This report has been prepared under Article 8 of the Audit (Northern Ireland) Order 1987 for presentation to the Northern Ireland Assembly in accordance with Article 11 of the Order.

K J Donnelly CB

Northern Ireland Audit Office

Comptroller and Auditor General

8 December 2021

The Comptroller and Auditor General is the head of the Northern Ireland Audit Office. He, and the Northern Ireland Audit Office are totally independent of Government. He certifies the accounts of all Government Departments and a wide range of other public sector bodies; and he has statutory authority to report to the Assembly on the economy, efficiency and effectiveness with which departments and other bodies have used their resources.

Abbreviations

SBSG Small Business Support Grant

RHTL Retail, Hospitality, Tourism and Leisure Grant Scheme

SBRR Small Business Rates Relief

DfE Department for the Economy

LPS Land and Property Services

DoF Department of Finance

C&AG Comptroller and Auditor General

Invest NI Invest Northern Ireland

DSO Departmental Solicitor’s Office

NAV Net Annual Value

MoU Memorandum of Understanding

MP Member of Parliament

MPMNI Managing Public Money Northern Ireland

MLA Member of the Legislative Assembly

ATM Automated Teller Machines

TEO The Executive Office

DEL Departmental Expenditure Limit

UK United Kingdom

Key Figures

£10,000 Amount paid to each eligible business in the Scheme with a rateable value below £15,000

£244.76 million Total payments issued through the Scheme

£109.6 million Amount paid direct to businesses without having to apply for the grant

£13.5 million C&AG’s estimated extrapolated value of ineligible payments

£5.68 million Ineligible payments identified by LPS and DfE to date

£1.76 million Amount recovered by DfE to date

Executive Summary

1. The Small Business Support Grant Scheme (the Scheme) was designed to provide funding to help businesses with “unavoidable fixed costs” in the face of an expected cash flow crisis during the period of significant disruption the COVID-19 crisis was causing to Northern Ireland (NI) businesses.

2. This was the first of a number of schemes, aimed at supporting NI businesses during the COVID-19 crisis. The scheme implemented in NI was based on a scheme for England announced by the UK Chancellor of the Exchequer on 17 March 2020. That scheme provided a £10,000 grant for every business occupying premises with a rateable value of £15,000 or less that qualified for Small Business Rates Relief. The Scottish Government and Welsh Assembly Government announced that they would deliver similar grant schemes in their jurisdictions. On 18 March 2020, the First Minister and deputy First Minister announced that the grants would also be provided in NI.

3. Under exceptionally challenging circumstances, not previously encountered, the Scheme was designed and delivered jointly by the Department for the Economy (DfE) and Land and Property Services (LPS) within the Department of Finance (DoF). Given Ministers’ concerns that there was an urgent need to provide businesses with support, the Scheme was delivered at extreme pace. In these circumstances it was inevitable that issues would arise, but it is critical that lessons were learnt from this and taken on board for later schemes.

4. Staff involved in the Scheme’s design and implementation had been instructed to work from home in mid-March 2020 due to the pandemic. At that stage, however, they lacked key resources needed to properly facilitate remote working, including video conferencing facilities (such as Zoom, MS Teams or Webex). At a time when the need for collaboration was paramount this increased the challenge for the officials involved, given the number of teams involved in developing and implementing the Scheme across both departments. Long hours were worked in delivering this Scheme, with a very short time frame from its announcement on 18 March 2020 to the first payments going out on 26 March 2020.

5. Funding for the Scheme was supported by the Finance Minister on 23 March 2020 and the decision to issue a Ministerial Direction was agreed by the First and deputy First Ministers on 26 March 2020. A Ministerial Direction was requested as the DfE’s Permanent Secretary had serious concerns over value for money and the risk of fraud and error inherent in the Scheme. These concerns stemmed primarily from the timescale in which the Scheme was required to be delivered, allowing insufficient time to undertake normal planning processes.

6. Many of the concerns raised by the DfE’s Permanent Secretary in advance of the roll-out of the Scheme came to fruition. Whilst the DfE has identified a number of lessons from the implementation of this Scheme which it has actioned in subsequent schemes we have identified some key areas which should be considered if similar emergency interventions are required in the future. These may be difficult to implement with the normal rigour while a crisis is ongoing, particularly when there are political and time pressures. However, a small amount of extra time taken to adequately plan and assess the delivery risks in a proportionate way could provide a better balance between pace and appropriate control.

7. The three main considerations for any future crisis should be;

(i) Ensuring a collaborative approach across departmental boundaries

The Scheme was designed by the DfE and administered by LPS however, the collaborative working arrangements and communication methods used by the departments could be improved upon in future emergency responses. In April 2019, the Northern Ireland Audit Office (NIAO) published a good practice guide titled “Making Partnerships Work” which provides guidance on how to work in a collaborative way across departmental boundaries. Whilst officials found themselves in very difficult circumstances at the time with the emerging pandemic, it should still have been possible to organise a more agile, cross-departmental Project Team made up of staff empowered to take decisions to deliver the Scheme. Given the need for cross-departmental working, this could have been strengthened by a clear joint statement from the two Accounting Officers outlining how responsibility would be managed or shared by the team. Daily Project Team meetings could have been held to ensure any emerging issues were raised and actioned without delay. No evidence was found that Invest NI, a body with significant experience in awarding grants to businesses, was consulted or involved in a meaningful way in designing or delivering the Scheme. Invest NI was involved in the drafting of the MoU (see 8(ii) below), but in terms of Scheme operation, had no direct involvement. In subsequent schemes, however, this lesson was taken on board and its’ experience was utilised more fully.

(ii) An assessment of need should be undertaken to support the business case

The focus during the early period was on getting urgent support to businesses and Ministers decided to deliver the type of scheme announced by the Chancellor of the Exchequer on 17 March and adopted in Scotland and Wales, because it could be delivered quickly. However, there was no evidence that the Scheme required any assessment of need or hardship prior to issuing payments, nor did it require any attempt be made to understand the impact of COVID-19 on different business types. This made it likely that businesses not suffering financial hardship would receive support with no attempt to quantify how much money would be paid to businesses in this position.

We accept that a full assessment was not possible given the context in which this Scheme was delivered. However, had a small amount of additional time been afforded to officials to better understand the differing impact the pandemic might have on various business types, additional protection of public funds may have been possible.

(iii) Engagement with small businesses (or those requiring support) is crucial

There was no evidence that during the design or administration of the Scheme there was effective communication with small businesses or their representatives. Had there been engagement in the early stages with representatives of the businesses potentially affected, the DfE could have assessed and understood their needs and the Scheme could therefore have been better targeted at those businesses in most need of financial support during this time.

