Transactions Capital (FTC) funding, which was also based on higher spend in England. As a result, £2.0 billion, or 95 per cent, of the funding returned to HM Treasury did not result in an overall loss of spending power for the Executive.

5. In terms of cash available for spending on public sector services, only £0.3 million of Non-ringfenced Resource funding was returned to HM Treasury during the five financial years from 2018-19 to 2022-23. However, £91.8 million of Capital funding was returned to HM Treasury during this period. Although this only represented 1.2 per cent of the Executive’s Capital funding during the period, it is a significant amount of money which could have been used to fund key priorities of the NI Executive. For example, this equates to the projected final cost of the new maternity hospital in the grounds of the Royal Victoria Hospital.

6. In the other devolved administrations, the Head of the Civil Service (HOCS), who is designated as either the Principal Accounting Officer or the Accountable Officer, bears personal responsibility for the propriety and regularity of all government finance and the economic and effective use of related resources. The differences in the accountability arrangements in NI in relation to the role of the HOCS compared with those in place in Scotland and Wales, were first identified in the Public Accounts Committee’s 2020 Report on Major Capital Projects(external link opens in a new window / tab), with PAC stating that the NI structure dilutes the accountability process and leads to silo working.

7. We noted that the original terms of reference for the Northern Ireland Civil Service (NICS) Board made no specific reference to acting collaboratively in relation to the budget process to ensure that all departmental bids are based on demonstrable and objectively measured need to achieve the best outcomes for the people of NI. The terms of reference were updated in November 2023 and now state that the NICS Board will “provide collective leadership to the NICS as a whole… on the most impactful use of public resources.” However, we noted that the constitutional position of NI means that departments prepare budget bids which are in the best interests of their individual departments, rather than the NI Executive as a whole.

8. Our review identified that there is a lack of transparency in relation to overall spending by the NI Executive. Although some departmental spend information is published on the Open Data NI(external link opens in a new window / tab) portal, this information is incomplete. DoF advised us that it publishes additional detailed information on its website and is working with the Fiscal Council to further improve transparency.

9. In addition, DoF advised us that while it fulfils its expenditure approval role, scrutinises departmental spending decisions and challenges departmental budget/in-year submissions, current resourcing levels mean that it is unable to carry out all the work it would wish to do in terms of baseline reviews.

Conclusion and Recommendations

10. The absence of a functioning Executive meant that a number of issues identified in the previous Northern Ireland Audit Office (NIAO) and PAC reports in relation to budgeting and accountability have yet to be addressed. Whilst acknowledging that constitutional constraints have played a part in preventing implementation of some of the recommendations, it is crucial that, in these times of financial constraint, DoF addresses the issues identified in this report.

Recommendation 1

Whilst acknowledging the setting of multi-year budgets depends on the period covered by the UK Spending Review, the Northern Ireland Executive needs to ensure that where possible multi-year budgets are set to support long-term financial planning. This should be in accordance with the Northern Ireland Executive’s key priorities.

Recommendation 2

There needs to be a clearer linkage between budgets set by the Northern Ireland Executive and measurable outcomes identified in the Programme for Government.

Recommendation 3

There is a need to fully explore how to empower the Head of the Civil Service and Departmental Accounting Officers to act collaboratively in relation to the budget process within the current constitutional arrangements.

Recommendation 4

The Department of Finance should provide transparency in relation to public expenditure in Northern Ireland and ensure that any data published includes appropriate historical data and is updated on an on-going basis.

Recommendation 5

The Department of Finance should continue to progress the recommendations made by the Public Accounts Committee in its March 2022 Review of the Northern Ireland Budget Process report.

Part One: Introduction

Background

1.1 Since the Northern Ireland (NI) Executive was restored in 2007, there have been 11 budgets in NI. The first two budgets spanned the same multi-year periods as UK Spending Reviews. Although a draft NI Budget document setting out spending allocations for a three-year period, spanning 2022-23 to 2024-25, was issued for consultation, this was suspended after the Executive was not restored following the resignation of the First Minister in February 2022.

1.2 The Secretary of State subsequently announced a 2022-23 budget for NI in November 2022 and in May 2023, he published another single-year budget for 2023-24. Consequently, since 2015-16, Budgets have been set yearly either by the NI Executive or the UK Government.

1.3 Our report The Northern Ireland budget process published in June 2021, compared the NI Budget process with the Organisation for Economic Co-operation and Development’s (OECD) ten principles of budgetary governance. It identified a number of areas where work is needed for the process to more fully comply with this good practice. Issues identified included:

- the use of single-year budgets, albeit that multi-year budgets are only possible when multi-year settlements are notified by His Majesty’s (HM) Treasury;

- the restricted opportunity for the NI Assembly and its committees to debate the draft Budget and any in-year re-allocations;

- sufficiently detailed information is not always available to aid NI Assembly scrutiny;

- budget information not being easy for non-finance professionals to understand;

- the need for a clearer linkage between budget allocations and the outcomes identified in the Programme for Government (PfG); and

- the need for greater synchronisation between the budget process and the process for establishing the capital investment strategy.

1.4 In addition, The public finances in Northern Ireland: a comprehensive guide(external link opens in a new window / tab) published by the Northern Ireland Fiscal Council (NIFC) in November 2021, advised that “The two multi-year NI Budgets through to 2014-15 were developed alongside agreed PfGs. However, neither these nor any other PfGs to date have been linked clearly to the Executive’s Budget allocations.”

1.5 This link had been reflected in New Decade, New Approach(external link opens in a new window / tab) (NDNA) which preceded the restoration of the Stormont Executive in January 2020 and which stated that PfGs “must provide a sustainable basis for the Executive to work together in partnership to serve and deliver for all on the basis of demonstrable and objectively measured need”.

1.6 In March 2021, following a public consultation, The Executive Office (TEO) published a PfG draft Outcomes Framework, aimed at setting a clear direction of travel for the NI Executive and providing a vision for the future for all citizens. However, this draft was never finalised by the NI Executive, leaving any budget set in this context unaligned with a PfG.

Financial Pressures

1.7 The impact that the lack of a functioning NI Executive had on the current financial situation facing public services has been the subject of much public discourse in recent times and in March 2023, Westminster’s NI Affairs Committee (NIAC) launched an inquiry into the funding and delivery of public services.

1.8 The inquiry sought submissions on the impact that the lack of an Executive has had on budgetary management in NI, on the financial situation facing public services, on the effectiveness of the Barnett formula and on alternative options for increasing revenue in NI.

1.9 The NIAC also heard evidence from a number of parties including the Head of the Civil Service (HOCS), the Department of Finance (DoF), the Northern Ireland Audit Office (NIAO), the Northern Ireland Public Services Ombudsman (NIPSO), and representatives from the medical, policing and education sectors.

1.10 The NIAC published its report, The funding and delivery of public services in Northern Ireland(external link opens in a new window / tab), on 26 March 2024. The Committee concluded that “The funding and delivery of public services in NI are under enormous pressure with reduced budgets, unreformed systems and, until recently, an absence of Ministers all contributing to the current crisis.” The Committee also considered that “Single-year budgets and a lack of an agreed Programme for Government have not allowed for long-term thinking and planning for public services and spending in Northern Ireland over recent years” and urged the Executive to commit to returning to multi-year budgetary settlements following the next UK Spending Review.

The Budget Process

1.11 The UK Government allocates funding grants to the devolved administrations in Scotland, Wales and NI. The largest of these grants is the Block Grant, with the Barnett formula used to calculate changes to the devolved administrations’ Block Grant each year.

