Performance Report

137 Accounts Audited

- 123 Central Government

- 14 Local Government

22 Public Reports

- 6 Value for Money Reports

- 1 Emerging Issues Report

- 2 Impact Reports

- 3 Good Practice Guides

- 2 Local Government Reports

- 1 NFI Report

- 1 Other Report

- 6 Financial audit based reports

£60 Million in savings for the taxpayer

National Fraud Initiative

Co-ordinated the National Fraud Initiative in Northern Ireland

Prompt Payment of suppliers*

- 98.3% within 30 days

- 92.3% within 10 days

*For the period 1 October 2020 to 31 March 2021; due to COVID-19 restrictions, statistics are not available for the period 1 April 2020 to 30 September 2020

8 MLA queries dealt with

47 Disclosures about the use of public money

OVERVIEW

The purpose of this overview is to provide a short summary of the Northern Ireland Audit Office’s structure, purpose and performance during the year. It also sets out the key risks to the achievement of our objectives, providing sufficient information for users to form a high level understanding of our organisation and its performance.

Chairperson’s Statement

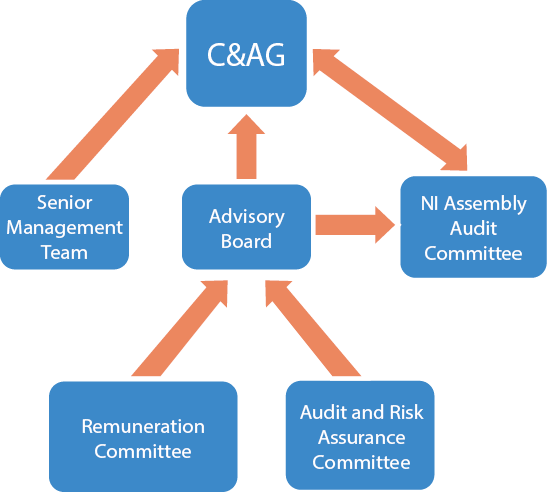

The role of the Advisory Board is to provide objective and impartial advice to the Comptroller and Auditor General (C&AG) and to assist him in the discharge of his functions. This involves oversight of the operation of the Northern Ireland Audit Office (NIAO) and its administrative activities but does not extend to the independent reporting on the Northern Ireland Assembly’s use of public money, which remains the C&AG’s sole responsibility under legislation.

The year to 31 March 2021 has been unprecedented. It was a year in which the full impact of the COVID-19 pandemic has affected all of our lives and the NIAO has had to adjust to new ways of working. I am pleased to report that the NIAO was able to continue to deliver our statutory functions and meet stakeholder expectations in a way you have come to expect.

During a period when new terminology, such as social distancing, lockdown, furloughing and reducing the R-number, has become commonplace, we as a Board have sought to support the C&AG in meeting the challenges and enhancing the impact of the NIAO in both safeguarding public money and improving public services. Throughout the pandemic, our focus has primarily been on the safety and wellbeing of our staff and clients, particularly any who are vulnerable. We recognise that our staff are and continue to be resilient, embodying the values of our organisation by not only adapting to changing work patterns but embracing them. This positive response has been replicated across the Northern Ireland public sector and gives us confidence that we will be able to continue to undertake our audit work, whether financial audit or public reporting, to assist the public sector to emerge stronger from the pandemic and with a renewed focus on the key priorities of the community and quality of life.

The focus of the Advisory Board remains on supporting the C&AG and delivery of our Strategic Plan through our Business Transformation Programme streams. We have had to transform the way in which we operate in response to the challenges of the pandemic and the positive lessons learned will be incorporated into new working practices which will continue as we move forward. Our staff have worked remotely from home for most of the financial year and on behalf of the Board, I want to congratulate them on the flexibility, adaptability and commitment which they have demonstrated throughout the crisis. Our response clearly demonstrates the benefits of the continuity planning and resilience management that were already in place before the COVID-19 pandemic emerged.

We are also acutely aware that some of our staff and clients will have lost a family member, or a friend, or a colleague, as a result of the pandemic and we offer them our deepest condolences. The year to 31 March 2022 will continue to be challenging but with some hope for a return to normality with the coronavirus vaccine rollout. The NIAO will continue to deliver on our core purpose as set out in our recently issued Strategic Plan and the Advisory Board is committed to supporting the pursuit of best practice and maintenance of the highest professional standards.

Martin Pitt

Chairperson

02 July 2021

Comptroller and Auditor General’s Statement

I am pleased to present the Northern Ireland Audit Office (NIAO) Annual Report and Accounts for 2020-21 to the NI Assembly. This has been a year without precedent, when we learned to live and work through the COVID-19 pandemic and all the issues it threw at us, and navigated the outworkings of the UK exit from the EU, whilst continuing to deliver on the Programme for Government.

Throughout this reporting period, collaboration with our stakeholders has been key. In recognising that we could not proceed in the normal manner, I decided to suspend publication of NIAO reports while the NI public sector dealt with the significant and immediate challenges of the pandemic and resulting lockdown.

I also took the opportunity to re-prioritise the Office’s Public Reporting Programme. In the financial audit field, whilst maintaining and further enhancing our relationships with our auditees, in particular with the Department of Finance, I extended the dates for the submission of accounts and the completion of the audits. This gave the public sector the breathing space it needed to deliver its services in a time of great need to the local taxpayer and ratepayer.

I continue to work closely with the NI Assembly, particularly the Northern Ireland Assembly Audit Committee (NIAAC) and the Public Accounts Committee (PAC). I welcome the review currently being conducted by NIAAC of “Governance and Accountability Arrangements for the NIAO [and NIPSO]” and I have already provided significant input to this process. Such an exercise is an opportunity to enhance my Office’s accountability and scrutiny to the Assembly, whilst also enshrining the independence of the C&AG’s function as the auditor for the NI Assembly and an Officer of the House.

Following on from the public enquiry into the Renewable Heat Incentive (RHI) Scheme, reported on 13 March 2020, one of the key recommendations was that my Office should assess and validate the extent of progress in implementing the lessons learned. To conduct this exercise, I have sought and been granted sufficient additional resources to enable me to perform this function and to report my findings periodically to the NI Assembly. This will be an important piece of work for my Office which I will report on in 2021-22 and beyond, and is a challenge I look forward to addressing.

Despite the circumstances we found ourselves in, I decided to proceed with the development of a new Corporate Plan for the period 2021-24. This sets out my Office’s three key strategic priorities for the next three years, detailing how we will continue to meet the needs of our stakeholders in delivering independent scrutiny and reporting on Northern Ireland’s public sector finances. This was completed following extensive engagement with our key stakeholders, politicians, public sector leaders, our Advisory Board and our own employees.

The Business Transformation Programme (BTP) continues to evolve. Set against the background of the Office’s key strategic priorities, the programme is a means by which I can ensure that we continue to deliver high quality, efficient and effective internal and external services both now and in the future. As it moves into Phase II, the programme structure continues to revolve around the five key pillars of People, Digitalisation, Governance and Audit Practice, Communication and Engagement and the Working Environment. New work streams have been introduced as others have been completed, creating a dynamic and challenging environment for my staff. We are continuing to introduce modern and innovative working practices through investment in technology, as we progress our data analytics and management information projects.

Addressing the Working Environment strand of BTP, the Office is currently in the middle of a major office refurbishment exercise. This project has proceeded unabated by the constraints of COVID-19. As a result we have decanted to temporary accommodation and plan to return to our newly refurbished building in Summer 2022.

Our achievements in 2020-21 have been wide-ranging, particularly considering the onset of the pandemic, the closure of the building for over three months and the need for staff to work remotely. Despite such impediments, my staff have delivered 137 accounts across the central and local government sectors and produced 22 public reports on the findings of our financial audit work and on a wide range of subjects including reducing costs in PSNI, workforce planning for nurses and midwives, special educational needs, capacity and capability in NICS and generating electricity from renewable energy.

We have also produced good practice guides on Raising Concerns, COVID-19 Fraud Risk and Procurement Fraud Risk, each of which were timely documents which have been well received across the public sector and beyond. Demonstrating value for money in our own work is hugely important, and I am pleased to report that last year my Office delivered savings to the public purse of almost £60 million.

I want to take this opportunity to thank the Board, led by Chair Martin Pitt, for their support. Over this particularly difficult period, their objective and impartial advice has been invaluable in the discharge of my functions.