We accept that a full consultation was not possible, however, agile engagement with business groups or Invest NI in the form of short meetings or focus groups may have been possible and provided useful insight.

8. In addition to the three main considerations identified above, there are a number of other observations:

(i) Identifying the appropriate legislative cover for issuing payments

Consideration was given during the design phase of the Scheme to what legislation could be used in order to make Scheme payments. The Department quickly established that it did not have the legal authority to make the payments directly to businesses and so a decision was taken to use the Industrial Development (Northern Ireland) Order 1982, which gives Invest NI the authority to make such payments. However, this may not have been the best “fit” in the circumstances. The Department essentially used Invest NI’s legal vires to make the payments to businesses and instructed Invest NI to record the spend through its accounts. Subsequent schemes used the Financial Assistance Act (Northern Ireland) 2009, although it is acknowledged if this route had been used here, the release of the first payments would have been delayed into April. Looking ahead, it is important that departments consider what powers may be available to facilitate urgent Executive business, how those powers can be used and how collaboration will work in a crisis.

(ii) Clarity of roles and responsibilities is crucial

The Memorandum of Understanding (MoU) for the Scheme outlined the various roles and responsibilities in its delivery, between the DfE, LPS and Invest NI. Whilst key points that informed this document were discussed and agreed prior to the first tranche of payments being made, the DfE told us that “by its very nature this process was evolutionary and this evolution helped to ensure that there was greater clarity of roles and responsibilities prior to agreement of the MoU”. As a result, by the time it was signed by all parties, £171 million had been paid out and questions around the eligibility of some businesses were still not resolved by the DfE. However, even with an MoU in place it is not clear if the DfE had sight of the work performed by LPS to identify and pay eligible businesses for the Scheme. There was no evidence that the DfE carried out any pre-payment checks over the accuracy of the data used or payments being prepared by LPS. The DfE, having overall responsibility for the Scheme, appears to be have been almost entirely reliant on LPS to deliver a Scheme for which it was responsible.

(iii) An appropriate dataset should be used, with the ability to undertake cross checks across other public sector databases

The use of the LPS dataset to determine businesses eligible to receive the grant was a creative solution. However, it was not the intended purpose of the non-domestic rating system, which records information about properties rather than the nature of the occupying businesses. Not surprisingly, problems arose when trying to match data in the rating system to other databases – but there were no plans in place to deal with the limitations of the LPS dataset. There was also a time lag in the rating system data as it relied heavily on ratepayer notifications of changes in circumstances to keep the information up to date and workarounds to deal with this had to be developed as the Scheme was being implemented. There appears to be numerous databases across government with different data structures being used by various bodies and an absence of common identifiers for addresses, businesses or individuals. This makes cross matching of information difficult when performing control checks, e.g. differences in how addresses are entered into a database can prevent automated data matching. Further options for data to be accessed from other public sector databases, such as the HMRC database, may have been possible had legislation facilitating this been in place at the time in Northern Ireland. For example, the full enactment of the Digital Economy Act, which facilitates easier sharing of data between public bodies, the implementation of electronic identify verification and a common address format for all public sector IT systems. These measures would greatly facilitate the design and delivery of emergency interventions and manage the associated risks to public funding in future crises.

(iv) The use of push payments carries risks

On the same day that the online portal for applications went live on 26 March 2020, £67.7 million was paid via push payments, directly into the bank accounts of those businesses identified on the LPS database as eligible for SBRR and which paid their rates via direct debit. These payments were made without State Aid approval from the European Commission (see paragraph 3.5 below). In total £109.6 million was paid out using push payments allowing support to be distributed quickly. However, the DfE had no assurance that those who received the support first were most in need of assistance.

We accept that, had the Scheme focussed on processing applications as it commenced, rather than rather than the use of push payments, it would have taken longer to get the financial assistance to businesses, but we believe it would have offered greater protection to public funds.

(v) Ensuring application forms collate the information and assurances required to ensure that public money is being used for the purpose intended

For the remaining £133.4 million paid out, businesses seeking assistance were required to apply through a portal on the NI Business Info website. However, the application did not require the applicant to confirm that all information provided was accurate, or to outline if they were facing any “unavoidable fixed costs”. This makes it difficult to ensure that the intent of the Scheme is being achieved. Declarations have been used in the online applications processes for subsequent Covid grant schemes administered by both DfE and LPS.

(vi) Ensuring a clear method of recovery is in place right from the start

To date, LPS and the DfE have identified £5.68 million of potentially ineligible payments and recovered £1.76 million. A clear method for recovery and clawback was not in place from the outset of the Scheme to address any potential payment errors or, indeed, fraud.

(vii) A clear understanding of the approval process is important

Due to weaknesses in communication within the DfE, some staff believed that approval was needed for the Scheme from the DoF Supply team. However, prior to push payments being made on 26 March 2020, other officials realised this was not required since agreement from the First and deputy First Ministers to issue the Ministerial Direction had been obtained that day. DoF Supply approval was granted on 27 March 2020 and the Accounting Officer continued to correspond with the DoF on certain conditions attached to the approval given. Once the position on Executive approval was clarified in April 2020 the request for DoF Supply approval was subsequently rescinded.

9. The DfE has identified a number of lessons from this Scheme and other early COVID-19 schemes which have been shared with subsequent support schemes to help inform best practice and these are shown in Appendix 2.

Part One: Introduction and Background

1.1 The COVID-19 pandemic has had an unprecedented and significant impact on the Northern Ireland economy, on businesses and on their employees. As part of its response, on 18 March 2020, the First Minister and deputy First Minister announced that two grant schemes, the Small Business Support Grant Scheme and the Retail, Hospitality, Tourism and Leisure Grant Scheme (RHTL), would be developed to ease immediate cash flow pressures on businesses. This report focuses on the Small Business Support Grant Scheme (the Scheme) only, however Appendix 2 includes lessons learned from a number of DfE schemes.

1.2 The Scheme was launched on 26 March 2020, “to provide £10,000 to help with fixed costs for small businesses across Northern Ireland”. Funding offered was to cover “unavoidable fixed costs” incurred as a result of the significant strain the COVID-19 crisis was having on Northern Ireland businesses. For the purposes of the Scheme, “small businesses” were defined as those eligible for the Small Business Rate Relief (SBRR), that is, those businesses operating from properties with a rateable value of £15,000 or less.

1.3 The Scheme was designed and delivered jointly by the Department for the Economy (DfE) and Land and Property Services (LPS) within the Department of Finance (DoF).