1.12 The majority of the Block Grant is transferred to the NI Executive and DoF has the principal responsibility for advising the Finance Minister on the amount of funding that each department/body should receive.

1.13 During a budget cycle, funds can be reallocated by the NI Executive during in-year monitoring rounds. These in-year monitoring rounds which generally take place in June, October and January, are the formal process by which spending plans and priorities for the financial year are reassessed in light of the most up-to-date information regarding the needs of the various departments and bodies.

1.14 The process allows the NI Executive to reallocate funds based on what are perceived as the highest priority areas. However, in-year monitoring rounds are not intended to facilitate the re-opening of the agreed budget position.

1.15 If during the financial year, departments determine that they do not need as much funding as they had initially been allocated, they should declare a reduced requirement at one of the in-year monitoring rounds.

1.16 Conversely, departments may make bids for in-year funding where they have identified ‘departmental pressures’. These additional calls on resources can come from many sources, including shortfalls in anticipated income, increases in the cost of goods or increased costs of providing a service.

1.17 Departments and bodies are meant to first seek resources from within their existing budgets to meet those pressures before submitting bids via in-year monitoring rounds.

1.18 DoF will only consider bids which are above the ‘de minimis’ threshold (unless there are exceptional circumstances); clearly demonstrate the potential impact on draft PfG commitments of a department/body not receiving the requested additional allocation of funding; are consistent with the department’s/body’s aims, objectives and priorities; contribute to the achievement of the department’s/body’s targets; and comply with their statutory equality obligations.

1.19 Departments/bodies must rank the bids they submit to DoF in the following priority order:

- Legal or Contractual Commitments - covering bids for additional firm legal or contractual obligations, whose costs were not previously anticipated and if not met, may lead to proceedings being taken against the department.

- Executive Pre-commitments – covering bids relating to situations in which the previous Executive has already taken decisions.

- Highest Priority - covering bids in areas which are deemed to be important proposed developments in either delivering the key areas covered in the draft PfG or dealing with other emerging issues of comparable importance.

- Desirable – covering bids which are considered value for money projects but have a less direct impact on key departmental objectives and targets.

1.20 DoF officials will consider these bids and prepare a draft Executive Paper on monitoring round allocations for the Finance Minister’s consideration. DoF will also brief the Minister on the findings contained within the draft paper.

1.21 Following any changes or revisions required by the Finance Minister, the draft Executive Paper is issued to the other NI Executive members for their consideration. The Finance Minister will consider any responses received from other members before determining whether or not an updated paper should be issued to the rest of the NI Executive.

1.22 The Executive then meets to consider this Monitoring Round Paper and agree the outcome of the in-year monitoring process.

1.23 Decisions regarding the allocation of funding in-year occurs without prior NI Assembly debate or approval. The Finance Minister provides an Oral or Written Ministerial Statement setting out the details of the reallocations and Assembly Members are then given the opportunity to ask questions about decisions made. However, while Members of the Legislative Assembly (MLAs) can share their views on the reallocations made, they have no influence over the decisions being taken. MLAs can though, via the Assembly Scrutiny Committees they sit on, question departmental expenditure plans.

1.24 It should be noted that the process described above applies when there is a functioning NI Executive. We noted that when the Executive was not functioning during the period January 2017 to January 2020, the in-year monitoring round process continued in agreement with the Northern Ireland Office (NIO). However, there were no monitoring rounds in the 2022-23 financial year.

1.25 DoF advised that this was because the Budget was not set until November 2022 (see paragraph 1.2), so there was no time for a monitoring round to take place and be reflected the Spring Supplementary Estimates(external link opens in a new window / tab) (SSE). DoF added that because the Budget 2022-23 was not set until November, it included many of the things that would otherwise have been included in monitoring rounds, such as carry forward from the previous year and additional Barnett consequences from the Spring Budget and Autumn Statements.

1.26 No in-year monitoring rounds took place in 2023-24. DoF advised that a technical update exercise took place, which involved DoF obtaining information from departments and then seeking decisions on some reallocations from the Secretary of State for NI. The Secretary of State provided DoF with his decisions on 3 November 2023 which included the allocation and reallocation of tens of millions of pounds to departments and bodies. There was also approval of the reclassification of some funding from resource to capital.

1.27 Following the restoration of the NI Executive in February 2024, the Executive agreed in-year changes to the 2023-24 departmental allocations in February 2024.

Budget Bill

1.28 On 16 February 2024, the Finance Minister wrote to the Assembly’s Committee for Finance explaining that there was an urgent need for a Budget Bill authorising the use of resources for the years ending 31 March 2024 and 2025 following the Chief Secretary of the Treasury’s confirmation of the financial package that accompanied the restoration of the NI Executive. The Minister also asked for the Committee’s agreement that the Bill proceeded using an accelerated passage procedure.

1.29 In a briefing to the Committee on 19 February 2024, DoF advised that the introduction of the Budget Bill would normally follow immediately after the Assembly’s consideration and approval of the SSE, involving a debate on the Supply resolution. The Department added that the timing of events this year has meant that it has not been possible for the SSE to be completed and published before the Budget Bill needs to be introduced.

1.30 DoF also advised the Committee that although it is always necessary for a finance bill to proceed via accelerated passage, because of the urgency that exists and the risk of departments reaching their 2023-24 cash limits, the Finance Minister would also be asking the Assembly to suspend Standing Order 42(5) to allow the Budget Bill to complete all stages in less than the normal minimum time of ten days.

1.31 The Finance Minister introduced the Budget Bill at an Assembly meeting on 19 February 2024. The Bill passed First Stage and was ordered to be printed. The Assembly also agreed that Standing Order 42(5) would be suspended. A Second Stage debate on the Bill took place on the same day, with the Finance Minister advising that the key element of the financial package that accompanied the restoration of the Executive relevant to the 2023-24 position was a £1,045.6 million Resource Departmental Expenditure Limit (DEL).

1.32 The NIAO noted that in her Written Ministerial Statement on Public Expenditure 2023-24 Final Plan(external link opens in a new window / tab), the Finance Minister had indicated that the £1,045.6 million was supplemented by £21.9 million of existing funds and that the £1,067.6 million DEL allocated to departments covered the current level of department forecast overspends, totalling some £380 million, and provided an additional £688 million for pay.

1.33 Although the Second Stage of the Budget Bill was agreed, Members expressed concerns regarding the time available to scrutinise the Bill, with one Member commenting that there had been practically zero scrutiny and another Member stating that the Bill had been brought forward without proper consultation. A Member expressed dissatisfaction with the level of information that the Assembly had been provided with in relation to the amounts in the Budget Bill.

1.34 A key aspect of budgetary control is the responsibility to live within budget. We are concerned that it appears that £380 million has been allocated to those departments forecasting overspends in 2023-24 without any scrutiny of the reasons for the overspends. It is important that, even when urgent action needs to be taken, that there continues to be full accountability and transparency in the use of public funds.

1.35 DoF advised that the overspends arose during a period where there was no Ministers/Executive/Assembly. HM Treasury and NIO were fully advised throughout the year and the financial package included funding for overspends because the UK Government recognised that it had not be possible to take decisions to live within budget in the absence of Ministers and the late stage at which the Executive returned meant that it was not possible to change the spending trajectory at that stage.

1.36 We noted that the process operated by DoF differs from that operated by HM Treasury. The in-year monitoring rounds normally undertaken by DoF provide an opportunity to reallocate funding in-year to those departments and bodies with the greatest need. However, no such exercises are undertaken by HM Treasury and as such reallocation of funding only occurs at the SSE stage.