They continue to bring me independence of thought, advice on business transformation and on the use of resources, gained by their vast experience and expertise in both the public and private sectors.

I also wish to thank my staff who never fail to inspire me with their drive, enthusiasm, insight and their humour. They have confronted and embraced each of the challenges as they arose, and they have done this with a positive mindset and a willingness to be flexible in the delivery of the work. They are undoubtedly my greatest asset as I strive to fulfil the Office’s vision to “Inspire confidence in public services through independent scrutiny based on impartial and innovative reporting.”

Kieran Donnelly CB

Comptroller and Auditor General for Northern Ireland

02 July 2021

Purpose and activities of the NIAO

Our role

The Northern Ireland Audit Office (“the NIAO” or “the Office”), established in 1987, has a pivotal role in helping to build a modern, high performing public service that is accountable to taxpayers and citizens. We do this by providing objective information, advice and assurance on how public funds have been used and accounted for, and encouraging best standards in financial management, good governance and propriety in the conduct of public business.

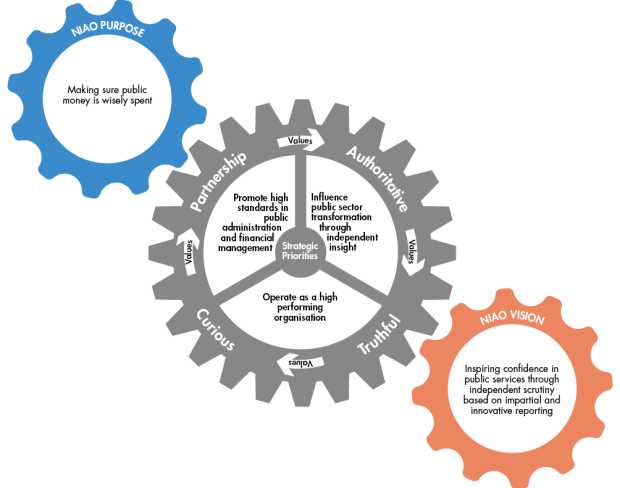

Our vision, purpose and values

Vision: Independence and excellence in audit to improve public services.

Purpose: Making sure public money is spent properly.

Values:

- Partnership (collaborative, engaging, respectful): building positive open relationships based on trust and respect as the basis for our work.

- Authoritative (credible, professional, evidence based): diligent and exemplary in our practice, upholding the highest professional and ethical standards.

- Curious (examining, interested, outward-looking): tenacious, inquisitive and open-minded so that we are continuously learning and improving.

- Truthful (courageous, fearless, upfront): constructively saying what needs to be said and doing what needs to be done.

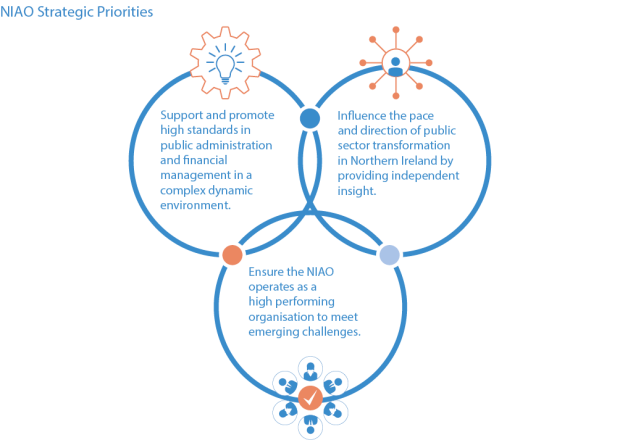

Our strategic priorities

- Support and promote high standards in public administration and financial management in a complex dynamic environment.

- Influence the pace and direction of public sector transformation in Northern Ireland by providing independent insight.

- Ensure the NIAO operates as a high performing organisation to meet emerging challenges.

Our independence

The head of the NIAO, the Comptroller and Auditor General (“the C&AG”), is an Officer of the Northern Ireland Assembly (“the Assembly”) and a Crown appointment made on the nomination of the Assembly. Under the Audit (Northern Ireland) Order 1987, the holder of the office is a corporation sole, and responsible for the appointment of NIAO staff who assist him in the delivery of his statutory functions. The C&AG and the NIAO are totally independent of government.

Our accountability

The NIAO and the Northern Ireland Assembly Audit Committee (NIAAC), which oversees NIAO performance, have agreed a Memorandum of Understanding on the governance and accountability of the Office. The Memorandum, which is (available on the Northern Ireland Assembly website sets out:

- the values and standards of the NIAO in carrying out its work;

- the internal governance arrangements of the NIAO and, in doing so, provides confidence to the Assembly and wider public regarding the arrangements for the governance and accountability of the NIAO; and

- the commitments of the C&AG and the NIAO to NIAAC on the actions they will take to uphold transparency and manage public money effectively.

These arrangements are currently being revisited by NIAAC as part of its review of “Governance and Accountability Arrangements for the NIAO [and the Northern Ireland Public Services Ombudsman].”

Our work

Financial Audit

Carrying out annual financial audits of government departments and arm’s length bodies is 65 per cent of the NIAO’s core business.

- Central Government - The C&AG has a statutory responsibility to audit the financial statements of all Northern Ireland departments, executive agencies and other central government bodies, including non-departmental public bodies, health and social care bodies and some public sector companies, and to report the results to the Assembly. Conducting the financial audits involves direct interaction with, and insight into, every public organisation in Northern Ireland. Through these audits, the NIAO gathers intelligence on how the public sector is operating, its main challenges and any emerging issues. This informs the NIAO’s public reporting work programme.

- Local Government - The Department for Communities may, with the consent of the C&AG, designate a member of staff of the NIAO as the Local Government Auditor (LGA). LGA, assisted by NIAO staff, is responsible for the audit of all local government bodies.

Public Reporting

The NIAO’s Public Reporting Programme is planned over a three-year rolling time frame and focuses on the most important issues facing the public sector in Northern Ireland. The range of work has widened from traditional value for money studies to shorter, fact-based reports and impact reports which assess the progress made on key issues from earlier reports. The programme includes significant work in the local government arena and addresses important cross-cutting issues that lie beyond the boundaries of any single government department.

Support to the Northern Ireland Assembly

The C&AG provides the Northern Ireland Assembly with independent support to enable it to hold public bodies to account for their financial management and the value for money they provide to the taxpayer for the public funds they spend. The main engagement is through the support the NIAO provides to the Public Accounts Committee (PAC). Based on the evidence presented by the NIAO, the PAC publishes its own report and recommendations to the Assembly. The Finance Minister is then required to respond formally to these recommendations, specifying the action the audited body intends to take. The NIAO monitors the action taken and may revisit an issue where insufficient progress has been made.

Tackling Fraud

The NIAO promotes good practice in governance arrangements and helps to combat fraud. NIAO staff attend the audit committees of all the audited bodies, providing support, advice and guidance to both non-executives and senior staff. The NIAO provides training through programmes developed by the Chief Executives’ Forum. The NIAO maintains a small counter fraud unit which provides support, advice and guidance on fraud related matters to public sector organisations. The key functions of this unit include local co-ordination of the biennial National Fraud Initiative (a UK-wide data matching exercise) and processing concerns raised by, among others, public sector employees, contractors and the wider public

Comptroller Function

The C&AG is responsible for authorising the issue of money from the Northern Ireland Consolidated Fund to enable Northern Ireland departments to meet their necessary expenditure, and for ensuring that there are adequate arrangements for the collection of revenue. This provides independent assurance to the Assembly that spending by government departments is lawful and within the scope, amount, and period of the appropriation or other authority, and it supports the important constitutional principle that the Executive cannot spend, borrow, or impose a tax without the Assembly’s approval.

Key issues and risks

A number of challenges and developments in our operating environment are summarised as follows:

Coronavirus

From 18 March through to 2 July 2020, the Office took the unprecedented step of closing its premises as a result of government advice and guidance in response to the threat of the coronavirus. All staff moved immediately to remote working from home. When our premises did re-open (on a two-days-per-week basis), attendance at the Office was always on a voluntary basis. Since then, the Office has remained open at least one day per week, excluding a two week period over Easter, at each stage taking cognisance of government guidelines. The Management Team and the Office’s Coronavirus Working Group have met and will continue to meet on a regular basis to monitor and plan the short and long-term response to this situation. The timelines have been reset for reporting and auditing of financial statements and our public reporting programme has been revised.