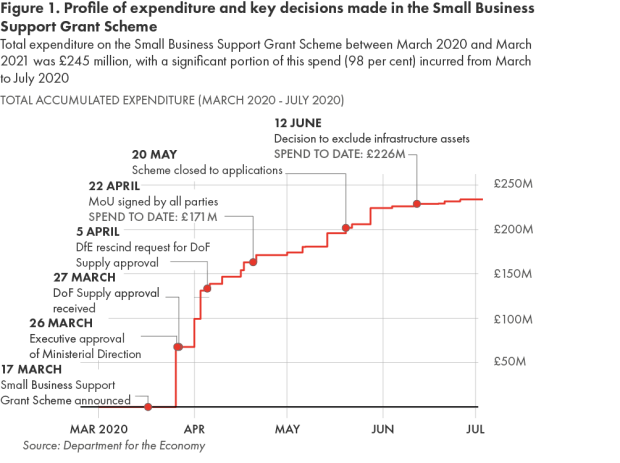

1.4 The Scheme closed to applications on 20 May 2020 with most of the payments made by the end of July 2020. Payments on appeal cases continued into 2021, with the last payment made at the beginning of October 2021 – 17 months after the Scheme launched. Expenditure made through the Scheme totalled £244.76 million. A profile of expenditure on the Scheme and details of key decisions are outlined in Figure 1.

Qualification of the 2019-20 DfE and Invest NI accounts

1.5 On 11 September 2020, the Comptroller and Auditor General (C&AG) provided a qualified regularity audit opinion on the DfE and Invest NI 2019-20 accounts in view of the level of ineligible payments issued through this Scheme.

1.6 The C&AG estimated that the extrapolated cost of ineligible payments may be in the region of £13.5 million. It appears that most, but not all, of the ineligible payments arose of a result of reliance on out of date or inaccurate data. Examples of the ineligible payments identified include:

- awards to businesses not trading from an eligible property at 15 March 2020, which were not notified to LPS until after an award was made;

- awards to landlords rather than tenants; and

- the issue of duplicate payments.

Scope of this report

1.7 Given the issues identified with the Scheme during the 2019-20 financial audit, the C&AG intended to carry out further work on the Scheme as part of the DfE 2020-21 audit. However, as further information on the Scheme emerged, he decided to prepare this short report in order to provide information on:

- the economic and political context in which the Scheme was conceived and delivered, including the decision to seek a Ministerial Direction;

- how key decisions were taken at the earliest stages of the Scheme’s development around how need was identified, Scheme eligibility criteria and how these were applied; and

- the extent to which lessons can, and have been, learnt and applied to subsequent schemes.

Audit of the 2020-21 DfE and Invest NI accounts

1.8 The outcome of our audit of Scheme expenditure in the 2020-21 accounts for both Invest NI and the DfE will be reported on in detail in the C&AG’s reports accompanying both sets of accounts.

Part Two: Designing the Scheme

The views of stakeholders were not sought prior to the implementation of the Scheme

2.1 A key control in designing any grant scheme is to consult with, and tap into the experience of, stakeholders with experience of designing and delivering similar schemes. Although staff within Invest NI had relevant experience, having implemented numerous grant schemes in the past, there was no evidence that their views on the design and delivery of the Scheme were sought or considered in any meaningful way. Similarly, there was no evidence that the DfE consulted with representatives from the small business sector in any meaningful way during the Scheme design phase.

2.2 While the Scheme was developed under significant time pressure, the views of those with relevant grant scheme knowledge, or knowledge of the potential impact of the pandemic on small businesses, should have been sought as effectively as possible within the constraints.

There were difficulties in identifying the appropriate legislative cover for issuing Scheme payments

2.3 One of the difficulties encountered by the DfE from the outset was determining which legislation to use in order to make Scheme payments. The DfE, conscious of the timescales which would have been required to secure secondary legislation to enact the Scheme, proposed making payments under legislative cover of the Industrial Development (Northern Ireland) Order 1982. This would ensure that grants could be issued promptly.

2.4 Since the legal authority to make payments under this Order sits with Invest NI, the DfE’s Accounting Officer instructed it to act as an agent of the NI Executive and record the Scheme payments in its accounts. Invest NI, however, had no involvement in designing the Scheme, identifying those who should be eligible for assistance or approving and processing payments.

2.5 As outlined above at 8(i) and paragraphs 1.5 and 1.6, this use of Invest NI for accounting purposes despite them having no role in the delivery of the Scheme, has resulted in the qualification of both organisations 2019-20 Accounts by the C&AG.

2.6 Invest NI had concerns about using this legislation for the Scheme. In fact, it advised the DfE against use of this legislation. In response to the Invest NI concerns, the DfE obtained advice from the Departmental Solicitor’s Office (DSO) which confirmed that Article 7 of the Industrial Development (Northern Ireland) Order 1982 could be “stretched” to permit the payments.

2.7 The decision to use this legislation was based primarily on time constraints. In our view, the DfE should consider developing alternative legislation to provide cover in the event of any future need to issue emergency payments to businesses. This would avoid “stretching” existing legislation for an unintended purpose.

There was confusion on the appropriate approval process

2.8 When developing a proposal to commit public expenditure, the proposing department must prepare a business case, and, in cases where anticipated expenditure exceeds its delegated authority, seek approval from the relevant DoF Supply team.

2.9 On 26 March 2020, the DfE submitted the Scheme business case to the DoF for approval. In relation to the need for the Scheme, the business case highlighted that:

- many small businesses would not be able to survive the COVID-19 crisis without help to meet unavoidable fixed costs. This had the potential to result in significant job losses; and

- there was an urgent need for these payments to be issued to NI small businesses.

2.10 DoF approval for the Scheme was given on 27 March 2020 on the basis that both Accounting Officers (DfE and DoF (on behalf of LPS)) ensure that:

“all necessary checks and balances are in place and there is no risk of inappropriate use of the monies.”

2.11 The DfE Accounting Officer continued to correspond with the DoF Supply team on the conditions imposed by its approval during April 2020. However, the DfE had not understood that the Supply Team would be unable to provide an approval if a Ministerial Direction was in place, and that approval was therefore required from the Finance Minister or the Executive, of which he is a part. This was provided on 26 March 2020, without the conditions previously imposed by the Supply Team, following the Ministerial Direction being obtained. The DfE advised the Supply Team in May 2020 that its request for approval was formally rescinded, but the conditions previously set reflect standard expectations of how public money is spent.

Identifying businesses eligible for support

2.12 The DfE was responsible for the policy decisions on Scheme eligibility and approving payment files prepared by LPS. Initial eligibility covered those businesses with a Net Annual Value (NAV) of up to £15,000 which had availed of SBRR on15 March 2020. This information was available from the LPS rates database.

2.13 At the start of the Scheme, LPS pulled together a dataset of those properties that met the basic SBRR criteria, with certain premises (for example, GP surgeries and political offices) set aside while DfE considered whether they should be eligible for support as they were unlikely to have been financially impacted by the COVID-19 disruption.