Scope and Methodology

1.37 Our review of budget and accountably arrangements included:

- Examination of the funding provided to the nine departments and six bodies that receive a direct budget allocation from the NI Executive or the Secretary of State (see Appendix 1) for the five financial years 2018-19 to 2022-23.

- Analysing and seeking explanations for the underspends and overspends by departments/bodies, and subsequent funding returned to HM Treasury.

- Engagement with DoF’s Public Spending Directorate (PSD) and other stakeholders.

- Obtaining an update on progress made in implementing the recommendations contained in the Public Accounts Committee’s (PAC) 2022 report Review of the Northern Ireland Budget Process(external link opens in a new window / tab).

Part Two: Analysis of Funding

Introduction

2.1 We obtained budget and outturn data from PSD for the nine Executive departments and six other bodies that received a direct budget allocation from the NI Executive or the Secretary of State for the five-year period 2018-19 to 2022-23 (see Appendix 1).

2.2 Our analysis focused on those elements of the budget controlled by the NI Executive, namely Resource Departmental Expenditure Limit (DEL) funding (both Non-ringfenced and Ringfenced); Capital DEL funding; and Financial Transactions Capital (FTC). Definitions for these categories of funding are as follows:

- Non-ringfenced Resource DEL funding is used for the day-to-day costs of public services, grants and administration. In the main, a Minister (or a departmental Accounting Officer in the absence of a Minister) has control over how this money is used to meet key spending priorities.

- Ringfenced Resource DEL funding can only be used to cover non-cash spending on depreciation and impairment. A Minister (or a departmental Accounting Officer in the absence of a Minister) cannot use this funding for any other purpose.

- Capital DEL funding is used on things which will likely create growth in the future and on longer-term investment spending, for instance, major road work projects or building schools or hospitals. In the main, a Minister (or a departmental Accounting Officer in the absence of a Minister) has control over how this money is used to meet key spending priorities.

- Financial Transactions Capital funding can only be deployed as a loan or equity investment in a capital project delivered by the private sector.

2.3 Although most Resource and Capital DEL funding can be allocated at the discretion of the NI Executive, HM Treasury may earmark elements for a specific purpose and/or from a specific funding stream. For example, the Fresh Start Agreement committed the UK Government to provide up to £500m Capital funding for shared and integrated education over a 10-year period. In addition, Resource DEL includes over £300 million per annum which is earmarked by Treasury for Farm/Fisheries payments.

2.4 Of the NI Executive’s 2022-23 Budget of £17.6 billion, 81.4 per cent was Non-ringfenced Resource DEL, 6.5 per cent was Ringfenced Resource DEL and 11.6 per cent was Capital DEL. FTC accounted for less than 1 per cent of the 2022-23 budget.

2.5 Whilst Annually Managed Expenditure (AME) funding for the 15 departments/bodies was £13.5 billion in 2022-23, AME is managed through a different process. Therefore, our report does not consider issues relating to AME.

2.6 Our analysis showed that at a NI Executive level, except for 2019-20, there were underspends compared with the final budget allocation (see Figure 1).

Figure 1 – Underspends/Overspends* compared to final budget allocation 2018-19 to 2022-23

| Financial Year | Non Ringfenced Resource DEL £ million | Ringfenced Resource DEL £ million | Capital DEL £ million | FTC £ million | Total £ million |

|---|---|---|---|---|---|

| 2018-19 | 36.0 | 72.0 | 11.6 | 1.0 | 120.6 |

| 2019-20 | 192.7 | 56.3 | 103.6 | 0.2 | 32.6 |

| 2020-21 | 94.7 | 158.0 | 23.8 | 0.3 | 276.8 |

| 2021-22 | 86.3 | 747.2 | 40.6 | 0.2 | 874.3 |

| 2022-23 | 58.4 | 548.1 | 30.3 | 0.1 | 636.7 |

| Total | 82.7 | 1,581.6 | 209.9 | 1.6 | 1,875.8 |

*Overspends are shown in orange text.

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

2.7 We noted that:

- In 2018-19, of the 13 departments/bodies which underspent on their final budgets, seven were allocated additional funding in-year.

- In 2019-20, of the 14 departments/bodies which underspent on their final budgets, eight were allocated additional funding in-year.

- In 2020-21, of the 13 departments/bodies which underspent on their final budgets, ten were allocated additional funding in-year.

- In 2021-22, all 15 departments/bodies underspent on their final budgets. Of these, 11 were allocated additional funding in-year, including all nine departments.

2.8 We also noted that the underspend of Ringfenced Resource DEL was 37 per cent of the total budget allocation for the five financial years from 2018-19 to 2022-23. The net underspends for the other funding categories over this period were less significant, with the Capital DEL underspend being 2.5 per cent and the FTC and Non-ringfenced Resource DEL net underspends being less than 1 per cent of their final allocations.

2.9 There were significant increases in the amount of additional funding allocated in both 2020-21 and 2021-22 compared with previous years (see Figure 2). This was largely in response to the COVID-19 pandemic.

Figure 2 - In-year budget increases/decreases*

| Financial Year | Non Ringfenced Resource DEL £ million | Ringfenced Resource DEL £ million | Capital DEL £ million | FTC £ million | Total £ million |

|---|---|---|---|---|---|

| 2018-19 | 118.5 | 23.4 | 27.4 | 75.2 | 94.1 |

| 2019-20 | 282.5 | 47.7 | 3.5 | 99.0 | 234.7 |

| 2020-21 | 2,767.8 | 212.5 | 31.1 | 159.5 | 3,170.9 |

| 2021-22 | 1,065.6 | 480.0 | 107.2 | 31.4 | 1,621.4 |

| Total | 4,234.4 | 763.6 | 169.2 | 46.1 | 5,121.1 |

*Decreases are shown in orange text.

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

2.10 It should be noted that, as indicated in paragraph 2.2, while a Minister (or a departmental Accounting Officer in the absence of a Minister) has control over how Non-ringfenced Resource DEL and Capital DEL funding can be used, Ringfenced Resource DEL which is non-cash, can only be used for specific purposes.

Underspends

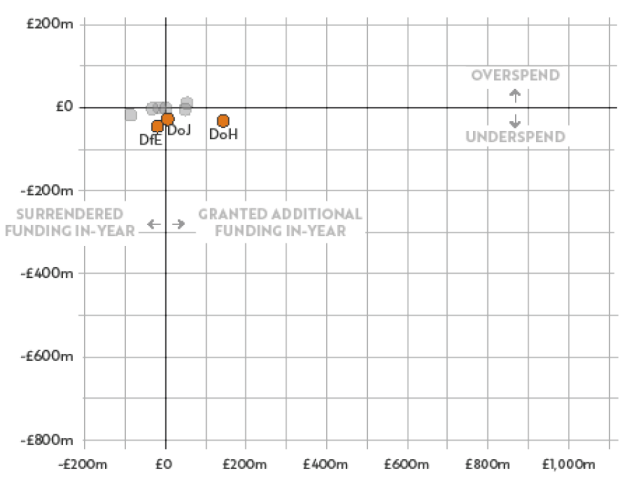

2.11 In 2018-19, three departments, the Department for the Economy (DfE), the Department of Health (DoH) and the Department of Justice (DoJ), had underspends exceeding £20 million (see Figure 3 and Appendix 2).

2.12 The three departments’ combined underspends accounted for 80 per cent of the 2018-19 total underspend:

- Although DfE’s budget was reduced at the in-year monitoring rounds, it still underspent by £45 million. However, Ringfenced Resource DEL accounted for £43 million of the underspend and an additional £15 million had been allocated to this category of funding during the year. The Department advised that the underspend related mainly to Student Loan impairments and that the amount of Ringfenced Resource DEL budget available to NI is calculated through a Barnett consequential, which given the considerably higher costs of student loans in England, is often more than is required in NI. In addition, given the huge volatility in the market in recent years it has been agreed with DoF officials that it was prudent to build in an element of contingency and allocate the maximum available to the NI Block for student loan impairment to DfE.