Digitalisation

We continue to develop our skills and capabilities to audit digital systems as we progress our Small Business Research Initiative (SBRI) project on data analytics. The GovTech Board decided to withdraw funding from the value for money analytics project following the onset of the COVID-19 pandemic, as it did not consider that it was achievable within the set timescales. However, in collaboration with other public audit agencies, we successfully applied to the local SBRI fund to secure funding to proceed with phase two of the financial audit analytics project. We anticipate that this will allow the two appointed suppliers to fully develop a product which will enable audit teams to import, analyse and interrogate datasets from multiple financial reporting systems.

Budgetary Constraints

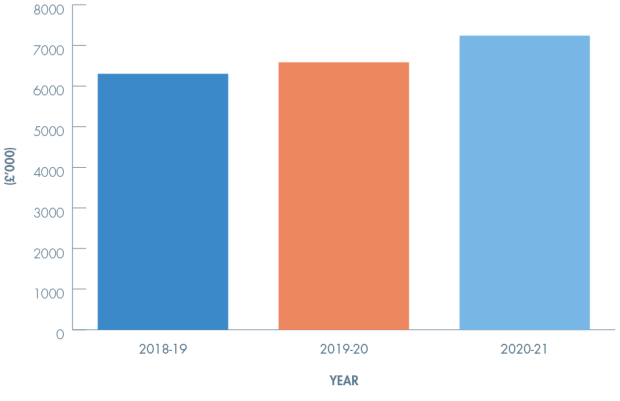

From 2011-12 to 2018-19, we reduced our net resource requirement by 26%, from £8.1m to £6.0m in cash terms (38% in real terms), on a like for like basis. Savings during this period were achieved primarily through reductions in staff numbers, a change in senior management structures and the implementation of a staff Voluntary Exit Scheme. However, since 2019-20 our expenditure has increased, and for 2021-22, we have sought and obtained a 5.1% increase in our budget. This will enable us to increase our focus on staff, aligning skills, cost and efficiency, as well as on quality and governance as part of the Business Transformation Programme. We also obtained the necessary capital funding for our Office accommodation project.

Resourcing

Full Time Equivalent (FTE) staff numbers have increased by 12 (12%), from a total of 102 in 2019-20 to 114 in 2020-21, albeit this has fallen from a peak of 140 in 2011-12.

In the reporting period, there have been 4 leavers and 13 new starts, with the focus on recruitment being for auditors (6), graduate trainees (3), apprentices (3) and one Learning and Development Officer.

Governance Structure

The Northern Ireland Assembly Audit Committee is currently conducting a review of the governance and accountability arrangements for the NIAO. Under the current structure, introduced in 2018-19, the Advisory Board provides objective and impartial advice to the C&AG, and assists him in the discharge of his functions. To provide support in these functions, the Board has an Audit and Risk Assurance Committee to review the comprehensiveness of assurances on systems of internal control, risk management and corporate governance, and a Remuneration Committee to advise on issues including terms and conditions of employment such as job descriptions, pay settlements, talent management and succession planning arrangements.

Brexit

We continue to plan for the outworkings of the UK withdrawal from the EU post 31 December 2020 as the negotiations on future relations between the parties remain ongoing. Uncertainty remains around the outworking of the process, what its impact will be on government reform and the knock-on effect it will have on the work of our Office. However, we have agreed with the UK Coordinating Body to continue working on the European Agricultural Fund audit over the next three years, focusing on Rural Development expenditure.

PERFORMANCE ANALYSIS

Our performance

The NIAO Corporate Plan 2021-24 (available on our website), sets out the Office’s role, strategic priorities and impact indicators. It also examines the funding required to achieve these.

Financial audit

Financial audit work undertaken by the Office comprises the audit of central and local government accounts

| Accounts / Qualifications | 2020-21 | 2019-20 |

|---|---|---|

| Total Accounts Audited | 137 | 143 |

| Total Central Government Accounts | 123 | 128 |

| Total Local Government Accounts | 14 | 15 |

| Total Accounts Qualified | 8 | 7 |

| Total Central Government Accounts Qualified | 8 | 7 |

| Total Local Government Accounts Qualified | 0 | 0 |

Central Government

The C&AG has a statutory responsibility to audit the financial statements of all Northern Ireland departments, executive agencies and other central government bodies, including non-departmental public bodies, health and social care bodies and some public sector companies, and to report the results to the Assembly.

The purpose of our financial audit is to provide independent assurance that the accounts of an audited body give a true and fair view of its financial position, have been prepared in accordance with the relevant accounting requirements and that the transactions underlying the financial statements are in line with the intentions of the Assembly and other authorities.

In 2020-21, we certified 137 central and local government accounts (2019-20: 143). The decrease in the number of accounts certified is largely due to the impact of COVID-19. As a direct result of the pandemic, the dates for 2019-20 accounts and audits were extended as follows:

- Central government accounts to be submitted by 4th August, with the statutory deadline for certification 31st October.

- Local government accounts to be submitted by 31st August, for certification by 31st December.

- Whole of Government Accounts were progressed in line with a new timetable of 4th December.

For the audit of central government bodies, there is an explicit requirement for the auditor to provide an additional audit opinion on whether, in all material respects, expenditure and income have been applied for the purposes intended by the Assembly and conform to the authorities which govern them; a regularity opinion.

If at the end of an audit we consider that the accounts do not present a true and fair view, that expenditure and income have not been incurred in line with Assembly intentions, nor conform to the authorities which govern them, then the C&AG will qualify his opinions on the accounts. Eight central government accounts were qualified in 2020-21 (2019-20: 7), with some accounts receiving more than one qualification, and a further two opinions were modified (but not qualified). In these cases, and in other cases where there are significant issues arising, we make a report to the Assembly which may be considered by the PAC.

We inform the organisations we audit of the issues we find during our work, giving our independent view on areas where the audited body could improve its governance, controls and financial management. We liaise with management to obtain their response to the issues identified.

During 2020-21, we continued to work with the Office of the Comptroller and Auditor General in Dublin on the shared audit and certification of North-South bodies. We also continued to have close working arrangements with the National Audit Office for the accounts we audit on its behalf. This is a significant workload and includes audits of the European Agricultural Funds, National Lottery Funding and Whole of Government Accounts.

Local Government

A senior member of NIAO staff is designated by the Department for Communities, with the consent of the C&AG, as the Local Government Auditor. Until her departure on 28 February 2021, Pamela McCreedy, the Office’s Chief Operating Officer, undertook this function. Following Mrs McCreedy’s departure, Colette Kane, an NIAO Director, was appointed interim Local Government Auditor (LGA). The LGA, assisted by NIAO staff, is responsible for the audit of local government bodies. In 2020-21 we completed the audits of 14 local government accounts (2019-20: 15). None of the opinions on the local government accounts certified in 2020-21 were qualified (2019-20: nil).

Public Reporting

The Office produces a wide range of public reports each year, reflecting its broad audit remit.

Total Public Reports Published 2021-22: 22

- 6 Value for Money Reports

- 1 Emerging Issues Report

- 2 Impact Reports

- 3 Good Practice Guides

- 2 Local Government Reports

- 8 Others

The reports completed in 2020-21 are shown below. Copies of the full reports can be obtained from our website.

Value for Money Reports

Our examinations into economy, efficiency and effectiveness (value for money) consider how public bodies use their resources. Our value for money work is informed by a careful analysis of the audit field. We select a balanced programme of studies which aims to:

- The Management and Delivery of the Personal Independence Payment Contract in Northern Ireland

- Capacity and Capability in the Northern Ireland Civil Service

- Generating Electricity from Renewable Energy

- Workforce Planning for Nurses and Midwives

- Addiction Services in Northern Ireland

- Reducing Costs in the PSNI

Emerging Issues Report

- The LandWeb Project: An Update

Impact Reports

- Managing Children Who Offend: Follow-Up Report

- Impact Review of Special Educational Needs

Good Practice Guides

- Procurement Fraud

- COVID-19 Fraud Risks

- Raising Concerns: A Good Practice Guide for the Northern Ireland Public Sector

Other

- The Executive Office - Annual Report and Accounts 2019-20

- Report by the Comptroller & Auditor General on the Legal Services Agency Northern Ireland - Annual Report and Accounts 2019-20

- Report by the Comptroller & Auditor General on the Driver and Vehicle Agency Northern Ireland Annual Report and Accounts for the Year Ended 31 March 2020

- Overview of NI Executive’s Response to the COVID-19 pandemic

- Report by the Comptroller & Auditor General on the Department for the Economy and Invest Northern Ireland Annual Report and Accounts for the Year Ended 31 March 2020

- Report by the Comptroller & Auditor General on the Education Authority Annual Report and Accounts for the Year Ended 31 March 2019

- The National Fraud Initiative: Northern Ireland

Local Government Reports

- Local Government Auditor’s Report 2020

- Managing Attendance in Central & Local Government

Value for Money Reports

Our examinations into economy, efficiency and effectiveness (value for money) consider how public bodies use their resources. Our value for money work is informed by a careful analysis of the audit field. We select a balanced programme of studies which aims to:

- provide the Assembly with independent information and advice about how economically, efficiently and effectively departments, agencies and other public bodies have used their resources;

- encourage audited bodies to improve their performance in achieving value for money and implementing policy; and

- identify good practice and suggest ways in which public services could be improved.