A Ministerial Direction was requested for the Scheme

2.14 Appendix 1 provides a timeline of key events and decisions in the early stages of Scheme design. The focus during this early period was on getting urgent support to businesses. There was no evidence to suggest that an objective assessment of need or hardship was conducted prior to issuing payments.

2.15 The decision to issue payments to all businesses in receipt of SBRR was inherently risky since it was likely that some public money would be issued to businesses which did not suffer hardship as a result of the COVID-19 crisis. No evaluation was undertaken to quantify the potential level of funding likely to be issued to those who did not require it.

2.16 The DfE’s Permanent Secretary was coming under increasing pressure from Ministers to progress the Scheme as quickly as possible, but he clearly had some concerns. In a letter to the Economy Minister on 24 March 2020, he recognised the political desire to act quickly, but warned that rushing the Scheme might cause more problems. After raising a number of points, he advised:

“In summary, I would ask that you note these current concerns. Effective solutions will be developed but I believe we should take care and time in implementing the grant schemes. A careful and deliberate plan is needed to discharge the grants and also avoid confusion and reputational damage with the business community.”

2.17 In view of the Permanent Secretary’s concerns, in line with Managing Public Money Northern Ireland (MPMNI) requirements, he requested a Ministerial Direction to proceed with the Scheme. On 16 April 2020, he notified the C&AG that this had been provided for the Scheme on 26 March 2020, following agreement by the NI Executive. In his covering letter, the Permanent Secretary acknowledged the widespread political support for the Scheme, the NI Executive’s desire to proceed and the potential for the Schemes to mitigate the effects of the COVID-19 pandemic. However, he stated that he had insufficient evidence of the presumed value for money that the Scheme might deliver. In addition, he confirmed that he was unable to provide sufficient assurances that the risk of loss of public funds through error or fraud with this Scheme (and others) had been addressed.

A Memorandum of Understanding (MoU) was established to clarify roles and responsibilities

2.18 This Scheme was designed and set up at an extreme pace, from the initial announcement on 18 March 2020 to the first payment on 26 March 2020. A lot of co-ordination, co-operation and agreement was required between departments, agencies, Ministers and the Executive at a time when most officials had been instructed to work from home with limited IT resources.

2.19 Whilst key points that informed an MoU were discussed and agreed prior to the first tranche of payments being made, the DfE told us that “by its very nature this process was evolutionary and this evolution helped to ensure that there was greater clarity of roles and responsibilities prior to agreement of the MoU”. As a result, the MoU between the DfE, Invest NI and the DoF (LPS and Account NI), was not signed until 22 April 2020, by which stage £171 million had already been paid out.

2.20 The MoU outlined the various roles and responsibilities in relation to the delivery of the Scheme, as follows:

- The DfE assumed responsibility on behalf of the NI Executive for the Scheme, including any potential error, fraud or losses arising from the administration of the Scheme.

- The DoF (via LPS) was responsible for the identification and checking of eligible businesses and making the payments to those businesses. LPS’s data on ratepayers was used to determine who was eligible to receive the grant.

- Invest NI’s responsibility was to record the costs of the grant Scheme. Invest NI was not directly involved in determining which organisations were eligible or making the payments to the organisations.

2.21 The length of time taken to agree this MoU should have afforded ample opportunity to ensure key roles and responsibilities were documented in detail. This was particularly important as the Scheme was being administered almost entirely by LPS, and the DfE had limited sight of, or familiarity with the LPS control systems. Had joint roles and responsibilities been clearly agreed upfront as part of establishing the Project Team, less time could have been spent refining an MoU and splitting responsibilities when the Scheme was already in progress.

Eligibility was refined as the Scheme progressed

2.22 As grants started to be processed, various queries arose from LPS and, as a result, the initial eligibility criteria was refined by the DfE. Resolution of a number of the issues raised by LPS caused payment delay to some businesses, for example to small industrial businesses which were initially deemed ineligible for a grant but subsequently qualified on the basis of industrial de-rating.

2.23 A summary of eligibility refinements is set out in Figure 2.

2.24 Important LPS queries on eligibility were not answered by the DfE for some time. For example, in the case of infrastructure assets including wind turbines, the DfE took almost a month to confirm its position. The initial query was raised by LPS on 15 May 2020 and an official response was not received until 12 June 2020. A total of 52 wind turbine businesses (at a cost of £0.52 million) were paid in the first tranche of automatic payments but when subsequent applications were received from owners, through the online portal, applications were disallowed on the basis that their business income was not negatively impacted by COVID-19. Repayments have been arranged for 30 of these grants. There is no evidence that other businesses were assessed in terms of how they were impacted by COVID-19.

2.25 It is likely that had the DfE been able to take an extra few days at the planning stage of the Scheme to obtain a better understanding of the types of organisations within the LPS rates database, it could have ruled out businesses such as wind turbines and other infrastructure assets that would later be deemed ineligible.

2.26 When the automatic push payments were initially made, wind turbines were not excluded and payments were made within the Scheme parameters. The DfE did, however, later engage with these wind turbine owners and to date, just over half of these payments have been recovered. The DfE is continuing to work to recover the remaining amounts.

2.27 There was no evidence of a wider review to link business type to financial hardship due to the impact of COVID-19 disruption. In deciding on the eligibility of certain types of businesses (primarily infrastructure assets), consideration was given to the ‘spirit’ and ‘intention’ of the Scheme, which was intended to provide support to those businesses suffering financial hardship caused as a result of the COVID-19 crisis. However, the ongoing changes to eligibility were reactive and based on questions raised by LPS. The DfE told us that there were a number of highly complex queries relating to types of business/ specific organisations which required extensive evidence gathering and consideration of eligibility from a policy perspective.

Figure 2: DfE changes to the Scheme eligibility

|

Date of Eligibility Refinement |

Detail |

|---|---|

|

23 March 2020 |

Only one £10,000 payment would be issued to businesses with multiple premises. |

|

23 March 2020 |

Agreement to exclude MP and MLA constituency offices. |

|

23 March 2020 |

Payment of the grant would still be made to those ratepayers in rate arrears, with the arrears recovery process kept separate. |

|

10 April 2020 |

Industrial de-rated properties were not eligible for the grant initially because they are not eligible for SBRR but the Executive subsequently decided to extend the scope of the Scheme to include small manufacturing businesses. |

|

17 April 2020 |

The DfE confirmed to LPS that sports and recreational properties were to be excluded. |

|

12 June 2020 |

Infrastructure assets including wind turbines were deemed as ineligible (although by this point some had already been paid). |

Source: DfE

2.28 It was surprising that questions on eligibility were still being asked after payments had been made. In our view, the eligibility criteria should have been agreed between all parties and finalised before any payments were made. This could have prevented further amendments as the Scheme progressed, and overpayments being made that may not be fully recovered.