- DoH, which had been allocated additional funding of £143 million during in-year monitoring rounds, had an underspend of £32 million, £26 million of which was Non-ringfenced Resource DEL funding. We asked DoH why the underspend occurred. The Department advised that the £26 million underspend represents 0.47 per cent of the Department’s Non-ringfenced Resource DEL budget. The underspend mainly related to Confidence and Supply Transformation funding of £100 million that was received at the beginning of the financial year. The Department acknowledged at the time that this would be challenging to spend in full due to the non-recurrent nature of the investment. The underspend was attributed to issues with recruitment of staff. In total, 171 projects were brought forward in 2018-19 with circa 1,100 new posts filled at 31 March 2019.

- DoJ underspent by £28 million after being allocated an additional £6 million in-year. Although there had been a reduction in the Department’s Ringfenced Resource DEL allocation in-year, this category of spend accounted for £19 million of the total underspend. We asked DoJ why the underspend occurred. The Department advised that the majority of the underspend related to depreciation charges of £12 million that had been highlighted to DoF as not being required. However, as the funds were also not required at NI Block level, the budget remained within DoJ. The remaining underspend was mainly in relation to delays in the commissioning of assets and the technical reclassification of an impairment of bad debt provision.

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

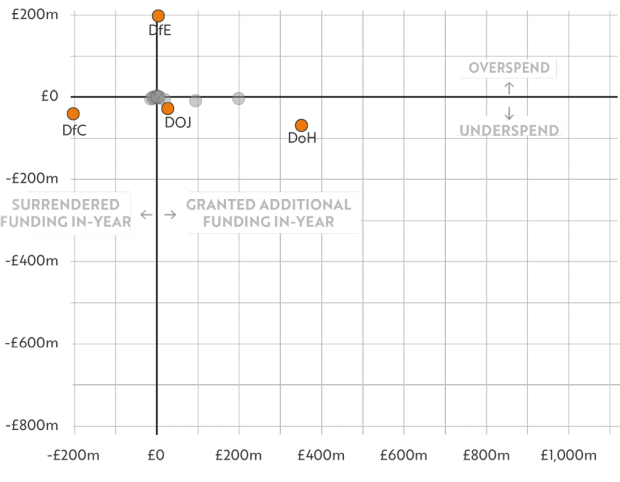

2.13 In 2019-20, three departments (DoH, the Department for Communities (DfC) and DoJ) had underspends exceeding £20 million (see Figure 4 and Appendix 3). Their combined underspends accounted for 83 per cent of the total underspend in 2019-20.

- DoH underspent by £69 million after a net increase in its budget of £175 million (largely Non-ringfenced Resource DEL) during the in-year monitoring rounds. Most of the underspend (£55 million) was Capital DEL funding. We asked DoH why this underspend occurred. The Department advised that the Capital DEL underspend mainly related to a delay in signing a major digital contract (Encompass) from the end of the financial year to May 2020. A number of further checks were required and contract signing was delayed. The Department subsequently funded the capital requirement from its 2020-21 budget allocation. In addition, a small element of the underspend was as a result of the COVID-19 outbreak which resulted in deliveries of vehicles and equipment not being received by the year-end, and estates projects not completing in hospitals and GP practices due to contractors leaving or being unable to access sites.

- DfC underspent by £41 million, £37 million of which was Capital DEL funding. DfC said this underspend was largely related to the impact of the COVID-19 pandemic on the social housing programme. For example, the Department told us developers were not prepared to sign and commence new build projects during a time of uncertainty. It occurred after DfC was allocated an additional £17 million of Capital DEL in-year funding.

- DoJ underspent by £28 million after being allocated an additional £13 million in-year. Although there had been a reduction in the Department’s Ringfenced Resource DEL allocation in-year, this category of spend accounted for £16 million of the total underspend. We asked DoJ why the underspend occurred. The Department advised that the majority of the underspend related to depreciation charges of £12 million that was not required by the Department. The remaining underspend was mainly due to the technical reclassification of an impairment of bad debt provision. The Department also indicated that it had told DoF that the funds were not required during the Monitoring Round process but as the funds were not required at NI Block level, the budget remained within DoJ.

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

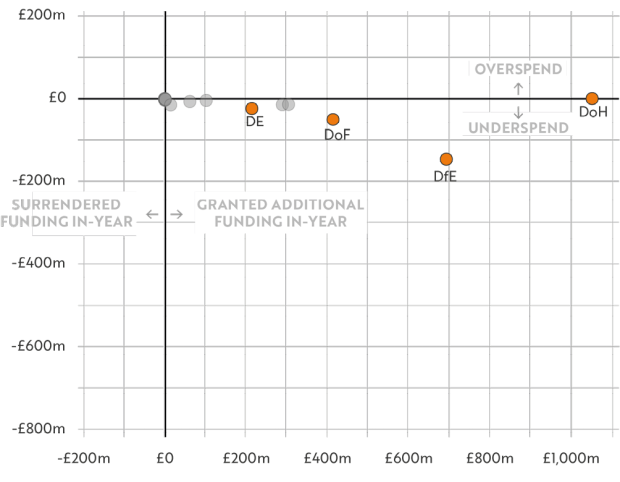

2.14 In 2020-21, three departments (DfE, DoF and the Department of Education (DE)) had underspends exceeding £20 million (see Figure 5 and Appendix 4). Their combined underspends accounted for 79 per cent of the total underspend in 2020-21.

- DfE was allocated an additional £699 million in-year and underspent by £146 million. Ringfenced Resource DEL accounted for £226 million of the additional allocation and £144 million of the underspend. The underspend related to Student Loan impairments – see paragraph 2.12.

- DoF was allocated almost £418 million of additional funding in 2020-21 and underspent by £50 million. The majority of the underspend (£44 million) related to business support schemes run during the COVID-19 pandemic. The Department advised that the Executive confirmed an allocation of over £200 million to DoF in March 2021 for COVID-19 support schemes, to maximise the funding which the Department could provide to businesses struggling with the impact of the pandemic on their finances. It was recognised that in doing so, there was the potential for underspends across all departments, particularly in relation to demand led expenditure. The Department advised that no funding was returned to Treasury as a result of this underspend.

- DE was allocated £216 million in-year, bringing its total budget for the year for Resource and Capital DEL to £2.649 billion, and underspent by £23 million, £22 million of which was Non-ringfenced Resource DEL. DE indicated that this was largely due to the unpredictable environment presented by the COVID-19 pandemic and the prolonged closure of schools during 2020-21.

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

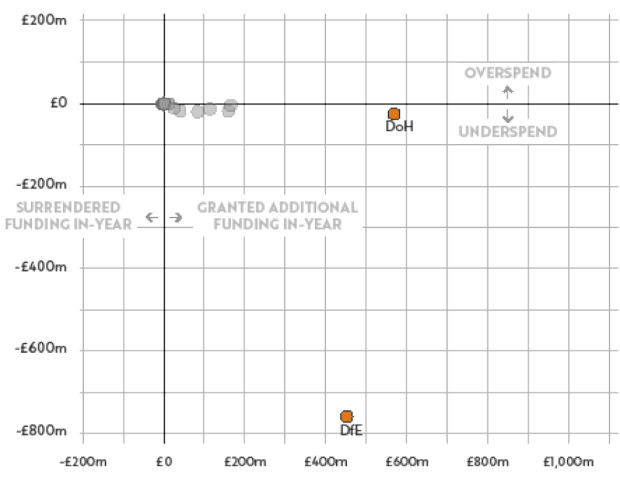

2.15 In 2021-22, two departments (DfE and DoH) had underspends exceeding £20 million (see Figure 6 and Appendix 5). Their combined underspends accounted for 90 per cent of the total underspend in 2021-22.