Our value for money studies focus on specific areas of government expenditure and seek to make a judgement on how well resources have been managed and services delivered. In 2020-21, these covered a range of topics across the Northern Ireland public sector in areas such as health, education, energy, social welfare and justice. In these reports, we sought to measure performance, identify the factors underlying that performance, and offer practical recommendations aimed at adding value.

Good Practice Guides

“Raising Concerns: A Good Practice Guide for the Northern Ireland Public Sector” was published on 25 June 2020. This guide is aimed at helping employees and public sector organisations to understand the value of an open and honest reporting culture. While aimed primarily at public sector organisations and their employees, the Guide also includes information for the general public on how they can raise concerns and how these should be treated by organisations.

A good practice guide on COVID-19 Fraud Risks was issued on 1 September 2020, which highlighted that the risk of fraud had increased with the onset of the coronavirus pandemic. This short guide drew together information issued by a range of counter fraud organisations on existing and emerging fraud risks, to provide a quick reference for NI public sector organisations on the key risks and mitigating controls.

On 24 November 2020, we published a guide on Procurement Fraud risks. Public procurement is vulnerable to fraud and corruption because of the level of expenditure, the volume of transactions, the complexity of the process and the number of stakeholders involved, and these risk factors increased significantly as a result of the COVID-19 pandemic. Fraud can only be tackled effectively if it is identified, measured and reported, so the guide was developed to help public sector organisations recognise the nature and level of procurement fraud, and to highlight effective controls which can be put in place.

Local Government Reports

Under the Local Government Act (Northern Ireland) 2014, the Local Government Auditor has a statutory duty to publish a Local Government Annual Improvement Report for each council. The purpose of these reports is to identify if councils have discharged their duties in relation to improvement planning and if they are likely to comply with the requirement to make arrangements to secure continuous improvement in the exercise of their respective duties. It was not possible to publish the Local Government Improvement Reports this year as the Department for Communities (the Department) suspended the requirements for Councils to produce and have audited improvement plans for 2020-21. We are working with the Department and Councils to consider arrangements going forward.

The Local Government Auditor published an annual report on the exercise of her functions in December 2020 which commented on a range of topics arising from her audit work. A further report, produced in conjunction with the C&AG, was also published on “Managing Attendance in Central and Local Government in the reporting period.

Governance and fraud prevention and detection

The Office works closely with audited bodies to promote good practice in governance arrangements and help combat fraud. Good governance structures which are well embedded in organisations are a key attribute to achieving corporate goals and are crucial in times of financial constraint. During this financial year, despite the challenges of COVID-19, we attended the audit committees of all our audited bodies, albeit remotely on most occasions, providing support, advice and guidance to both non-executives and senior staff. We continue to work with bodies to further enhance their governance arrangements.

We also continued to be involved in providing training to both staff and non-executives through programmes developed by the Chief Executives’ Forum. These programmes focussed on accountability and governance and were aimed at a number of different groups including Accounting Officers, Senior Managers, Board Members and Audit and Risk Assurance Committee Members.

We continue to support public sector bodies as they maintain their fight against fraud. Ongoing budgetary pressures and the unprecedented impact of the COVID-19 pandemic, with the increased risk of fraud that it has brought, mean that public bodies must continue to use all means at their disposal to prevent and detect misuse of public funds. Only in this way can frontline resources be maximised.

We maintain a small counter fraud unit which provides support, advice and guidanceon fraud related matters to public sector organisations. In light of the challenges of COVID-19, the unit produced two fraud risk guides during 2020-21. These helped to raise awareness across the NI public sector of the particular fraud risks associated with the pandemic and, in more detail, the fraud risks around procurement. The guides are available on our website.

A key focus continues to be the prevention and detection of fraud and error through data matching. Data matching involves comparing pieces of data or information held by one organisation against other records held by the same or another organisation, in order to highlight potentially fraudulent claims and payments.

Since 2008 we have participated in the National Fraud Initiative (NFI), a UK wide data matching initiative to combat fraud and error, which runs every two years. The seventh exercise in Northern Ireland is currently underway and will include a new area of data matching relating to business support grants paid out in response to the COVID-19 pandemic. The previous six exercises identified a total of almost £40 million of fraud and error. The C&AG’s reports on the NFI exercises are available on our website. We encourage public sector bodies to make the NFI a key part of their counter fraud strategies.

Raising Concerns

The Comptroller and Auditor General and the Local Government Auditor are prescribed persons under public interest disclosure legislation. Part of the Office’s counter fraud role is considering public interest concerns raised by, among others, public sector employees, contractors and the wider public. During 2020-21, we published a new good practice guide on Raising Concerns, available on our good practice guide webpage.

In 2020-21, 47 disclosures about the use of public money were received (2019-20: 49 cases). Disclosures are encouraged, dealt with professionally and treated in confidence, as appropriate.

| Nature of concern | 2020-21 | 2019-20 |

|---|---|---|

| Grant-related fraud | 1 | 2 |

| Non-entitlement to/misuse of public funds | 10 | 10 |

| Procurement/Contracts | 5 | 4 |

| Conflict of interest | 2 | 1 |

| Failure to follow proper procedures | 10 | 5 |

| Planning issues | 4 | 6 |

| Governance issues | 5 | 13 |

| Other | 10 | 6 |

| No remit | 0 | 2 |

| Total Cases | 47 | 49 |

Of the 47 disclosures, 19 related to our local government remit, two of which were received from councillors. In 2019-20, 18 disclosures related to local government, two of which were received from councillors.

MLA queries

We also pursue concerns raised with us by elected representatives. In 2020-21, Members of the Legislative Assembly (MLAs) raised eight separate concerns, all of which we have followed up (2019-20: 11 cases). Some remain under investigation.

| Nature of concern | 2020-21 | 2019-20 |

|---|---|---|

| Non-entitlement to/misuse of public funds | 4 | 5 |

| Failure to follow proper procedures | 1 | 0 |

| Procurement/contracts | 0 | 1 |

| Planning issues | 1 | 0 |

| Other | 1 | 4 |

| Conflict of Interest | 1 | 1 |

| Total Cases | 8 | 11 |

Support to the Northern Ireland Assembly and the public

We provide the Northern Ireland Assembly with independent support to enable it to hold the Executive to account for its financial management and the value for money it provides to the taxpayer for the public funds it spends. Our main engagement is through the support we provide to the Public Accounts Committee (PAC). We present our reports to the Assembly and many of these form the basis of the PAC’s inquiries, at which it takes evidence from the senior departmental officials involved. Reports not taken by PAC are released to the Assembly’s Statutory Committees and can sometimes form the basis for their own inquiries.

Following consideration of the evidence at its inquiries, the PAC publishes its own reports which include recommendations to departments and other public bodies. Relevant departmental Ministers, supported by Executive colleagues, are then required to respond to these recommendations, specifying the action the audited body intends to take. We monitor the action taken and may revisit an issue where we consider that insufficient progress has been made.

As a result of the COVID-19 pandemic, the PAC temporarily suspended its meetings from the 19 March until the 27 May 2020. This was to enable senior government officials to focus on ensuring that public services continued to be delivered during the pandemic. During this period we advised our auditees that public audit would not get in the way of the efforts of severely stretched public bodies in dealing with the pandemic. We continued to publish our reports, excluding health related matters, and present them to the Assembly as we awaited the return of the PAC. When the PAC reconvened in May we recommenced our support, resulting in the selection of six of our reports by the PAC to form the basis of new inquiries. By the end of the financial year four of these inquiries had been completed. The outcome from these inquires included the publication of four PAC reports, together with wide reaching recommendations which, when implemented, should enhance the effectiveness and efficiency of public services going forward.