2.29 Further consideration could have been given to the development of a cross-departmental Project Team which could potentially have addressed some eligibility concerns. Had a more collaborative joint-working arrangement been set-up from the start, with daily communication and meetings between a cross-departmental Project Team incorporating officials from LPS and the DfE, it is possible that long delays in responding to queries could have been avoided. This would have reduced the need for the slower official correspondence between the departments.

There were issues with the suitability of the LPS dataset for determining businesses eligible for grant

2.30 The determination of eligibility was that a company had a NAV up to £15,000 and availed of SBRR on 18 March 2020. In the absence of a more appropriate dataset (and with no time to develop a new dataset), the use of the LPS data on ratepayers to determine businesses eligible to receive the grant was a creative solution. This was, of course, not the intended purpose of LPS’s information, which relied heavily on ratepayer notifications of changes in circumstances to keep the information up to date.

2.31 Recognising the potential deficiencies of using the LPS data for the purposes of administering the Scheme, on 3 April 2020, the DfE Accounting Officer sought assurance from the DoF Accounting Officer (on behalf of LPS) that:

- LPS had in place processes of assurance and validation of its database and operating systems and, as there were no other criteria for eligibility outside of those determined by the LPS data, that assurance from LPS would fulfil the approval conditions;

- the data compiled and provided by LPS for use in this Scheme had been subject to all necessary checks and balances; and

- there was no risk of inappropriate use of the monies in both these methods of making and validating payments.

2.32 In its response, LPS stopped short of providing the specific assurance requested by the DfE and the DoF again reiterated that its approval was given on the understanding that all necessary checks and balances were in place. By this stage, almost 7,000 push payments (at a cost of £67.7 million) had been issued.

2.33 LPS identified that, since the rating year was almost over, information on the database was not up to date. While there is currently no statutory requirement for businesses to tell LPS of any premises move, LPS confirmed that most ratepayer changes (notification from a ratepayer) are notified to LPS following the issuing of rates bills in April each year (e.g. to say moved out/moved in).

2.34 It is not clear if the DfE had sight of the work performed by LPS to identify and pay eligible businesses through the Scheme. There was also no evidence that the DfE carried out any pre-payment checks over the accuracy of the data or payments being issued by LPS. The DfE, having overall responsibility for the Scheme, appears to be have been almost entirely reliant on LPS to deliver a Scheme for which it was responsible.

2.35 The use of LPS data was not ideal, however, given the circumstances, it was a quick and innovative method of distributing grants to businesses in the absence of any other suitable data. It is evident that LPS was proactive in the administration of the Scheme and quickly raised issues with the DfE where they arose.

Consideration was not given to which types of businesses were suffering financial hardship as a result of the pandemic

2.36 The stated intention of the Scheme was to provide support to businesses to assist with unavoidable fixed costs. Many businesses needed support with these costs due to the consequences of the response to COVID-19, primarily a loss of income. Despite this, the DfE did not provide any evidence to suggest that, in the design of the Scheme, the impact of COVID-19 was considered. Nor did it quantify the potential loss of public funds as a result of awarding grants to businesses not suffering financial hardship.

2.37 A considered analysis of the rateable properties in the LPS dataset may have allowed the DfE to identify and exclude certain kinds of property or business types that were unlikely to suffer due to the impact of COVID-19 – much in the way it did in relation to vacant properties and political offices, and subsequently some infrastructure assets (i.e. wind turbines). This may have prevented the loss of a significant amount of public funds and ensured support was targeted at those most in need.

2.38 It is still unclear how much money was provided to small businesses that did not need it, and even less clear if there is any way for this money to be recouped. From our review of payments, we have identified certain business types that may not have faced financial hardship due to COVID-19. That said, it is not difficult to see the complexity that the DfE was faced with when trying to design and deliver the Scheme and effectively target support in such a short time-frame.

Part Three: Push payments and ineligible payments

3.1 Both the DfE and the DoF (LPS) were tasked with taking forward the development and operation of the Scheme. The DfE was responsible for ensuring that sufficient and appropriate checks and balances were in place to support payments and for oversight of the checks and balances being undertaken by LPS. LPS had responsibility for providing assurance to the DfE on the validity and accuracy of ratepayer information in the payment files.

Push payments were made directly to businesses without application or confirmation of need

3.2 The DfE and the DoF recognised that issuing payments without application forms or owner declarations, created risks including the potential for error and non-compliance with State Aid protocol. Despite the risks, the Economy Minister and Finance Minister, with support from the Executive, took the decision to issue automatic payments (push payments) on 26 March 2020, the same day that the online application form was made available.

3.3 The DfE’s Permanent Secretary took the appropriate step of highlighting the risks associated with making payments quickly, without due process, to the Economy Minister on 24 March 2020. The following day, LPS’s Chief Executive advised the DfE and the DoF that it could:

- either proceed with paying the 7,000 automatic payments on 26 March 2020; or

- direct all potential beneficiaries to apply through the portal.

3.4 The Economy Minister and Finance Minister agreed (with endorsement by the NI Executive) that automatic push payments should issue on 26 March 2020. These first 6,775 payments (at a cost of £67.7 million) were paid on 26 March 2020, directly into the bank accounts of those businesses identified on the LPS database as eligible for SBRR and which paid their rates via direct debit. A further 4,185 push payments were issued over subsequent weeks to businesses that had not submitted an application. The businesses who received these push payments did not apply for assistance nor did they accept any of the terms of the Scheme.

3.5 These payments were issued in advance of State Aid approval being received and without obtaining any formal declaration from recipients that they satisfied the State Aid conditions. As a result, the payments were in breach of State Aid rules. State Aid allowed grants to be paid to businesses who were not considered to be in difficulty at 31 December 2019, but subsequently faced difficulties or entered into difficulty thereafter as a result of the COVID-19 outbreak. State Aid approval was subsequently provided on 6 April under the UK’s wider Covid-19 Temporary Framework. The European Commission raised no objections on the grounds that it was compatible with the internal market pursuant to Article 107(3)(b) of the Treaty of the Functioning of the European Union, which is used to remedy a serious disturbance in the economy of a Member State.

3.6 The DfE had no confirmation from any of the 10,960 business owners who received push payments that they had any unavoidable fixed costs or were suffering any financial hardship as a result of COVID-19 and, as a result, had no assurance that those who received grant were in need of assistance.