- DfE was allocated £452 million in-year and underspent by £759 million, £739 million of which was Ringfenced Resource DEL. The Ringfenced Resource DEL underspend related to Student Loan impairments (see paragraph 2.12). The Department advised that £14 million of the remaining underspend related to Executive earmarked funding which could not be utilised for other purposes including: demand led COVID-19 and economic recovery schemes; City Deals; and expected credit loss. A further £3 million related to unforeseen delays in demand led projects in Arm’s Length Bodies.

- DoH was allocated £569 million in-year and underspent by £25 million. Almost all of this underspend was Non-ringfenced Resource DEL (£13.5 million) and Capital DEL (£11.1 million) funding. We asked DoH why the underspend occurred. The Department advised that the Non-ringfenced Resource DEL underspend of £13.5 million represents 0.2 per cent of the total Non-ringfenced Resource DEL budget. It is made up of a series of small underspends across the system, the highest being £3.3 million of COVID-19 funding which was mainly due to an overestimate of the cost of an uplift in Domiciliary Care rates. The Department also advised that the capital underspend of £11.1 million which equates to 3.2 per cent of its final capital budget mainly resulted from: ICT - delays in recruitment, cost reductions for ICT licences and supply chain issues; and slippage in COVID-19 funding where the schemes encountered difficulties accessing clinical areas to allow equipment installation, as well as supply chain issues. The remaining slippage across the capital programme was due to a number of factors including supply chain issues and the unavailability of contractors to complete works within the required timescales.

2.16 Three further Departments (DfC, DoJ and DE) had significant monetary underspends in 2021-22:

- DfC advised that delays in the commencement of a number of housing projects contributed to their underspend of just under £20 million. This included a £9 million underspend of Capital DEL funding, with the COVID-19 pandemic preventing the progression of social housing development. In addition, easements in the demand led Housing Benefit Rates, Welfare Mitigations and Welfare Reform payments – as a result of lower than anticipated contractual costs and delays in filling vacancies – contributed to an £8 million Non-ringfenced Resource DEL underspend.

- Underspends by the Police Service of Northern Ireland, the Northern Ireland Prison Service and the Northern Ireland Courts and Tribunals Service contributed significantly to DoJ’s £18 million underspend. We asked DoJ why the underspend occurred. The Department advised that the underspends by these areas mainly related to staff costs (including underspends due to delays in filling vacancies), lower than expected injury on duty claims and delays in capital projects.

- We noted that the DE’s 2021-22 Annual Report and Accounts indicate that earmarked COVID-19-related funding for the Education Authority which it subsequently did not require and lower than expected uptake of childcare-related COVID-19 responses led to its £14.4 million underspend in respect of Resource DEL. There was also a £3.8 million underspend in respect of Capital DEL which arose mainly as a result of greater than expected capital receipts being received by the Department late in the financial year.

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

2.17 In 2022-23, two departments (DfE and DoH) had underspends exceeding £20 million (see Figure 7). Their combined underspends accounted for 92 per cent of the total underspend in 2022-23:

- DfE had an underspend of £558 million, which included £532 million Ringfenced Resource DEL and £25 million Capital DEL. The Ringfenced Resource DEL underspend related to Student Loan impairments (see paragraph 2.12), while the Capital DEL underspend was due to a delay in the implementation of a new energy capital programme. In agreement with DoF, DfE did not utilise the funding but made it available to meet capital pressures in the wider NI block. As it was too late to reflect the change in the SSE positions, an underspend was reflected in DfE and overspends in other departments. DoF was content to show this in this way as, on a block level, the Budget was managed to maximise the available funding. We asked DoF whether the approach in 2022-23 has been adopted in previous years or whether this necessary in the absence of the NI Executive. DoF advised that the circumstances in 2022-23 were unique given the absence of an Executive and the late stage of the year at which the Budget was set. This was compounded by the notification of a late change to the Capital DEL as result of a negative Barnett consequential of £45 million arising from changes to Whitehall departments budgets through the Westminster Supplementary Estimates process. Given the risk that this may result in an overspend at Block level, DoF asked departments to identify any underspends. This allowed DoF to manage the overall block position effectively. However, as DfE has indicated there was no opportunity to amend departmental budgets.

- DoH’s £27 million underspend included £23 million of Non-ringfenced Resource DEL. We asked DoH why the underspend occurred. The Department advised that the underspend represents 0.3 per cent of its Resource DEL budget. This is mainly made up of a £2.4 million underspend in the administration budget, £4 million from ring-fenced budgets due to difficulties in recruiting and late receipt of funding and £3.9 million of expected provisions utilisation that only partially materialised. The remaining amount is made up of a range of smaller underspends across a variety of programmes of work and the Department’s arm’s length bodies.

Figure 7 – Total underspends in 2022-23

| Financial Year | Total underspends £ million |

|---|---|

| DfE | 557.9 |

| DoH | 27.0 |

| DoF | 13.4 |

| DfC | 9.1 |

| TEO | 8.6 |

| DoJ | 6.1 |

| DfI | 5.7 |

| NIA | 5.3 |

| DAERA | 1.5 |

| NIAO | 1.0 |

| DE | 0.5 |

| FSA | 0.3 |

| NIPSO | 0.2 |

| PPS | 0.1 |

| NIAUR | 0.1 |

| Total | 636.8 |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

2.18 As advised in paragraph 1.24, there were no monitoring rounds in 2022-23. Consequently, there were no additional allocations in year.

2.19 Our above analysis shows that in the four years in which there were in-year monitoring rounds, 9 out of the 13 departments which underspent on their final budget allocation by more than £20 million had been allocated additional funding in-year.

Overspends

2.20 In the five years examined, there were eleven occasions when departments/bodies overspent on their final budget allocation for particular categories of funding (see Appendix 6).

2.21 Only three of the overspends in the five-year period from 2018-19 to 2022-23 were greater than £5 million (see Figure 8):

- DE’s overspend of £12 million on Non-ringfenced Resource DEL in 2018-19 related to an overspend by the Education Authority, mainly caused by an increased expenditure on schools and on children with special educational needs.

- The 2019-20 Non-ringfenced Resource DEL overspend by DfE of £219 million related solely to the COVID-19 Small Business Grant Scheme. The Department was tasked with administering the scheme in March 2020 and it was too late to reflect the associated budget in the DfE SSE position or January monitoring round. DoF advised the NIAO that this approach has been agreed by the NI Executive.

- DoH’s £6.7 million Non-ringfenced Resource DEL overspend in 2020-21 related to COVID-19 expenditure. This overspend was agreed with DoF prior to being incurred in order to assist with the overall management of the NI Block position.

Figure 8 – Overspends which exceed £5 million compared with final budget allocation occurring during 2018-19 to 2022-23

| Financial Year | Department/body | Overspend |

|---|---|---|

| 2018-19 | Department of Education | £12.0 million Non-ringfenced Resource DEL |

| 2019-20 | Department for the Economy | £218.8 million Non-ringfenced Resource DEL |

| 2020-21 | Department of Health | £6.7 million Non-ringfenced Resource DEL |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

2.22 It should be noted that none of the overspends led to an excess vote and therefore a qualified audit opinion as none of the control totals voted by the NI Assembly were exceeded. Although the C&AG issued a qualified audit opinion on the DfE 2019-20 accounts, this was because the C&AG was unable to form an opinion on whether some expenditure had been applied for the purposes intended by the NI Assembly due to a lack of audit evidence and because other expenditure did not conform to the authorities which governed it.