Responding to Citizens

We continue to receive enquiries from a wide range of people about the bodies we audit. Where appropriate, we may carry out further audit work in response.

- 8 new issues of concern raised through MLAs/MPs (11 in 2019-20)

- 47 issues of concern received from the public/employees (49 in 2019-20)

- 2 Environmental Information requests received under Data Protection Act 2018(0 in 2019-20)

- 3 Complaints received (3 in 2019-20)

- 14 Freedom of Information requests (15 in 2019-20)

Stakeholder Engagement

Effective communication and engagement with stakeholders is vital to the NIAO. It informs and influences what we do, and helps build awareness, trust and confidence in those interested in and affected by our work. We remain committed to open, two-way communication that involves us listening to our stakeholders; keeping them informed; and being clear about how their contributions are being used. It is about recognising and understanding stakeholders’ individual values, beliefs, perceptions and ideas, while maintaining our independence and impartiality.

We have continued to build on our work to engage with internal and external stakeholders, this year working through the action plan which evolved from our Communications and Engagement Strategy. This strategy has continued to guide us in planning and undertaking engagement activities in support of our key strategic priorities.

As well as maintaining sustained dialogue and interaction, in May 2021 we issued our latest survey to all audited bodies across central departments, local government and NDPBs. Of the 111 questionnaires issued, 65 responses were received. This survey collected feedback on audited bodies’ experiences of working with the Office during the previous twelve months, both in relation to public reporting and financial audit. Of the responses received:

- 97% Agreed or strongly agreed that NIAO audit staff provided a high quality and professional service

- 97% Agreed or strongly agreed that the NIAO’s work leads to improvement in public services

- 92% Agreed or strongly agreed that our auditors were responsive to the challenges faced during the pandemic

- 98% Agreed or strongly agreed that our good practice guides are a useful resource)

- 82% Agreed or strongly agreed that our Public Reporting Programme addresses salient issues and challenges stemming from the COVID-19 pandemic

We are active on social media, publishing on both Twitter (@NIAuditOffice) and LinkedIn. Content continues to cover new reports, corporate events and miscellaneous news on organisational and staff achievements. Audiences on both platforms have increased over the last 12 months, with followers on Twitter increasing by 25 per cent and LinkedIn followers increasing by 81%.

We have also introduced the use of both video and animation to our media portfolio through our social media handles and the establishment of an NIAO YouTube channel. This has further enhanced our outreach with over 4,000 views being achieved in the first 11 months.

Impacts

We have a responsibility to achieve value for money on the services we provide to our stakeholders. One way in which we measure our success is by identifying the quantifiable financial impact of our work. In doing so, we recognise that our measurement of impact will only present a partial picture, as it is hard to quantify the deterrent effect of public audit, including the issue of our good practice guides, in contributing to improved public services.

During 2020-21, quantitative financial impacts of £60 million were achieved as a result of the work of the Office (2019-20: £63.28 million). This figure has been independently validated by the Office’s External Auditor and represents 8.2 times the net resource outturn of the Office (2019-20: 9.5 times).

The following examples demonstrate the main financial impacts achieved during 2020-21:

| NIAO REPORT | IMPACT |

|---|---|

| Renewable Heat Incentive (RHI) – Our work previously identified that the tariff paid to applicants to the scheme before November 2015 was greater than the cost to produce the heat, which therefore incentivised those applicants to unnecessarily burn more fuel. We had a direct impact in reducing tariffs paid to all applicants and also in changing the behaviour of applicants once our first report was published in 2016. | £49.6 million (cumulative impact of £162 million) |

| General Report on Health & Social Care Sector 2012-13 and 2013-14 – As a result of our recommendations, a number of fraud investigations were undertaken, resulting in estimated annual savings of some £3.8 million. We agreed a proportionate share of the savings – £0.76 million in the current year. | £0.76 million |

| Primary Care Prescribing – Following our 2014 report, the HSC Board developed a prescribing efficiency plan for the primary care drugs budget. The HSC Board reported efficiency savings of £15.1 million. We agreed a proportionate share of these savings - £3.02 million in the current year. | £3.02 million |

Reform of Legal Aid Remuneration for Legal Aid Providers Savings arising from the introduction of Crown Court Rules 2016 are forecast to save £5 million per year. Our report and PAC’s report contributed to this position and we have agreed a proportionate share of the savings. | £2.5 million |

| Generating Electricity from Renewable Energy – as a direct result of this report, Land and Property Services was able to identify a large number of renewable generating stations that had not been assessed for rates valuation, resulting in £4.1 million billed. We had a direct impact on LPS being able to identify and bill those generating stations that were previously not paying rates. | £4.1 million |

| TOTAL IMPACTS | £59.98 million |

The extent of savings achieved can fluctuate from year to year and is largely dependent on the nature of the studies undertaken in the value for money audit programme. Where our recommendations overlap with audited bodies’ own performance improvement work, we will consider the percentage share of the quantified financial impact that can be attributed to our influence.

Qualitative impacts of the audit function

Contract Management

In our reports on Management of the NI Direct Strategic Partner Project – helping to deliver Digital Transformation and The LandWeb Project: An Update, we highlighted that final Department of Finance (DoF) costs (of over £120 million) over the life of both contracts will be more than double the original contract values. Both contracts have been extended and additional services were provided.

Both contracts were very different in nature and decisions to extend these contracts arose due to a variety of reasons including a failure to plan strategically for the replacement of the contracts, the absence of basic contract management systems, a lack of contract management and commercial skills among key staff and silo-working within and across departments.

DoF has accepted the need for improvements in contract management. It plans to complete a deep culture audit with respect to contract management approach, knowledge and skills by October 2021. It intends to share the findings with other departments and use the results as a baseline to monitor progress in the future.

DoF also intends to publish guidance for all departments, setting out the need to maintain a register of all contracts and expiry dates. Senior Responsible Officers will be required to regularly update these registers which will be monitored by Departmental Boards.

In addition, DoF has undertaken to identify and manage talent pools of staff with contract management and commercial skills across the NICS. Details will be shared with Arm’s Length Bodies (ALBs) to encourage them to consider a similar approach.

Further, the DoF Permanent Secretary has issued Engagement Letters to Senior Business Owners (SBOs) and Senior Responsible Owners which set out the full range of their contract management responsibilities, including the requirement to undertake the necessary training to fulfil the role. The responsibilities of team members have also been defined and these roles are filled by staff with the required knowledge, skills and experience.

We welcome DoF’s positive response to our findings and acknowledge that the actions planned should do much to improve contract management across the public sector.

Managing Attendance in Central and Local Government

In this report we provided an overview of sickness absence levels across the nine central government departments and eleven local councils in Northern Ireland. We identified key principles in attendance management that are consistent across the public sector. We made a number of recommendations which we believe will assist the public sector in making progress on managing attendance. These included the need for a more strategic, joined up approach, a particular focus on reducing long-term absence and opportunities for organisations to share good practice.

Workforce Planning for Nurses and Midwives

Our July 2020 report highlighted the need to sustain the substantial increase in the number of nursing training places commissioned in 2020-21 to start to address rising nursing vacancy rates and an increasing spend on temporary staff.

In April 2021, the Department announced that it was retaining the all-time high 1,350 nursing and midwifery training places which were commissioned in 2020-21 for 2021-22 (an increase of 87 per cent compared to 2015-16 commissioning levels). This represents further progress in the ongoing efforts to build a workforce which is of sufficient size to deliver safe care and has the necessary skills and expertise to support the transformation agenda.

Good Practice Guides

In keeping with our corporate strategic priority “to influence the pace and direction of public sector transformation in Northern Ireland by providing independent insight”, the Office continues to work with our stakeholders in the development and implementation of best practice. This can be demonstrated through the development of three further good practice guides during 2020-21 which were designed to support the delivery of the new outcomes-based approach in the Programme for Government (PfG).