3.7 From 26 March 2020, businesses seeking assistance were required to apply through a portal on the NI Business Info website. Applicants were required to complete a State Aid declaration (confirming they were not in difficulty on 31 December 2019 as per paragraph 3.5 above) and to provide their ratepayer and occupancy ID details, bank account details and an email address. However, the application forms did not require the applicant to confirm that all information provided was accurate or to outline the nature of financial hardship they were facing.

3.8 Undoubtedly the use of push payments at the start of the Scheme ensured money was delivered quickly to businesses, but it came with associated risks. The DfE did not make use of push payments in later schemes, however LPS did subsequently use push payments to issue grants worth £94 million to businesses eligible for two other grants: the £25,000 grant for medium sized industrial businesses; and the top-up payments for businesses which had previously received the £10,000 Small Business Support Grant or the £25,000 Retail, Hospitality, Tourism and Leisure Grant. LPS told us that, drawing on its experience of the £10,000 Small Business Support Grant (SBSG) scheme, it had taken several weeks to examine the lists of potential payees of both schemes in some detail, and validate the payments before they were issued. This is a good example of learning being applied.

LPS identified potential errors

3.9 LPS prepared 62 payment batches over the course of the Scheme, which were all approved by the DfE and forwarded to Account NI for payment. LPS’s manual and automatic validation reviews identified numerous potential duplicate payments to the same business at different premises and payments to multiple ineligible businesses. It is not clear what level of checking the DfE carried out on the payment files or if it simply relied on the LPS review.

Ineligible payments were made and the recovery process is ongoing

3.10 As outlined in paragraph 1.6 above, on 11 September 2020, the C&AG estimated that the potential extrapolated ineligible payments could be up to £13.5 million. At this date, LPS had identified 374 ineligible payments totalling £3.74 million, of which £0.62 million had been recovered. The number of potentially ineligible payments identified to date has now increased to 568 (with a value of £5.68 million), of which £1.76 million has been recovered. These ineligible payments include:

- £2.0 million duplicate payments;

- £2.1 million in cases where a ratepayer change was performed after the grant was issued;

- £0.7 million paid to landlords rather than tenants;

- £0.5 million paid to wind turbine owners (in the first tranche); and

- £0.3 million issued in cases where the eligibility changed after the payment was issued.

3.11 The local media drew attention to Scheme payments made to three political offices - these payments were part of the initial payments issued automatically, without an application being received. These offices should have been excluded from the payment list but were overlooked.

3.12 It is unclear if the DfE will be able to recoup all payments made erroneously. To date, 130 letters have been issued to request repayment from a total of 568 potentially ineligible payments identified. We asked the Department to give an update on how it planned to approach recoupment to ensure it recovered as much money as possible; it told us that “a dedicated Project Board and Project Team has been set up to deliver post-payment validation and to provide assurance oversight for the Small Business Support Grant Scheme. Recovery procedures for overpayments on the Small Business Support Grant Scheme will be instigated, where justifiable and appropriate to do so. Repayment has been requested from 52 wind farms with 29 repayments and two part repayments received as of 5 November 2021. Recovery action is ongoing to validate and recover the other categories of ineligible payments on the £10k scheme, which includes duplicate payments made through fraud or error. This work is expected to continue well in to 2021.”

3.13 A clear method for recovery and clawback was not in place from the outset of the Scheme to address any potential payment errors or, indeed, fraud. This is usually a standard mechanism in a grant scheme. The DfE did not initially know if it could seek to recover ineligible payments made because:

- it did not know if it had a legally defensible right to pursue these overpayments for recovery, as the automatic payments were unsolicited by recipients; and

- even those recipients who did submit applications were not required to complete any formal declaration confirming all information provided was accurate.

3.14 Following legal advice, the DfE wrote to each of the businesses involved to request repayments of grant paid in error. At the time of this report, 95 grant recipients who received automatic payments but were ineligible, had repaid the amounts received. The DfE will continue to work to recover the remaining amount.

3.15 In addition to the payments identified by LPS and the DfE as ineligible, a number of payments were issued to businesses who, despite being technically eligible, did not need the grant as they were not suffering COVID-19 related hardship. It is not possible to quantify the number of grant payments this applies to although there were a number of instances where the grant was returned voluntarily by the recipient on the grounds of not needing it. To date £805,002 has been recovered due to 82 businesses either repaying the grant in full or in part without any requirement to do so. These businesses are to be commended.

Part Four: Learning lessons for future schemes

4.1 Usually, a scheme of this scale would take some considerable time to design and set up. In this case, officials were tasked with implementation in days, under extremely challenging circumstances, as businesses were forced to close and uncertainty rose over the economy.

4.2 The DfE encountered numerous difficulties and, in recognition of the concerns, a Ministerial Direction was sought and received. The provision of a Ministerial Direction does not absolve departments from their responsibility to do what they can, even in such a limited timeframe, to develop and implement appropriate controls to safeguard public money and ensure that expenditure is allocated for the purposes intended. More could have been done to protect public funds in terms of assessing and targeting need, agreeing eligibility criteria and developing recoupment procedures.

4.3 While a significant number of lessons learnt have been identified, some issues have been carried forward into subsequent schemes where, for example, reliance is still placed on LPS data to identify businesses eligible for assistance. The DfE is aware that this reliance on LPS data poses risks, however MoUs in these subsequent schemes have been developed to better clarify the specific roles and responsibilities of each party. Details of lessons identified by the DfE from the SBSG scheme and other early COVID-19 business support grant schemes are provided in Appendix 2.

A Fraud and Error Oversight Group was established

4.4 In December 2020, the DfE established a Fraud and Error Oversight Group to oversee the management of fraud and error in the development of future COVID-19 related schemes. It had its first meeting on 11 January 2021 and part of its remit is to consider options for recouping grant paid in error.

4.5 The creation of this oversight group is welcomed. It demonstrates the DfE’s willingness to address the issues experienced and to learn from them. The group looks across all relevant schemes and provides a forum for applying lessons as further schemes are being developed. The C&AG will continue to monitor the work of this group and the results it achieves.

Internal Audit made a number of recommendations on the Scheme

4.6 In February 2021, the DfE’s Internal Audit team carried out a review of the operation of the Scheme. It identified a number of areas which required immediate action to provide assurance over the propriety of funds which have been paid and to enable post payment activity and an evaluation of the Scheme to be completed.

4.7 The Internal Audit team also made a number of recommendations around scheme closure, eligibility criteria, clawback arrangements, compliance with State Aid and a number of lessons learnt for future consideration in scheme design and implementation.

4.8 Expenditure on the DfE’s other COVID-19 schemes has been reviewed as part of the 2020-21 financial audit of the DfE Resource Accounts and any further examples of similar issues or difficulties will be reported as part of that process.