Funding Returned to HM Treasury

2.23 Data provided by PSD showed that in the five years up to 2022-23, more than £2 billion worth of funding had to be returned to HM Treasury (see Figure 9) as the underspends exceeded the permitted limits which could to be reallocated via the Budget Exchange Scheme.

2.24 More than £1.3 billion (63 per cent) of the funding returned to HM Treasury during the last five year relates to Student Loan impairments which are Ringfenced Resource DEL and which could not be used for other purposes. As indicated in paragraph 2.12, this does not actually represent an underspend by DfE but is a Barnett consequential caused by higher Student Loan costs in England, with more funding provided to NI than is required.

2.25 In addition, £485.8 million (23 per cent) of the amount returned is FTC which is also Ringfenced funding. This amount is larger than the underspend compared with final budget allocation of £1.9 million in Figure 1 as departments had declared reduced requirements in-year. The return of FTC funding to HM Treasury is largely due to the Barnett consequential, with the amount allocated to the NI Executive being the result of higher FTC spend in England. DoF has agreed with HM Treasury that any FTC underspends are used to offset the required repayment of 80 per cent of FTC allocations. Therefore, the £485.8 million returned to Treasury reduces future liabilities.

Figure 9 – Funding returned to HM Treasury 2018-19 to 2022-23

| Financial Year | Non-ringfenced Resource DEL £ million | Ringfenced Resource DEL £ million | Capital DEL £ million | FTC £ million | Student Loans £ million | Total £ million |

|---|---|---|---|---|---|---|

| 2018-19 | 0 | 40.9 | 0 | 171.9 | 42.1 | 254.9 |

| 2019-20 | 0 | 35.0 | 81.1 | 72.0 | 18.9 | 207.0 |

| 2020-21 | 0 | 27.0 | 0 | 26.4 | 373.3 | 426.7 |

| 2021-22 | 0.3 | 0 | 10.7 | 0 | 733.8 | 744.8 |

| 2022-23 | 0 | 78.2 | 0 | 215.5 | 138.4 | 432.1 |

| Total | 0.3 | 181.1 | 91.8 | 485.8 | 1,306.5 | 2,065.5 |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

2.26 NIFC’s response to the NIAC Inquiry into the funding and delivery of public services in NI (see paragraph 1.7) highlighted how neither the NI Executive, nor the other devolved administrations, find FTC funding a particularly convenient way to address their investment priorities. However, DoF advised that they and the Strategic Investment Board are engaging with departments to understand possible future uses of FTC.

2.27 The Ringfenced Resource DEL funding of £181.1 million returned to Treasury in the five years from 2018-19 to 2022-23 relates to funding for depreciation and impairments only. These are non-cash costs and, as such, the funding could not have been used to fund public services.

2.28 Only £0.3 million of Non-ringfenced Resource DEL, which could have been used to fund public services in NI, was returned to HM Treasury in the five years examined.

2.29 However, underspends of non-earmarked Capital DEL funding totalling £91.8 million have been returned to HM Treasury. This is a significant amount of money that has been lost to NI’s public services and which could have been used to fund the key priorities of the NI Executive. For example, this equates to the projected final cost of the new maternity hospital in the grounds of the Royal Victoria Hospital as reported in our Major Capital Projects Follow-up report.

Public Bodies

2.30 Our financial audits of other public bodies have identified issues with regards to budgets and overspends.

Education Authority

2.31 The C&AG reported upon the Education Authority’s (EA) £19.1 million overspend on its final budget allocation from DE in 2016-17(external link opens in a new window / tab) and the subsequent overspends in 2017-18(external link opens in a new window / tab) and 2018-19(external link opens in a new window / tab). In our review of the relevant years’ Annual Report and Accounts, we noted that the overspends would have been higher had EA not received additional in-year funding.

2.32 In its written evidence submitted to the NIAC inquiry(external link opens in a new window / tab), EA advised that it “has been very heavily dependent on additional financial support being provided via DoF’s in-year monitoring rounds” and advised that it had received additional in-year funding of £135.8 million in 2020-21.

2.33 EA said that “the non-recurring nature of monitoring round funding means that the sector has commenced each of the subsequent financial years with a funding gap” and that “it is impossible to plan effectively for the delivery of services when the underlying funding position is so volatile.”

Legal Services Agency

2.34 Although the amounts involved are not of the same magnitude as the EA, the Legal Services Agency (LSA) has needed additional funding to deliver on its statutory functions, with £20.5 million received in 2021-22 and £22 million received in 2022-23. In both years this represented a significant fraction of the LSA’s budgets.

2.35 However, the LSA has said this reflects a historical pattern of opening budgets falling short of forecast requirements with increased demand being driven in recent years by the impact of COVID 19 recovery and larger bills.

Northern Ireland Water and the Northern Ireland Transport Holding Company/Translink

2.36 The C&AG’s report on the Department for Infrastructure’s (DfI) 2020-21 Annual Report and Accounts(external link opens in a new window / tab) advised that public sector expenditure constraints in recent years have created significant funding challenges for the Department in meeting its responsibilities as custodian of the public transport system and the water and sewerage network, with both Translink and NI Water having been underfunded in recent years.

2.37 The report advised that uncertainty of funding for future years continued to raise financial sustainability issues for Translink and that ongoing uncertainty over funding can hamper the ability to make decisions and investments.

2.38 Similarly, the report noted whilst the increased funding allocated to NI Water during 2020-21 was welcomed, there remained uncertainty surrounding the availability of future funding. NI Water continued to stress that the annual cycle of public expenditure funding does not enable it to plan and finance a continuous investment programme and there is an ever-growing risk that the levels of service to customers in NI will be impacted.

2.39 The report also noted that NI is the only jurisdiction in the UK whose regulated water utility was unable to fully implement the Utility Regulator’s Price Control Final Determination for the period April 2015 to March 2021, due to public expenditure constraints.

2.40 DfI advised the NIAO that it is developing a ten-year recovery plan to aid financial planning and investment in infrastructure. The Department considers that such a timespan is required in order to re-build and promote multi-generational growth and invest in infrastructure. As part of this plan, DfI has recognised that budgets are not determined across this ten-year period as these are decisions for Ministers and the Executive and has therefore applied assumptions which will need to be modified as conditions change.

2.41 DfI also highlighted its ability to spend capital funding, having projects “shovel ready” for when funding became available, and how this has provided benefits as otherwise the funds would be lost to the NI Block.

2.42 Whilst DoF has been supportive of DfI’s ten-year recovery plan, DoF has indicated that the setting of a multi-year budget depends on the period covered by the UK Spending Review and that it also requires agreement of the Finance Minister and the Executive.

2.43 We note that the approach being taken by DfI is reflective of a 2021 report, Anticipatory Public Budgeting(external link opens in a new window / tab), commissioned by the Global Innovation Council. The report identified that short-term approaches to budgeting results in both the economy and people’s quality of life being undermined. The report concludes that public finance in the 21st century must be anticipatory. It says this can, in part, be achieved by focusing on longer time horizons (10 to 50 years into the future).

2.44 In addition, the Anticipatory Public Budgeting report highlights that budgets should align with long-term goals. This echoes our finding in our 2021 report, The Northern Ireland budget process, which highlighted how there needs to be a clearer linkage between budget allocations and the outcomes identified in the PfG. DoF advised that it can only link a budget to a PfG once a PfG has been agreed by the Executive.