Raising Concerns: A Good Practice Guide for the Northern Ireland Public Sector

This guide, published in June 2020, was launched at a virtual event hosted by the Chief Executive’s Forum. It encourages organisations to put in place effective arrangements for receiving concerns from employees and the wider public, to ensure that such concerns are properly considered and appropriately acted upon. The guide advocates having a well sign-posted route for those wishing to raise a concern in the public interest, and suggests that organisations should appoint a raising concerns champion who can be a source of advice and support for staff but, in addition, a key resource for connecting the organisation to service users and the wider public. The guide draws on the Freedom to Speak Up report by Sir Robert Francis QC in 2015, which made significant recommendations in relation to speaking up in the health service in England, and also the Renewable Heat Incentive (RHI) Inquiry report, published in March 2020, which made recommendations on how public sector organisations should deal with concerns raised by the wider public.

COVID-19 Fraud Risks

A further good practice guide on COVID-19 Fraud Risks was issued on 1 September 2020, which highlighted that the risk of fraud had increased with the onset of the coronavirus pandemic. This short guide drew together information issued by a range of counter fraud organisations on existing and emerging fraud risks, to provide a quick reference point for NI public sector organisations on the key risks and mitigating controls.

Procurement Fraud risk guide

In November 2020, we published a guide to Procurement Fraud risks. Public procurement is vulnerable to fraud and corruption because of the level of expenditure, the volume of transactions, the complexity of the process and the number of stakeholders involved, and these risk factors increased significantly as a result of the COVID-19 pandemic. Fraud can only be tackled effectively if it is identified, measured and reported, so the guide was developed to help public sector organisations recognise the nature and level of procurement fraud, and to highlight effective controls which can be put in place. The guide will also be useful for auditors reviewing procurement arrangements and procurement expenditure, helping them to identify the warning signs (or “red flags”) of potential fraud.

Office Collaborations

Arm’s Length Bodies – The Office retains a sitting member on the Review Group, led by the Department of Finance, which is examining the sponsorship arrangement for arm’s length bodies. This working group has developed and produced a number of reports including an NI Code of Good Practice on Partnerships between departments and arms’ length bodies, a partnership agreement template and guidance around proportionate autonomy for arm’s length bodies. These have been issued across the public sector in the form of Dear Accounting Office (DAO) letters.

Boardroom Apprentice programme – We continue to collaborate and participate with the apprenticeship scheme run by Strictly Boardroom, a training programme for those who want to serve on a board, especially in the public and third sectors. It is an initiative that bridges the gap between aspiration and reality for those who want to serve on a board and would like some help to get there.

Chief Executives’ Forum – We work closely with the Chief Executives’ Forum (CEF), an association of chief executive officers of civil and wider public service bodies in Northern Ireland, whose strategic purpose is ‘To support Northern Ireland’s public sector leadership to achieve improved outcomes by building trust, understanding, learning and collaboration across the public sector’. As part of this collaboration we have contributed alongside CEF to various training events on good governance and in the launch of our good practice guides. The Comptroller and Auditor General is a member of the CEF Board.

Our People

We also consider the impact that the Office has had on our staff in providing them with the tools and training opportunities to develop and broaden their experience.

Every year the Office employs a number of Trainee Accountants (TA), where they work while undertaking their studies. We are extremely proud of our TAs, the hard work they put in, and the results they achieved, especially during the Covid-19 pandemic.

A sample of their achievements are set out below:

Sinead Henry

In October 2020, when our TAs took their exams, one of our students, Sinead Henry, was ranked in 5th place out of 326 students in the CAP1 exam. She was delighted with her results and said “When I opened the letter this morning, it was a case of telling myself to breathe as I was so nervous! I was really shocked and delighted with my results.” Sinead spoke about sitting the exam remotely and what it was like, “…even though we weren’t together with the other TAs in the Office, if you ever were confused or had a question, there was always someone that you could talk to about something, and they were always really helpful.” The NIAO has recently appointed a new Learning and Development Officer to assist the TAs during their studies and time at NIAO.

Clare Monaghan

At the beginning of 2021, Trainee Accountant (TA) Clare Monaghan, was appointed to the role of Chair of Chartered Accountants Students Society Ireland (CASSI). Clare had previously been active in the Chartered Accountants Students Society Ulster, and decided that the next step was to move to CASSI, as her term had ended in November 2020.

CASSI held their AGM in February 2021 where, following a conversation with the incumbent Chairperson, Clare decided to allow her name to be put forward for this post and was successful in the subsequent election.

In her role, Clare maintains a strong working relationship with the different regions of the Students Society (Dublin, Ulster, Midlands, South-East, Cork, Galway, Sligo, Limerick); supports and manages all the committee members; keeps strong communication with external bodies; as well as sitting on the Strategic Communications Committee and Council, representing students.

Clare believes that through sitting on committees she has had the opportunity to work with a diverse group of individuals with expertise in the different areas of business across audit, risk management, stock market, and financial accountant management. She has also been able to build a wide support network of friends and colleagues, and working as part of a team.

When asked about her experience of working at the NIAO Claire said “It’s been challenging so far. You take every day as it comes, and as long as you have a good support network around you, may that be your family, friends, work colleagues, I would say reach out to them during your challenging times, but it’s definitely worth it. I couldn’t recommend it more to anyone.”

Performance measurement

In addition to measuring the financial impact of our audit work, we have a number of key performance measures to assist in demonstrating our productivity, quality of work and achievements in reducing costs. Performance achieved in 2020-21 against these key measures is as follows:

Key performance measures

Target: To deliver a comprehensive programme of work with reduced resources, maintaining high standards.

We delivered a range of audit outputs with a net resource outturn that was 10.2 per cent higher in 2020-21 compared to 2019-20 (excluding ring-fenced VES and SBRI/GovTech expenditure). In the six years up to and including 2020-21, our annual net resource outturn (excluding ring-fenced VES and SBRI/GovTech expenditure) has reduced by 8.5 per cent (16.0 per cent in real terms).

Target: To produce 32 public reports in 2020-21 as per the NIAO Public Reporting Programme (2019-22).

We published 22 reports (2019-20: 31), including 6 which arose as a result of findings from the financial audit process.

NIAO Public Reporting Programme (2019-22) was re-prioritised in-year following the onset of COVID -19

Target: We subject our value for money reports to independent review by a panel of experts who rate the reports on a scale of one to five. We aim to ensure that our value for money reports maintain an average quality review score of at least three.

We achieved an average score of 3.7 for reports reviewed during 2020-21, (2019-20: 3.5).

Target: To certify 149 accounts; 80 per cent of audited bodies within seven months and 100 per cent within twelve months.

We achieved certification of 126 accounts. In addition, 11 prior year accounts were certified in 2020-21, to total 137, (2019-20: 142). Of the 126 accounts certified, 56 per cent of audits were delivered within seven months (2019-20: 80 per cent) and 83 per cent within 12 months (2019-20: 88 per cent). This was achieved despite the onset of the pandemic, the closure of the building for over three months and the need for staff to work remotely.

Target: Annual confirmation of compliance with the International Standard on Quality Control (ISQC 1), to ensure that our financial audit has complied with our audit methodology and professional auditing standards.

Eight accounts were reviewed by teams independent of the audit team or NIAO. Six audits were rated as ‘limited improvements required’ and two audits were rated as, improvements required. The results include two audits reviewed by ICAEW, which were rated as ‘limited improvements required’. The review process has continued to identify a lack of documentary evidence as a key issue.

Resource Accounts 2020-21

Schedule 2 of the Audit (Northern Ireland) Order 1987 requires the NIAO to prepare resource accounts. Details of the Order can be found at www.legislation.gov.uk.

The financial statements on pages 88 to 107 have been prepared by us on a resource basis in accordance with the 2020-21 Government Financial Reporting Manual (FReM) issued by the Department of Finance.

NIAO Estimate and Budget process

The Audit (Northern Ireland) Order 1987 requires the C&AG to prepare a Supply Estimate each financial year. The Northern Ireland Assembly Audit Committee (NIAAC) examines our budget proposals, agrees the annual Supply Estimate with the C&AG, and lays the Supply Estimate before the Assembly for approval.

The NIAAC approved the NIAO budget proposal for 2020-21 in February 2020. The Budget Act (Northern Ireland) 2020 was approved by the Assembly and enacted on 26th March 2020. The authorisations, appropriations and limits in this Act provided the authority for a Vote on Account to provide cash and resources for the initial months of the 2020-21 financial year.