Appendix 1: Timeline of Scheme design

17 March 2020 – The Chancellor of the Exchequer announced a grant scheme of £10,000 support for small businesses to be administered by local authorities in England. He also announced that the devolved administrations would receive funding to provide support to businesses in Scotland, Wales and Northern Ireland.

18 March 2020 – The DoF, The Executive Office (TEO) and the DfE receive brief details of the COVID-19 Small Business Grant. The document noted that ‘an immediate grant of £10,000 will be provided to all small businesses who are eligible for Small Business Rate Relief …the Scheme will be administered by the DfE / Invest NI working with the DoF’s Land and Property Services’.

18 March 2020 – The First Minister and deputy First Minister announced that ‘an immediate grant of £10,000 will be provided to all small businesses who are eligible for Small Business Rate Relief …to ease their immediate cash flow pressures’.

19 March 2020 – The DfE issued a press release on the £10,000 grant Scheme, detailing that ‘the Scheme will be administered by DfE / Invest NI working with DoF’s Land and Property Services’.

23 March 2020 – The Finance Minister provided a letter of support for the £10,000 Small Business Grant Scheme to the Economy Minister, outlining that resource Departmental Expenditure Limit (DEL) funding was available to the DfE in 2019-20 but that the payments will result in a technical excess vote due to no increase being possible in the Estimates cover.

23 March 2020 – In addition to the Minister and Executive approvals above, the DoF issued a memo to all Finance Directors detailing the funding and approvals process of the COVID-19 response.

24 March 2020 – The DfE Permanent Secretary sent a submission to the Economy Minister requesting a Ministerial Direction, in line with MPMNI requirements, to make the grant payments and this submission highlighted three main concerns:

- The DfE did not have budget nor Assembly approval to spend the funding in 2019-20 so the Permanent Secretary was requesting a Ministerial Direction to make the grant payments.

- A legislative challenge was also raised as the DfE did not have legal power to make such grant payments but highlighted that the only route available would be to request Invest NI to make payment under the 1982 Industrial Development Order.

- The DfE did not have State Aid approval to make such payments.

The DfE Permanent Secretary also added that “If the Scheme payments are to be deferred into the 2020-2021 financial year, then a regularised system could be put in place to make payments. I appreciate the political desire is to be seen to react quickly. But, rushing into this for a sake of a few days will cause many more problems for Ministers”; and

“In summary, I would ask that you note these current concerns. Effective solutions will be developed but I believe we should take care and time in implementing the grant schemes. A careful and deliberate plan is needed to discharge the grants and also avoid confusion and reputational damage with the business community.”

25 March 2020 – The DfE Permanent Secretary sent a submission to the Economy Minister detailing the lack of State Aid cover but that the DfE expected this to be in place in advance of payments being received. The following risks were also raised:

- Value for Money: inherent to this Scheme is a risk of being unable to evidence value for money.

- Risk around payment: the DfE will be reliant on the data held by LPS and there is a risk that the LPS dataset contains errors leading to loss. This risk is inherent in repurposing the dataset for this purpose and not possible to quantify.

- Operational Risks: the absence of staff due to the current crisis to fulfil a call centre function to handle queries relating to the Scheme such as not having LPS call centres to provide ratepayer IDs to applicants. LPS anticipate an emergency team being put in place to handle grant related queries.

- Risk of legal challenge: The DSO has advised that it is possible to ‘stretch’ Article 7 of the Industrial Development (Northern Ireland) 1982 Order to provide cover to make these payments. There remains a risk of challenge based on the scope of the legislation being relied on and the nature of the Agency agreement being entered into by the DfE and Invest NI.

- Risk of Excess Vote.

25 March 2020 – The Economy Minister wrote to First Minister and deputy First Minister outlining “that the current COVID-19 crisis is placing significant strain on businesses across Northern Ireland. The Executive announced a small business grant Scheme to provide £10,000 to help with fixed costs for small businesses across Northern Ireland.”

25 March 2020 – The Economy Minister wrote to Executive colleagues outlining the nature of the Scheme and associated risks and the urgency of getting this Scheme operational and payments made to eligible businesses.

26 March 2020 – The Finance Minister wrote to the Economy Minister outlining:

“that there is an urgent need to provide this support to businesses. It is over a week since the Scheme was announced and I have received many emails from businesses asking when this will be paid...note, and agree with, the intention to use the current Valuation List as the basis for assessing eligibility. However, this is not a normal rating year as we have the non-domestic revaluation and the 8th List comes into effect on 1 April 2020. I have asked my officials to identify the businesses to benefit on the basis that the Executive wishes these grants to be as inclusive and supportive of business as possible and, therefore, an individual business should get their grant on the basis of whichever list would benefit them the most.”

26 March 2020 – The Economy Minister wrote to the First Minister and deputy First Minister for agreement to proceed with issuing a Ministerial Direction under the urgent decisions procedure, and approval was duly given. This effectively provided Executive approval, including approval of the Finance Minister.

26 March 2020 – The DfE send submission to the DoF, including Scheme policy and legal considerations, noting:

- The current COVID-19 crisis is placing significant strain on businesses across Northern Ireland and a small business grant Scheme has been announced to provide £10,000 to help with fixed costs for small businesses across Northern Ireland.

- Many of NI small businesses would not be able to survive the current crisis without this support to help them meet unavoidable fixed costs, with the potential for significant job losses.

- Similar schemes have been announced in England, Scotland and Wales. The absence of a scheme in NI would place businesses at a significant disadvantage to their United Kingdom (UK) counterparts.

- Given the sheer magnitude and impact of the COVID-19 crisis, if this response is delayed, many small businesses in NI will not be able to meet their fixed costs and will not survive the current crisis, leading to significant job losses and hardship.

- This is a one-off payment grant scheme to assist small businesses with unavoidable fixed costs during the current COVID-19 crisis.

In signing the business case, the DfE’s Permanent Secretary confirms “I am content with the regularity and propriety of this expenditure appraisal and that it represents value for money for the Department.”

26 March 2020 – The DfE issued a press release stating ‘the first payment in the Small Business Support Grant Scheme will be made on March 31, if not before’ and that the online portal had gone live for businesses to register their bank details.

27 March 2020 – The DoF Supply team approval was given and noted:

- that the expenditure is needed to address the current COVID-19 crisis which is placing significant strain on businesses across Northern Ireland;

- Value for Money has not yet been evidenced in respect of this Scheme, however, the First and deputy First Minister have agreed this Scheme and the Finance Minister has expressed his written support for the Scheme; and

- the responsible Accounting Officer in both the Department and Invest NI must ensure that all necessary checks and balances are in place and that there is no risk of inappropriate use of the monies.