Recommendation 1

Whilst acknowledging the setting of multi-year budgets depends on the period covered by the UK Spending Review, the Northern Ireland Executive needs to ensure that where possible multi-year budgets are set to support long-term financial planning. This should be in accordance with the Northern Ireland Executive’s key priorities.

Recommendation 2

There needs to be a clearer linkage between budgets set by the Northern Ireland Executive and measurable outcomes identified in the Programme for Government.

Part Three: Accountability

NICS Board and HOCS

3.1 The Northern Ireland Civil Service (NICS) Board provides strategic leadership of the work of the NICS in support of the NI Executive. Membership of the Board comprises the HOCS, the nine Departmental Permanent Secretaries, the First Legislative Counsel, the Departmental Solicitor and, from February 2023, three non-executive members.

3.2 The character of the Board is defined in particular by the following features:

- The Permanent Secretary members of the Board are the Accounting Officers for their respective Departments, accountable to the Assembly for the management of their own departments and to their Minister for the delivery of the Minister’s policies.

- Policy decisions in respect of the NICS are ultimately the responsibility of the Minister of Finance.

- The HOCS is Chair of the Board but is not the Accounting Officer for the administration as whole.

3.3 Our review of minutes of NICS Board meetings in 2022 and 2023 showed that current budgetary pressures facing the NI Executive were discussed. However, there was no evidence of discussion of how the Board could act collectively in relation to budgets, bids and monitoring rounds.

3.4 The original terms of reference for the NICS Board stated it had a “particular emphasis on delivery, to ensure those aspects requiring strategic cross-departmental collaboration are taken forward; and to address major problems being experienced in delivering the PfG”. However, there was no specific reference to acting collaboratively in relation to the budget process to ensure that all departmental bids are based on demonstrable and objectively measured need to achieve the best outcomes for the people of NI.

3.5 We noted that the terms of reference for the NICS Board were updated in November 2023 and now state that it will “provide collective leadership to the NICS as a whole… on the most impactful use of public resources.”

3.6 The PAC’s 2020 Report on Major Capital Projects(external link opens in a new window / tab) noted that accountability arrangements in NI are different from those in place in Scotland and Wales where the HOCS, who is designated as either the Principal Accounting Officer or the Accountable Officer, bears personal responsibility for the propriety and regularity of all government finance and the economic and effective use of related resources. The PAC stated that the NI structure dilutes the accountability process and leads to silo working with a lack of joined-up thinking, and that it is not acceptable the HOCS sits outside the formal chain of public accountability in NI.

3.7 The PAC recommended that the role of the NI HOCS is revised to mirror the role in Scotland and Wales.

3.8 The PAC reiterated its recommendation for change in this regard in its Report on Capacity and Capability in the Northern Ireland Civil Service(external link opens in a new window / tab).

3.9 The Memorandum of Reply(external link opens in a new window / tab) (MOR) which was cleared by the Executive and issued in June 2021 in response to the PAC’s Report on Major Capital Projects advised that Scotland and Wales operate under a different constitutional position, in that they have collective Ministers and do not have separate departmental corporations. The MOR also states that the arrangement proposed by PAC would not sit easily within the current constitutional position here and that such change could only be achieved through significant legislative changes.

3.10 In addition, the MOR stated that the question of what authority the HOCS could exert over departments that are separate legal entities, under the direction of their own Ministers who are accountable to the Assembly, would remain. The MOR also advises that TEO and DoF had brought PAC’s recommendation to the attention of the First Minister and deputy First Minister for consideration in determining the future role of a permanent HOCS.

3.11 In conversation with the HOCS, NIAO has noted that her role and responsibilities are unchanged from those highlighted by the PAC in 2020. Therefore, like the NICS Board, the HOCS is also limited in her ability to influence the budget process and ensure there is collaboration by departments.

3.12 The constitutional position of NI means that departments prepare budget bids which are in the best interests of their individual departments, rather than the NI Executive as a whole.

Departmental and Other Boards

3.13 All public sector bodies are responsible for managing their own budget, whether this has been set by the NI Executive or, in the case of Arm’s Length Bodies, their sponsoring department.

3.14 Our Board Effectiveness - A Good Practice Guide, published in June 2022, indicated that effective boards are a key component to the successful operation of any organisation through the provision of high quality support and constructive scrutiny.

3.15 Our guide also highlighted that a board’s performance will benefit from recruiting individuals with the requisite knowledge, skills and expertise. However, it also recognised that board members come to the boardroom with varying degrees of previous training, knowledge, skills, experience and understanding of the body itself. As such our guide highlighted the importance of undertaking a gap analysis to identify any potential training or development needs.

3.16 It is especially important in this time of budget constraint that boards challenge departments’ and bodies’ decisions to ensure that they are doing all that they can to drive down costs and improve efficiency.

Transparency and Resourcing

3.17 We have noted that the Government of Ireland publishes a Public Expenditure Databank(external link opens in a new window / tab) which sets out every aspect of the jurisdiction’s public expenditure since 1994. In addition, the Anticipatory Public Budgeting(external link opens in a new window / tab) report (see paragraph 2.43) highlights that there have been a number of innovations in recent years designed to make public spending more transparent, alongside a much broader movement of open data in government. For example, USA Spending(external link opens in a new window / tab) provides geographically tagged data on spending.

3.18 As part of its Open Data Strategy for Northern Ireland - 2020-2023 the NICS is committed to greater transparency on fiscal matters. As a result of this commitment, DoF decided that it would publish details of all departmental spend above £25,000 on the Open Data NI(external link opens in a new window / tab) portal, in line with a similar commitment by HM Treasury. Work on the report began in early 2022. NIAO noted that although some departmental spend data for a number of departments (DoF, DfE, DfI, TEO and DoH) has been published on the Open Data NI portal, the data is incomplete.

3.19 The Central Expenditure Division (CED) within DoF’s PSD is responsible for the planning and management of public expenditure in NI, including the budget process, the in-year monitoring process, forecast outturn and outturn, management of borrowing under the Reinvestment and Reform Initiative, liaison with HM Treasury and the provision of guidance on technical budget and classification issues.

3.20 We noted that CED’s staffing numbers have reduced significantly in recent years. There are currently only 9 staff in post within CED compared with 17 in 2013.

3.21 DoF advised that while it scrutinises departmental spending decisions through the expenditure approval process and scrutinises/challenges departmental submissions to budget and in-year monitoring exercises, current resourcing levels in CED and PSD mean that it is unable to carry out all the work it would wish to do in terms of baseline reviews.

The Northern Ireland Fiscal Council (NIFC)

3.22 The NIFC was formed in March 2021 following agreement by the NI Executive.

3.23 The NIFC’s initial Terms of Reference reflect the commitment in the NDNA agreement that an independent body should be created to:

- prepare an annual assessment of the Executive’s revenue streams and spending proposals and how these allow the Executive to balance their budget; and

- prepare a further annual report on the sustainability of the Executive’s public finances, including the implications of spending policy and the effectiveness of long-term efficiency measures.

3.24 The NIFC’s mission is to bring greater transparency and independent scrutiny to the current and future condition of NI’s public finances. In doing so, the council aims to inform public debate and policy decisions.

3.25 To date, the NIFC has produced four full Budget Assessment Reports, two Sustainability Reports, eight Technical Reports and a comprehensive guide to public finances in NI (see Our Reports | NI Fiscal Council(external link opens in a new window / tab)).

3.26 In October 2023, the NIFC published a Technical Paper, Improving transparency of In-Year Monitoring, providing recommendations on how information provided during the In-Year Monitoring process could be expanded to improve transparency.