While it would be normal for this to be followed by the 2020-21 Main Estimates and the associated Budget (No. 2) Act before the summer recess, the COVID-19 emergency and the unprecedented level of allocations which the Executive agreed in response, necessitated that the Budget (No. 2) Act instead authorise a further Vote on Account on 17th June 2020 to ensure continued access to cash and resources until the 2020-21 Main Estimate was laid.

The 2020-21 Main Estimate, and the associated Budget (No.3) Act, was approved by the Assembly and enacted on 25th November 2020.

The NIAO budget proposal for 2021-22 was agreed by the Assembly Audit Committee in December 2021 and was included in the 2021-22 Main Estimate when it was approved by the Assembly on 7 June 2021.

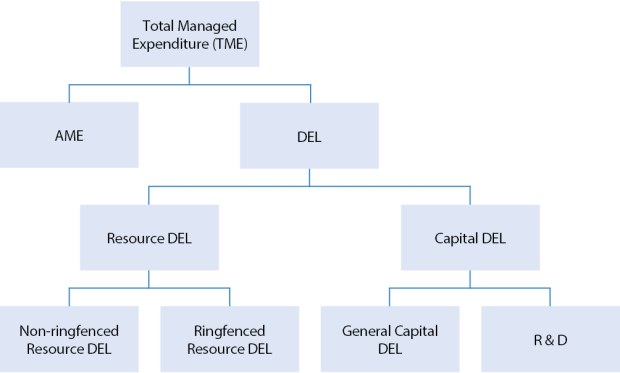

Budget structure

Budgets are split into 2 categories:

- Annually Managed Expenditure (AME);

- Departmental Expenditure Limit (DEL).

AME budgets are volatile or demand-led in a way that bodies cannot control. The NIAO does not have any AME expenditure.

DEL budgets are classified into resource and capital.

- Resource budgets are further split into non-ring fenced resource that pays for programme delivery and running costs, and separately ring fenced resource that covers non-cash charges for depreciation and impairment of assets.

- Capital DEL includes spending on assets. Research and Development grants are also included as Capital DEL for budget purposes but as resource in the Estimate.

Budget information does not currently relate directly to financial information presented in Financial Statements due to a number of misalignments. It is intended that the Executive’s Review of Financial Process will help address these differences and improve transparency.

Further detail on DoF’s Budgeting Framework can be found in the Consolidated Budgeting Guidance published by Treasury.

Resources

Set out below are the resource outturn figures in cash terms from 2014-15 to 2020-21 excluding the costs of the Voluntary Exit Scheme (VES) and SBRI/GovTech. In real terms, the 2020-21 position represents a 16 per cent reduction in net Resource Outturn compared with 2014-15. Significant reductions were made since 2014-15 primarily through natural wastage and the implementation of VES.

Resource Outturn 2014-15 to 2020-22

The resources used by the Office in 2020-21 are set out in the following table:

| Estimate £’000 | Outturn £’000 | Saving/(Excess) | ||

|---|---|---|---|---|

| £’000 | £’000 | |||

| Gross Resource Requirement | 10,245 | 9,968 | 277 | 2.7 |

| Income | 2,665 | 2,641 | (24) | (0.9) |

| Net Resource Requirement (NRO) | 7,580 | 7,327 | 253 | 3.3 |

| SBRI/GovTech | 250 | 249 | 1 | 0.0 |

| NRO excluding SBRI/GovTech | 7,330 | 7,078 | 252 | 3.4 |

| Capital | 330 | 278 | 52 | 15.8 |

Savings arose from:

- a decrease to in-year salary costs arising from the timing of recruitment; and

- reductions in travel and training expenditure due to COVID-19.

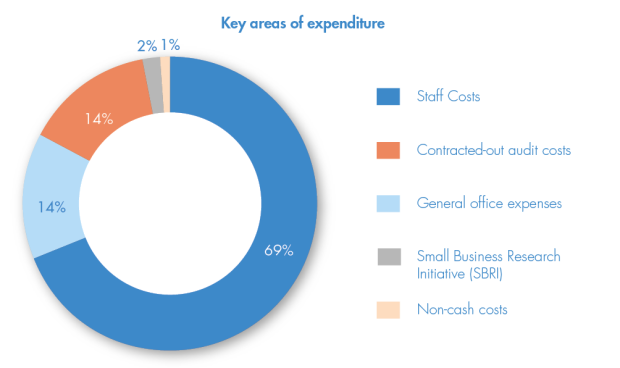

Staff costs continue to be the largest area of expenditure for the Office:

In addition to the above, the cost of administering the Comptroller Function was £14,000, as shown at Note 2 to the Financial Statements

Income includes:

- fees received from:

- some central government bodies and North-South bodies in respect of the audit of their accounts;

- the National Audit Office, for audits we carry out on its behalf;

- local government bodies, for the audit of their accounts and performance improvement;

- recoupment of salary and associated costs for seconded staff; and

- rental income from subletting areas of our building.

Each element of income, and the direct costs associated with it, is shown in Other Assembly Accountability Disclosures (Audited), at page 78.

Resources required in the future

The 2021-22 Main Estimate was approved by the Assembly on 7 June 2021. Allocated resources are shown in the following table:

| 2021-22 £’000 | |

|---|---|

| Gross Resource Requirement | 11,130 |

| Income | 2,540 |

| Net Resource Requirement (NRR) | 8,590 |

| Capital | 4,450 |

Capital – Redeveloping our Office Accommodation

The 2021-22 capital budget includes £4.41 million of capital for the redevelopment of our premises as part of a project to better utilise the space that we currently occupy. The capital budget is to cover most of the construction phase of this project. Costs incurred to date are shown under ‘Assets under Construction’ in Note 6 of the financial statements.

The tender process for the main construction works has been completed and the contract was awarded on 4 June 2021.

Reconciliation of Resource Expenditure between Estimates, Accounts and Budgets

The Government Financial Reporting Manual requires a table showing a reconciliation, on an outturn basis, between the Net Resource Outturn, the Net Operating Cost and the Budget. This table is shown below:

| 2020-21 £’000 | 2019-20 £’000 | |

|---|---|---|

| Net Resource Outturn | 7,327 | 6,663 |

| Consolidated Fund Extra Receipts | - | (1) |

| Non-supply expenditure | 160 | 160 |

| Net Operating Cost | 7,487 | (6,822) |

| Research & Development Expenditure (SBRI/GovTech) | (249) | (238) |

| Resource Budget Outturn of which | 7,238 | 6,584 |

| Department Expenditure Limits (DEL) | 7,238 | 6,584 |

| Annually Managed Expenditure (AME) | - | - |

Payment of Suppliers

The Office is committed to the prompt payment of bills for goods and services received, in accordance with the Better Payment Practice Code. Unless otherwise stated in the contract, payment is due within 30 days after delivery of the invoice or the goods and services, whichever is later.

Our University Street premises were temporarily closed on 18th March 2020, due to COVID-19 restrictions. Despite putting alternative arrangements in place for postal deliveries, these were subject to disruption and delay, having an adverse impact on the availability of prompt payment data. Prompt payment figures for the 6 month period from 1 April 2020 to 30 September 2020 are not available.

For the 6 month period from 1 October 2020 to 31 March 2021, the Office paid 98.3 per cent of bills (2019-20: 97 per cent) within this standard.

In addition to this, the government has said that, wherever possible, public sector bodies should seek to pay suppliers within 10 working days of receipt of the invoice. For the 6 month period from 1 October 2020 to 31 March 2021, we met this standard for 92.3 per cent of invoices received (2019-20: 89.6 per cent).

Future development of the business

Our three strategic priorities for the period 2021-24 in our Corporate Plan are as follows:

- Support and promote high standards in public administration and financial management in a complex dynamic environment.

- Influence the pace and direction of public sector transformation in Northern Ireland by providing independent insight.

- Ensure the NIAO operates as a high performing organisation to meet emerging challenges.

Each of these will be impacted upon by the COVID-19 pandemic as we move through the remainder of the reporting period.

In supporting and promoting high standards in public administration and financial management in a complex dynamic environment, we will:

- provide our taxpayers, ratepayers, elected representatives and the wider public through the timely delivery of our financial audit programme;

- support the PAC in holding the public sector to account through the delivery of topical, timely and accurate reports;

- promote high standards of leadership and transparency across the public sector;

- promote a strong counter fraud culture across the public sector; and

- produce best practice reports and disseminate across the public sector.