30 March 2020 – The DfE’s Accounting Officer wrote to the DoF’s Accounting Officer asking for specific assurances that LPS had completed all necessary checks and balances on the data provided although the response stopped short of providing this specific assurance.

2 April 2020 – The DfE’s Accounting Officer wrote to DoF Supply Division expressing concern about the specific reference in the approval letter to ensure all necessary checks and balances are undertaken. DoF Supply Division again reiterated that approval was given on the understanding all necessary checks and balances are in place. In the meantime more than 10,000 push payments had been issued.

5 April 2020 – The DfE rescinded its previous request for DoF Supply approval for the Scheme, noting the DoF advice that it was not required following the Ministerial Direction which was endorsed by the Executive on 26 March 2020.

10 April 2020 – The DfE issued a press release providing detail on the extension of the Small Business Support Grant Scheme to include small industrial businesses that qualify for industrial de-rating.

30 April 2020 – The DfE issued a press release confirming that a new online form for businesses occupying rental properties was live, the Economy Minster stated ‘I have taken this step so that the small business that occupies a rental property, and not the landlord or managing agent who is responsible for paying the rates, will benefit’.

Appendix 2: Lessons learnt

The DfE has identified a number of lessons from this Scheme which can be applied and shared with other DfE-led COVID-19 grant support schemes to help inform best practice which include:

(i) Have strong and tightly defined eligibility criteria for the Scheme, which is communicated and promoted in the media.

(ii) Ensure early consideration of EU State Aid rules (and/or UK subsidy control regime obligations), to ensure that schemes comply with the relevant subsidy control rules, that no payments are made unlawfully and that reporting / transparency obligations are fully understood.

(iii) Establish clear recovery pathway and clawback mechanisms at the outset of schemes to address any errors associated with the scheme delivery.

(iv) Avoid making automatic push payments as they do not afford the necessary verification and validation checks required to prevent fraud and error.

(v) Require businesses to provide notification of business closure during the qualifying period (rather than relying solely on the LPS database). This self-declaration check will be undertaken by applicants in the full knowledge that any fraud will be investigated.

(vi) Have a clear fraud process signposted and in place.

(vii) Put in place clear communication channels including a dedicated mailbox per scheme to aid correspondence and query management.

(viii) Update NI Business Info and other communication channels regularly with key scheme points of reference, closure dates etc.

(ix) Ensure the necessary data protection arrangements are in place including data sharing agreements – data for application forms subject to departmental privacy notices.

(x) Cross-check applicants from one scheme to other schemes before payments are made – to avoid the potential of duplicate payments.

Lessons from the SBSG and £25,000 grant schemes

The £25,000 Business Support Grant Scheme was opened in May 2020 and took on board many of the lessons referred to above under the SBSG scheme. In working towards development and delivery of the subsequent COVID-19 business support schemes, the DfE took on board further lessons after reflecting on both these schemes. These included:

(i) Ensuring clear communication lines with businesses to ensure the scheme is accessible to all eligible businesses.

(ii) Engaging with industry in advance of scheme launch.

(iii) Having a clear and consistent appeals process for the schemes.

(iv) Having a thorough FAQ document which is dated and version numbered that provides responses to as many potential enquiries as possible.

(v) Putting in place a suite of project management documentation from the outset including a Policy Panel to assess complex policy queries, a policy log documenting policy decisions and keeping this live throughout scheme development and implementation, a risk register and EQIA and rural proofing assessments.

(vi) Agree a process within Department whereby general queries are treated as ‘treat official’ cases particularly where they are just sign posting to NI Business Info – this speeds up response time to applicants.

(vii) Give the Executive sight of scheme criteria at the earliest opportunity to allow time to comment and identify any gaps.

(viii) Where schemes cross over departments/ agencies, ensure an MoU is agreed and put in place which clearly outlines designated roles & responsibilities.

(ix) Advise applicants at outset that the names of any successful applicants of grants may be released to the public.

Lessons from the NI Micro-business Hardship Fund scheme

The NI Micro-business Hardship Fund opened in May 2020 and provided funding to micro-businesses and qualifying social enterprises facing immediate cash flow difficulties due to the impact of COVID-19 that were not eligible for other support. Lessons learnt included the following:

(i) Agreement of broad policy intent at the outset is vital.

(ii) Developing eligibility criteria, application forms etc. to deliver the policy intent in such a short space of time can lead to complications and require revisions later.

(iii) Deployment of adequate resources to deliver schemes is vital and this should be evenly spread.

(iv) Engagement with external partners was vital to the successful delivery of the fund, but in some cases this took a long time to agree.

(v) Some project documentation also took a long time to agree (e.g. Data sharing Agreements, MoUs).

(vi) Clear legislative provision should be made for such schemes going forward.

(vii) Running the scheme consecutively with the £10,000 and £25,000 schemes made delivery a lot easier, concurrent delivery (required as it might be in the context of the pandemic) is a lot more problematic.

(viii) Regular communication between policy, delivery and support teams is vital.

(ix) Better that staff have a reasonable knowledge of the end to end process than just a specific part or parts in isolation.

(x) An independent appeals process is required, but a working level adjudication panel meant that this was not required as much as it might have been.

(xi) Some analysis / checks could not be carried out because existing data could not be used for the purposes required.

(xii) Significant resource needs to be dedicated to handling the huge volume of correspondence generated by schemes such as these.

(xiii) Resource also needs to be dedicated to developing and maintaining project management documentation and for records management.

Lessons from the SBSG Scheme carried forward into schemes administered by LPS

LPS was given the task of administering a number of grant schemes later in 2020 and in the first half of 2021, including the Localised Restrictions Support Scheme and three new schemes announced by the Finance Minister on 15 March 2021. Learning from the delivery of the SBSG scheme was carried forward into the administration of these schemes. This included:

(i) Putting in place specific legislation governing the grants by making use of powers under the Financial Assistance Act 2009. This included specific powers relating to recovery of payments issued in error.

(ii) Designing the core eligibility criteria in advance to address issues which had arisen in the £10k scheme, such as the treatment of shared occupiers of one rateable property and handling of applications in respect of properties with rating cases in progress.

(iii) Taking time to analyse and adapt the data in the rating system to assist with the administration of the grants.

(iv) Developing bespoke software for receiving online applications and making decisions on applications.

(v) Regular meetings involving policy, IT, statistics and operational staff to discuss issues as they arose and develop solutions in an agile way.

(vi) Close liaison with other Departments involved in the COVID-19 response, including the Department of Health and The Executive Office in relation to the measures to control the spread of the virus and the DfE, Invest NI, Department for Communities and Department of Education teams delivering financial support to specific sectors.

(vii) Setting up structured processes to handle appeals.

(viii) Setting up a specific team to handle correspondence in relation to grants.