3.27 In its Review of the Northern Ireland Budget Process(external link opens in a new window / tab), the PAC referred to the work of the NIFC, recommending DoF build on NIFC’s guidance on budget sustainability.

PAC Report Recommendations

3.28 Our previous report, The Northern Ireland budget process, highlighted several issues of concern relating to the NI budget process (see paragraph 1.3). This report was considered by the PAC and in March 2022 the PAC published its own report, Review of the Northern Ireland Budget Process(external link opens in a new window / tab), making ten recommendations.

3.29 The Finance Minister presented a Memorandum of Reply (MOR) to this PAC report to the NI Assembly on 15 March 2024. The MOR indicated the following:

- Three recommendations were accepted;

- Four recommendations were accepted ‘in principle’;

- One recommendation was partially accepted; and

- Two recommendations were noted.

Recommendation 3

There is a need to fully explore how to empower the Head of the Civil Service and Departmental Accounting Officers to act collaboratively in relation to the budget process within the current constitutional arrangements.

Recommendation 4

The Department of Finance should provide transparency in relation to public expenditure in Northern Ireland and ensure that any data published includes appropriate historical data and is updated on an on-going basis.

Recommendation 5

The Department of Finance should continue to progress the recommendations made by the Public Accounts Committee in its March 2022 Review of the Northern Ireland Budget Process report.

Appendix 1: Departments and bodies that receive a direct budget allocation from the NI Executive or the Secretary of State (paragraphs 1.37 and 2.1)

The Department for Agriculture, the Environment and Rural Affairs

The Department for Communities

The Department for the Economy

The Department of Education

The Department of Finance

The Department of Health

The Department for Infrastructure

The Department of Justice

The Executive Office

The Food Standards Agency

The Northern Ireland Assembly

The Northern Ireland Audit Office

The Northern Ireland Authority for Utility Regulation

The Northern Ireland Public Services Ombudsman

The Public Prosecution Service

Appendix 2: Total underspends/overspends by departments/bodies and movements in their in-year funding allocations in 2018-19 (paragraph 2.11)

| Department/body | Underspends £ million | Overspends £ million | Additions £ million | Reductions £ million |

|---|---|---|---|---|

| DAERA | 0.0 | - | - | 14.7 |

| DfC | 17.0 | - | - | 85.8 |

| DfE | 44.7 | - | - | 19.6 |

| DE | - | 10.9 | 53.6 | - |

| DoF | 1.6 | - | 0.7 | - |

| DoH | 32.3 | - | 142.8 | - |

| DfI | 4.1 | - | 48.9 | - |

| DoJ | 27.8 | - | 5.8 | - |

| TEO | 2.1 | - | - | 32.3 |

| FSA | 0.4 | - | 0.1 | - |

| NIA | 0.9 | - | - | 5.1 |

| NIAO | 0.4 | - | - | 1.0 |

| NIAUR | 0.0 | - | - | 0.1 |

| NIPSO | 0.1 | - | - | - |

| PPS | 0.4 | - | 0.5 | - |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

Appendix 3: Total underspends/overspends by departments/bodies and movements in their in-year funding allocations in 2019-20 (paragraph 2.13)

| Department/body | Underspends £ million | Overspends £ million | Additions £ million | Reductions £ million |

|---|---|---|---|---|

| DAERA | 1.7 | - | - | 4.8 |

| DfC | 40.6 | - | - | 101.5 |

| DfE | - | 198.3 | 1.8 | - |

| DE | 3.8 | - | 99.2 | - |

| DoF | 6.3 | - | 9.3 | - |

| DoH | 68.7 | - | 175.6 | - |

| DfI | 9.2 | - | 47.0 | - |

| DoJ | 28.0 | - | 13.3 | - |

| TEO | 4.9 | - | - | 7.4 |

| FSA | 0.3 | - | 0.8 | - |

| NIA | 1.3 | - | - | 0.6 |

| NIAO | 0.2 | - | - | 0.8 |

| NIAUR | 0.0 | - | - | 0.2 |

| NIPSO | 0.2 | - | 0.2 | - |

| PPS | 0.7 | - | 2.9 | - |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

Appendix 4: Total underspends/overspends by departments/bodies and movements in their in-year funding allocations in 2020-21 (paragraph 2.14)

| Department/body | Underspends £ million | Overspends £ million | Additions £ million | Reductions £ million |

|---|---|---|---|---|

| DAERA | 6.4 | - | 62.0 | - |

| DfC | 14.0 | - | 291.7 | - |

| DfE | 146.2 | - | 699.0 | - |

| DE | 23.3 | - | 216.0 | - |

| DoF | 50.1 | - | 417.6 | - |

| DoH | - | 0.5 | 1,060.9 | - |

| DfI | 13.4 | - | 307.0 | - |

| DoJ | 14.5 | - | 14.3 | - |

| TEO | 3.8 | - | 102.7 | - |

| FSA | 0.7 | - | - | -0.6 |

| NIA | 3.0 | - | 0.1 | - |

| NIAO | 0.3 | - | - | -0.6 |

| NIAUR | 0.0 | - | - | -0.2 |

| NIPSO | 0.1 | - | - | -0.2 |

| PPS | 1.6 | - | 1.3 | - |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

Appendix 5: Total underspends/overspends by departments/bodies and movements in their in-year funding allocations in 2021-22 (paragraph 2.15)

| Department/body | Underspends £ million | Overspends £ million | Additions £ million | Reductions £ million |

|---|---|---|---|---|

| DAERA | 0.7 | - | 11.9 | - |

| DfC | 19.7 | - | 83.8 | - |

| DfE | 758.7 | - | 452.1 | - |

| DE | 18.3 | - | 160.1 | - |

| DoF | 13.2 | - | 114.3 | - |

| DoH | 25.1 | - | 568.9 | - |

| DfI | 4.0 | - | 165.8 | - |

| DoJ | 18.4 | - | 40.4 | - |

| TEO | 10.7 | - | 25.2 | - |

| FSA | 0.8 | - | 1.5 | - |

| NIA | 2.0 | - | - | 3.7 |

| NIAO | 2.1 | - | - | 0.3 |

| NIAUR | 0.0 | - | - | 0.1 |

| NIPSO | 0.1 | - | - | 0.1 |

| PPS | 0.5 | - | 1.6 | - |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.

Appendix 6: Total overspends by departments/bodies 2018-19 to 2022-23 (paragraph 2.20)

| Financial Year | Department/body | Overspend |

|---|---|---|

| 2018-19 | Department of Education | £12.0 million Non-ringfenced Resource DEL |

| 2018-19 | Public Prosecution Service | £0.1 million Ringfenced Resource DEL |

| 2019-20 | Department for the Economy | £218.8 million Non-ringfenced Resource DEL |

| 2019-20 | Department for Infrastructure | £1.4 Non-ringfenced Resource DEL |

| 2019-20 | Public Prosecution Service | £0.3 million Ringfenced Resource DEL |

| 2020-21 | Department of Health | £6.7 million Non-ringfenced Resource DEL |

| 2020-21 | Department of Justice | £0.8 million Non-ringfenced Resource DEL |

| 2022-23 | Department of Justice | £2.2 million Ringfenced Resource DEL |

| 2022-23 | The Executive Office | £0.3 million FTC |

| 2022-23 | Northern Ireland Assembly | £0.2 million Ringfenced Resource DEL |

| 2022-23 | Northern Ireland Public Services Ombudsman | £0.1 million Ringfenced Resource DEL |

Source: Northern Ireland Audit Office analysis of data provided by Public Spending Directorate.