What is the Outcome: The NIAO plays a key role in overseeing and providing assurance on public sector spending in Northern Ireland to the NI Assembly.

Through influencing the pace and direction of public sector transformation in Northern Ireland by providing independent insight, we will:

- ensure our reports and good practice guides target the key public sector priorities in a proportionate and timely manner;

- influence public sector transformation through providing informed opinion on the contribution to Programme for Government outcomes;

- share lessons learned and insights gained through the public sector COVID response to accelerate transformation;

- work collaboratively and constructively with other public sector leaders to develop more efficient and effective public services in Northern Ireland; and

- promote opportunities for ‘joined up’ working across the public sector to implement the new PfG.

What is the Outcome: Using its experience and expertise, the NIAO offers ‘thought leadership’ to the public sector as it transforms in a dynamic and challenging environment.

By ensuring that the NIAO operates as a high performing organisation to meet emerging challenges, we will:

- implement the NIAO People Strategy and Investors in People standards to develop the capacity and capability of our highly skilled, motivated and versatile workforce;

- regularly review our audit policies, standards, procedures and methodologies, including digitalisation, to ensure the NIAO is at the forefront of best practice;

- put in place robust governance and quality control mechanisms and apply them consistently in a proportionate and cost effective manner;

- develop a balanced suite of performance measures to oversee, manage and measure all aspects of performance and productivity; and

- create a modern attractive workplace and working arrangements that maximise the productivity of staff.

What is the outcome: The NIAO is an exemplar of good governance and organisational economy, efficiency, and effectiveness.

Our purpose drives our vision, which is delivered through our corporate priorities and our core values. How these fit together in an integrated way is represented in the diagram below.

NIAO Purpose, Vision, Values and Priorities

Sustainability, environmental, social and community matters

We are committed to sustainable practice and minimising our impact on the environment. We meet these commitments by disposing of waste carefully, recycling appropriate materials, and by conserving the energy we consume. Locally, we have removed individual waste paper bins to encourage staff to think more carefully about personal recycling.

Redundant electronic and electrical equipment is passed to an external contractor who expunges all data to a standard set by government and then recycles the hardware; redundant furniture is disposed of by way of re-use or environmental destruction; and electricity consumption has been reduced by replacing halogen lighting with lower energy alternatives and air conditioning units with more energy efficient units. Our reprographic equipment will only print after logging on using a personal swipe card, with a default setting for two-sided printing in black and white, reducing the amount of unnecessary printing and thus paper consumption. In addition, we have reduced the number of printed copies of each public report, issuing reports electronically where appropriate.

The Office’s procurement guidance requires procurement decisions to have regard to equality of opportunity and sustainable development. Much of what we procure, including services for the upkeep of our premises, is through Northern Ireland Civil Service (NICS) wide contracts. These contracts, established locally by the Department of Finance’s Construction and Procurement Delivery, are committed to delivering on the NICS’ sustainability, environmental, social and community objectives. For example, contractors are encouraged to work with small suppliers (i.e. fewer than 50 employees), micro suppliers (i.e. fewer than 10 employees) or Social Economy Enterprises throughout their supply chains. Payment to subcontractors should be made within 30 days of receipt of a valid invoice.

Kieran Donnelly CB

Comptroller and Auditor General for Northern Ireland

02 July 2021

Accountability Report

£7.33 Million Net Resource Outturn for 2020-21

Auditor’s Report Unqualified independent auditor’s report

£6.94 Million Staff costs

114 FTE Staff in post at 31 March 2021

6 Senior Management Team

- 4 Male

- 2 Female

108 Other Staff

- 49 Male

- 59 Female

CORPORATE GOVERNANCE REPORT

The purpose of the corporate governance report is to explain the composition and organisation of the NIAO’s governance structures and outline how they support the achievement of our objectives.

Directors’ Report

The directors of the NIAO comprise the senior managers and the non-executive members, whose details are set out below.

NIAO Senior Management Team

Subject to the C&AG’s statutory position as corporation sole and his primacy in setting strategy, policy and procedures, the Senior Management Team (SMT) is the principal mechanism for directing the business and decision making in the NIAO. This team is chaired by the C&AG and its membership over the reporting period was as follows:

Pamela McCreedy

Chief Operating Officer (until 28 February 2021)

Rodney Allen

Chief Operating Officer (from 15 March 2021)

Rodney Allen

Director (until 14 March 2021)

Patrick Barr

Director

Neil Gray

Director

Colette Kane

Director

Suzanne Walsh

Director

Tomas Wilkinson

Director

Denver Lynn

Director (Retired 2 January 2020)

Brian O’Neill

Director (effective from 1 June 2021)

C&AG’s Advisory Board

The Advisory Board is responsible for providing objective and impartial advice to the C&AG to assist him in the discharge of his functions, and works in partnership with the C&AG and the SMT. The Advisory Board scrutinises the work of the NIAO in the five areas of strategic clarity, commercial sense, talented people, results focus and management information. It also scrutinises and advises on Office finances on an ongoing basis.

The Advisory Board comprises both executive (C&AG and Chief Operating Officer (COO)) and non-executive members, the latter bringing an independent and external perspective to the work of the Board.

Under current arrangements, the Chairperson of the Advisory Board is appointed by the C&AG through open competition, based on merit, following endorsement by the Northern Ireland Assembly Audit Committee (NIAAC). Non-executive members are similarly engaged and will be members of the Advisory Board.

Each non-executive member is appointed for a three year period, which may be extended for a maximum of a further three years by the C&AG with the endorsement of the NIAAC.

These arrangements will be revisited following the review of “Governance and Accountability Arrangements for the NIAO [and the Northern Ireland Public Services Ombudsman]” currently being conducted by the NIAAC.

In 2020-21, the Advisory Board’s membership was as follows:

Martin Pitt

Advisory Board Chairperson

In December 2018, Martin Pitt was appointed as the Chairperson of the Advisory Board. He was previously a partner within PwC’s Audit and Assurance Team and Head of Internal Audit, bringing with him over 30 years’ experience working with public and private sector bodies across the UK. Throughout his career, he has advised organisations on issues relating to corporate governance and risk management.

Rodney Allen (from 15 March 2021)

Chief Operating Officer

On 15 March 2021, Rodney Allen was appointed Chief Operating Officer, with responsibility for both leading and managing the NIAO’s operational business and supporting the C&AG in the strategic leadership of the NIAO, including stakeholder management. He is responsible for cultural change within the NIAO, and for developing greater flexibility in management structures and service delivery.

Pamela McCreedy (until 28 February 2021)

Chief Operating Officer

Up until her resignation on 28 February 2021, Pamela McCreedy was Chief Operating Officer for the NIAO. She was also Local Government Auditor, with responsibility for leading all local government audits across Northern Ireland.

Three further non-executive members were appointed to the Advisory Board, effective from 1 April 2019.

Professor Noel Hyndman

Since January 2021, Noel has been Professor Emeritus and Honorary Professor at Queen’s University of Belfast, after a period as Professor of Accounting (2002-2020) and Director of the Centre for Not-for-profit and Public-sector Research (2015-2020). Previously, he was Professor of Accounting at the University of Ulster, and has held Visiting Professorships at the University of Ottawa in Canada and the University of Sydney in Australia, as well as being an Erskine Fellow at the University of Canterbury in New Zealand and a PARG Visiting Scholar in the Sprott School of Business, Carleton University, Ottawa, Canada. He is a Chartered Global Management Accountant and a Fellow of the Chartered Institute of Management Accountants. He is currently Chair of the British Accounting and Finance Association’s (BAFA’s) Public Services and Charities Special Interest Group, and a member of BAFA’s Executive Committee. Professor Hyndman has been Academic Advisor to the Chartered Accountants Ireland Educational Trust since 2011.

Marie Mallon MBE

Marie Mallon MBE was Chair of the Labour Relations Agency, from 2014 to 31 April 2021. Prior to that she was Director of HR and Deputy CEO of Belfast Health and Social Care Trust for seven years, having previously held the position of Director of HR with the Royal Hospitals Trust. Mrs Mallon is a Chartered Member of the Chartered Institute of Personnel and Development (CIPD) and obtained a distinction in her MSc in HR Leadership from University of Manchester. She is currently an associate of the Health and Social Care Leadership Centre and also undertakes independent HR consultancy. She was awarded an MBE in the Queen’s birthday honours list (2015) for services to health and social care.

John Turkington